WTI recaptures key 100-DMA around $68, awaits fresh impetus

- WTI jumps 2% but remains in a range around $68 mark, where 100-DMA aligns.

- Geopolitical risks in Afghanistan, hurricane in the Gulf of Mexico lift the US oil.

- WTI has room to rise towards $70.40 amid bullish technical indicators.

WTI (NYMEX futures) is resuming its recent bullish momentum, following a temporary reversal seen in Thursday’s trading.

At the press time, WTI is hovering around $68.25, adding nearly 2% on the day, although remains stuck in a familiar range since the past three trading sessions.

Friday’s bump up in WTI prices can be mainly attributed to a potential threat from the powerful hurricane forecast in the Gulf of Mexico, which ignited supply disruption concerns, as energy firms began winding up their production, with the hurricane expected to hit on the weekend.

Adding to the upbeat tone in the black gold are the geopolitical tensions simmering over Afghanistan. Tensions escalated in Afghanistan after ISIS exploded Kabul airport on Thursday and caused causalities in the US troops among other civilians.

Meanwhile, a pause in the US dollar’s rally also offers an additional zest to the WTI bulls. The USD bulls take a breather ahead of Fed Chair Jerome Powell’s Jackson Hole address, with tapering guidance looked out for with bated breath.

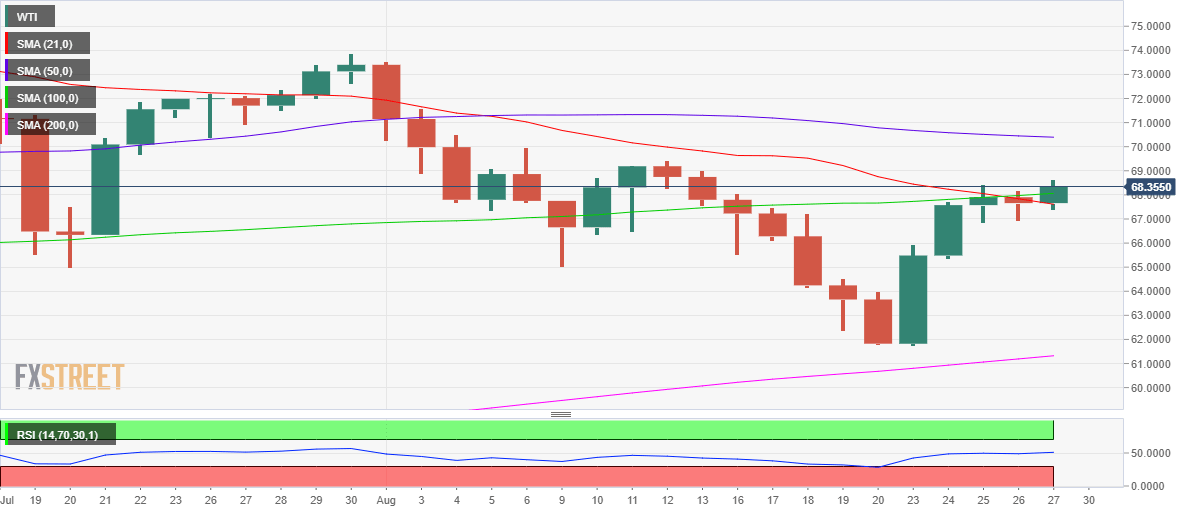

Technically, WTI has been ranging around the critical 100-Daily Moving Average at $68.06, with fresh support lent by the 21-DMA at $67.61.

A daily closing above the 100-DMA could fuel a fresh upswing towards the horizontal 50-DMA at $70.40.

The 14-day Relative Strength Index (RSI) holds firmer above the midline, suggesting that there is room for more upside.

WTI: Daily chart

On the flip side, acceptance below 21-DMA could open floors towards Thursday’s low of $66.91.

Further south, the $66.50 psychological barrier could be put to test.

WTI: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.