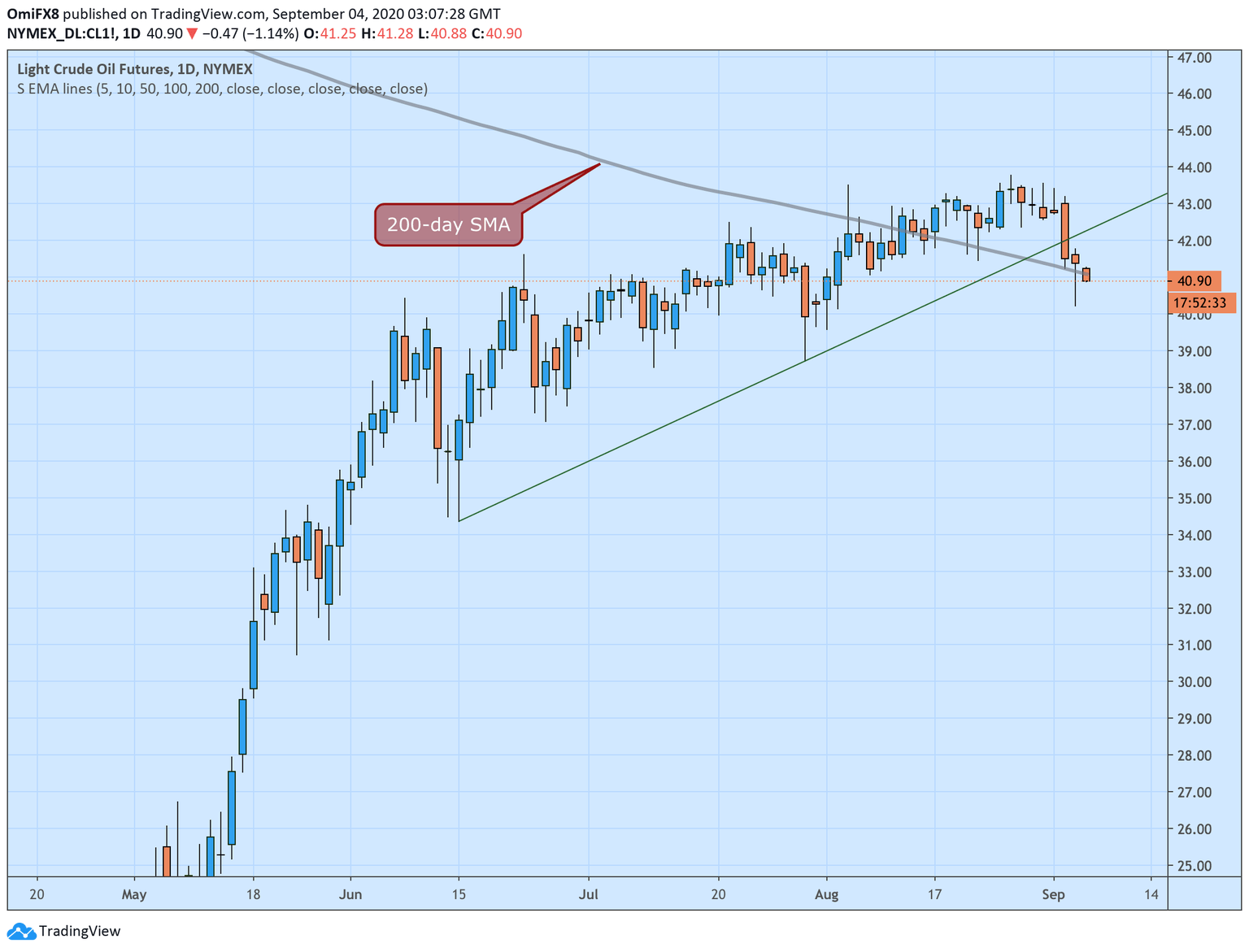

WTI Price Analysis: Oil falls back below 200-day SMA

- WTI flips the 200-day SMA into support after rejection at $41.28.

- A close below Thursday's low may invite more substantial chart-driven selling.

West Texas Intermediate (WTI) crude, the North American oil benchmark, is trading below the 200-day simple moving average (SMA) at $41.10.

The long-term average was breached on Thursday. However, the selling pressure ran out of steam at $40.22, and prices bounced back to levels above $41 early Friday only to turn lower again.

The black gold created a candle with a long lower wick on Thursday, aborting the immediate bearish view put forward by the downside break of an ascending trendline confirmed earlier this week.

The focus now is on Friday's close. Acceptance below Thursday's low of $40.22 would revive the immediate bearish view and expose support at $38.72 (July 30 low).

On the other hand, a close above Thursday's high of $41.79 would confirm reversal higher and allow a re-test of 43.78 (Aug. 26 high).

Daily chart

Trend: Neutral

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.