WTI Price Analysis: Consolidates losses above $39.00, no-entry for bulls yet

- WTI attempts recovery moves from intraday low of $39.33.

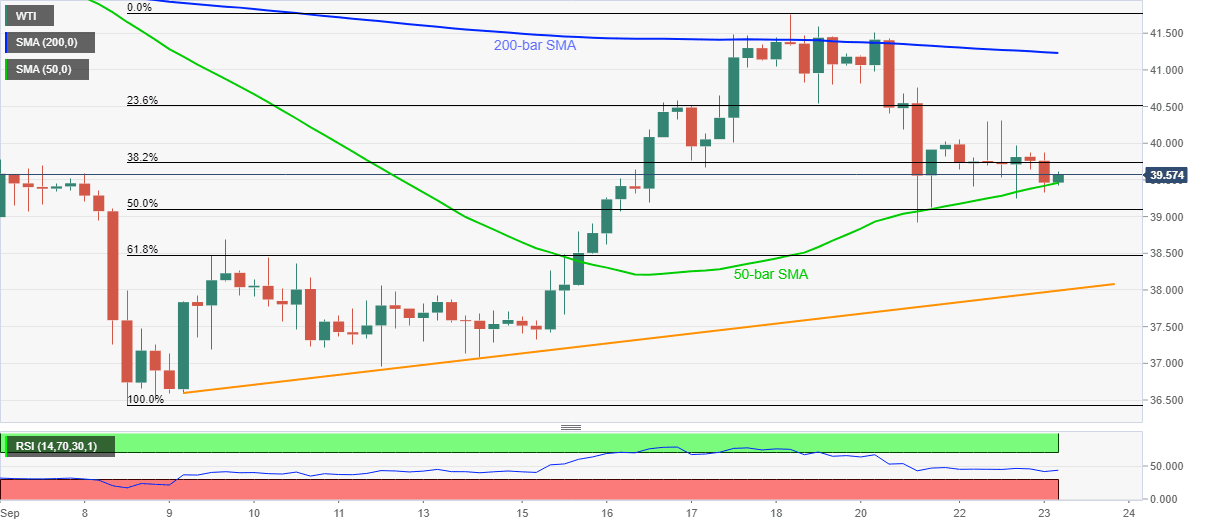

- In the 4-hour chart, 50-bar SMA offers immediate support, 200-bar SMA guards upside moves.

- Two-week-old ascending trend line, Friday’s top add filters to the momentum.

WTI picks up bids near $39.57 during the pre-European trading on Wednesday. Though, the black gold still drops 0.55% intraday by the press time.

While in the 4-hour chart the 50-bar SMA restricts the energy benchmark’s short-term declines, recovery moves are tamed by 23.6% Fibonacci retracement of September 08-18 upside and the 200-bar SMA.

Considering the latest pullback moves, WTI oil prices are likely to trim additional losses by challenging the 23.6% Fibonacci retracement level of $40.51. However, $40.00 may offer an intermediate halt during the rise.

Further to question buyers are the 200-bar SMA level of $41.23 and Friday’s top near $41.75.

Alternatively, the September 09 high of $38.68 can be tested on the break of $39.46 level, comprising immediate SMA support.

Also questioning the WTI weakness will be an upward sloping trend line from the early-month lows, at $38.00 now.

WTI four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.