WTI Price Analysis: Bulls continue to target key $76.50 resistance

- WTI looks to extend gains towards $76 amid a better market mood.

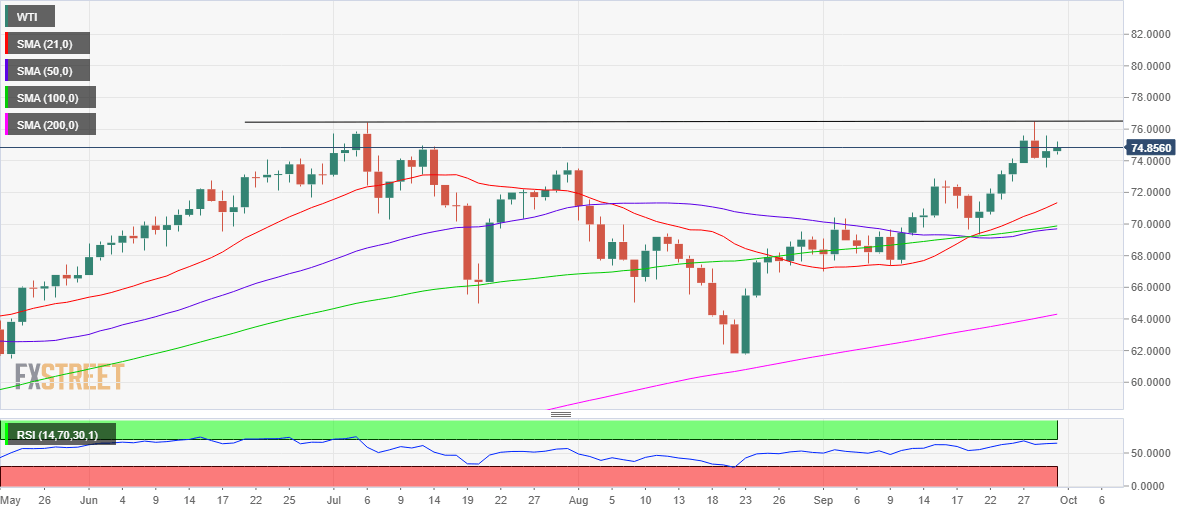

- The US oil needs acceptance above $76.50 to unleash further upside.

- Daily RSI looks north while above midline, keeping WTI bulls hopeful.

WTI (NYMEX futures) is posting modest gains in the European session, flirting with the $75 mark, as the bulls await a strong catalyst for the next big move.

The return of appetite for the riskier assets, in the wake of encouraging China Evergrande news, receding US Treasury yields and the aversion of a potential US government shutdown, is boding well for the higher-yielding WTI.

The renewed upside in the US oil keeps the buyers motivated to recapture the $76 level, as well depicted by its daily chart.

After a brief pullback from near three-year highs of $76.50 on Tuesday, WTI bulls have regained control but on a cautious footing amid the relentless surge in the US Treasury yields, which usually diminish the demand for oil as an alternative higher-yielding asset.

Further, global economic concerns re-emerged, amid China power cut and shortage of fuel in the Euro area causing manufacturing shutdowns, restricted the upside momentum in oil.

Nevertheless, the bullish bias remains intact, as WTI prices are set to take on the critical horizontal resistance around the mid-$76s.

The 14-day Relative Strength Index (RSI) continues to point north, well above the central line, allowing room for more gains.

Further, the 50-Daily Moving Average (DMA) is set to cut the 100-DMA from below, pointing to a potential bull cross confirmation.

WTI: Daily chart

On the downside, Wednesday’s low of $73.56 holds the key, below which a sharp correction towards the upward-sloping 21-DMA at $71.35 remains inevitable.

Ahead of that, the bulls could find some respite at the September 24 low of $72.72.

WTI: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.