WTI Price Analysis: WTI trades below $75.00 on choppy session

- WTI sets its second day in a row of losses as investors continue to take profits following a three-week gain streak.

- Unexpected supply disruptions in Nigeria and Lybia may limit the downside’s potential.

- Eyes on Tuesday’s Retail Sales data from the US.

At the start of the week, the West Texas Intermediate (WTI) barrel fell below $75.00. The downside movements may be explained by investors taking profits and a slight recovery of the US Dollar.

The focus is set on Tuesday’s Retail Sales data from the US from June. As the USD significantly weakened following soft inflation figures from June which fueled dovish bets on the Federal Reserve (Fed), weak Retail Sales figure could fire another downwards leg for the Greenback. As for now, markets are expecting the headline figure to have increased 0.5% MoM in June while the sales excluding the Automobile sectors to have expanded 0.3% MoM.

Meanwhile, according to the CME FedWatch Tool, investors have largely priced in a 25 basis points (bps) hike in the next July 26 meeting of the Fed but the odds of another hike in 2023 have dropped to nearly 20%. In that sense, as higher interest rates tend to be negatively correlated with Oil prices, the WTI could regain momentum if markets continue to bet on a dovish Fed.

WTI Levels to watch

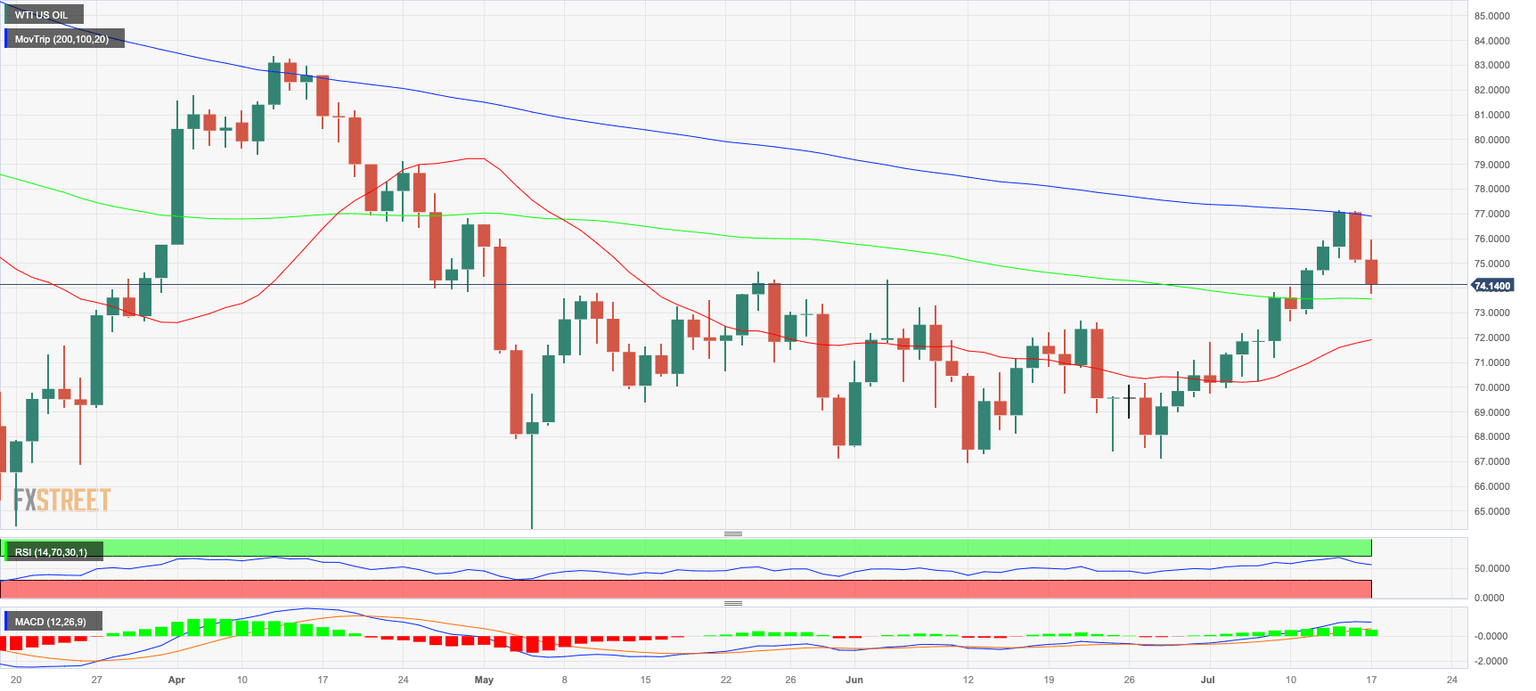

The daily chart suggest that the technical outlook is neutral to bearish for the short term. The Relative Strength Index (RSI) displays a negative slope but stands above its midline while the Moving Average Convergence Divergence (MACD) print lower green bars, indicating the the bullish momentum is slowly fading out. That being said, the price trading above the 100 and 20-day Simple Moving Averages (SMAs) suggests that on the bigger picture, the outlook favours the bulls.

Support Levels: $73.55 (100-day SMA), $72.80, $71.90 (20-day SMA).

Resistance Levels:$76.00, $77.00,$77.30 (200-day SMA).

WTI Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.