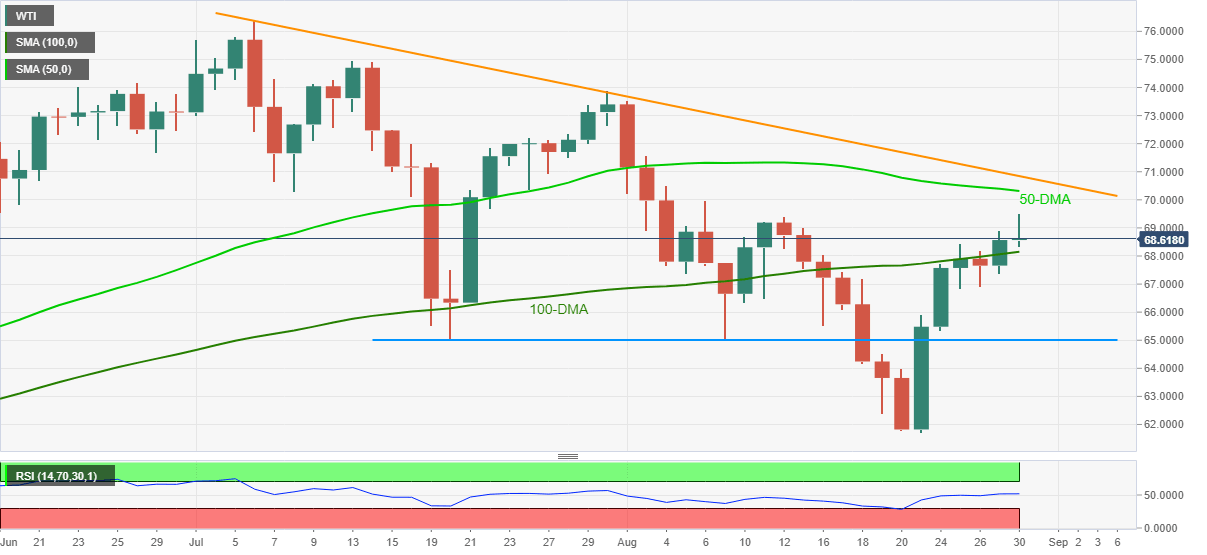

WTI Price Analysis: Eases from 16-day top above $68.00 but bulls stay hopeful

- WTI remains pressured around intraday low, keeps upside break of 100-DMA.

- Upbeat RSI conditions add to the bullish catalysts.

- 50-DMA, two-month-old resistance line challenge short-term buyers.

WTI takes offers around an intraday low of $68.35, down 0.08% on a day around $68.50 amid Monday’s Asian session.

The black gold earlier rallied to the highest since August 06 before stepping back from $69.50. In doing so, the quote stays below 50-DMA and a descending resistance line from July 07.

However, firmer RSI and the energy benchmark’s daily closing beyond 100-DMA keeps oil buyers hopeful unless witnessing a daily closing below $68.15, comprising the stated key moving average.

Even if the commodity prices drop below $68.15, the $68.00 threshold and double bottoms near $65.00, marked since July 20, will challenge the WTI bears.

Meanwhile, the $70.00 round figure guards the quote’s immediate upside ahead of the 50-DMA and the stated resistance line, respectively around $70.30 and $70.85.

In a case where the WTI bulls keep reins past $70.85, the late July tops near $73.90 and the July 13 peak of $74.95 will entertain them ahead of directing to the last month’s high of $76.40.

WTI: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.