WTI Price Analysis: Focus on Wednesday’s close amid a potential bull flag

- WTI reverses Tuesday’s losses, looks to extend the recovery.

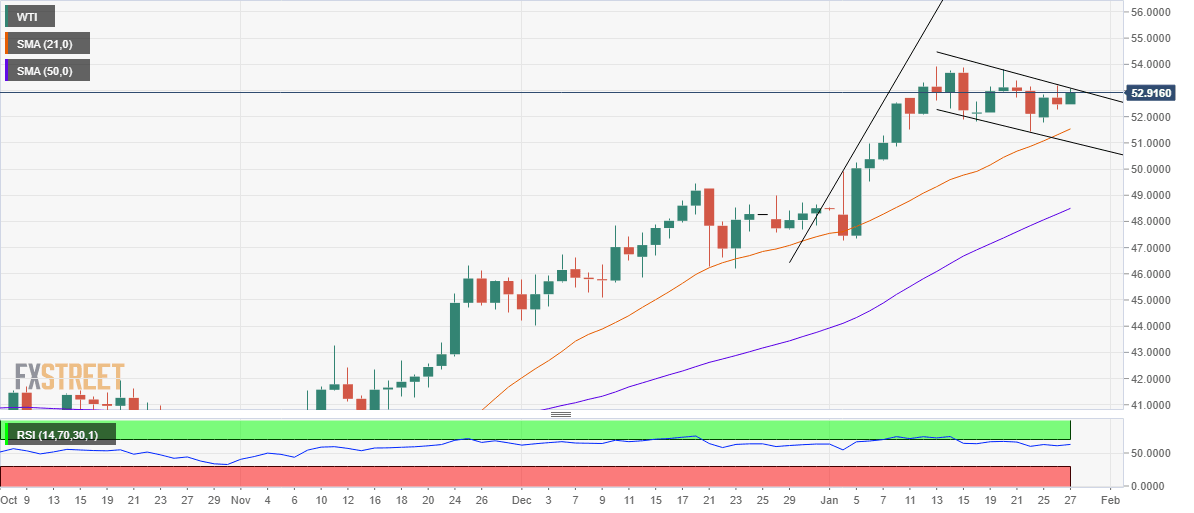

- Daily chart spots a likely bull flag amid bullish RSI.

- Focus on Wednesday’s close price, EIA and US data.

WTI (futures on NYMEX) battles the $53 mark, reversing most of Tuesday’s losses, as the bulls await the Energy Information Administration (EIA) US crude stockpiles data for fresh directives.

From a near-term technical perspective, the black gold remains in a consolidation phase after recoding multi-month highs at $53.93 on January 13.

The rally in the first week of this month that followed the consolidation charted a bull flag on the daily chart, which could likely get confirmed on a daily closing above $53.09 – the falling trendline resistance.

The bullish breakout would open doors towards the multi-month tops, above which the $55 threshold would be in sight.

The 14-day Relative Strength Index (RSI), currently trades at 63.12, pointing to more gains.

Alternatively, the pattern will get invalidated if the price closes the day below $51.03, the falling trendline support.

Ahead of that level, the 21-daily moving average (DMA) at $51.52 would challenge the bears’ commitment.

WTI daily chart

WTI additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.