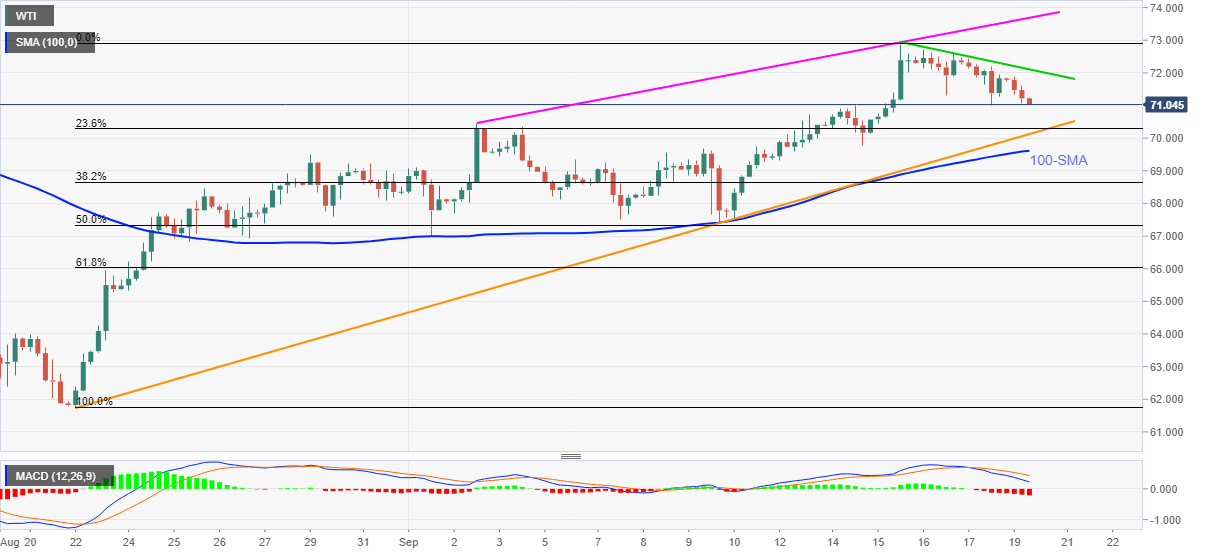

WTI Price Analysis: Oil bears need $69.60 break to retake controls

- WTI remains pressured around intraday low, extends pullback from early August highs.

- Monthly support line, 100-SMA challenge sellers amid bearish MACD.

- Weekly resistance line, 12-day-old rising trend line adds to the upside filters.

WTI justifies Thursday’s Doji candlestick while taking offers around $71.15, down 0.90% intraday, heading into Monday’s European session open.

Although a short-term falling trend line and bearish MACD hints at the black gold’s further weakness, an ascending trend line from August 22 near $70.10 and the $70.00 threshold, not to forget the 100-SMA level of $69.90, will challenge the bears.

In a case where WTI drops below $69.60, the bearish momentum can aim for the monthly low surrounding $67.00, also including 50% Fibonacci retracement of August-September upside.

On the contrary, a downward sloping resistance line from last Wednesday, near $72.10, challenges the WTI recovery moves ahead of the monthly peak surrounding $72.90.

If the oil buyers keep reins past $72.90, an ascending trend line from September 02 near $73.70 will flash on their radars.

WTI: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.