WTI Price Analysis: Bears break key hourly structure, eye $75.00bbls

- WTI bears break the hourly structure at $77.70 and the focus is on the downside.

- Bulls eye a higher resistance up at 61.8% Fibonacci retracement level near $78.50. While below there, the bias is to the downside.

- Bears can target between $75.36 and $74.88 on a break of $75.50.

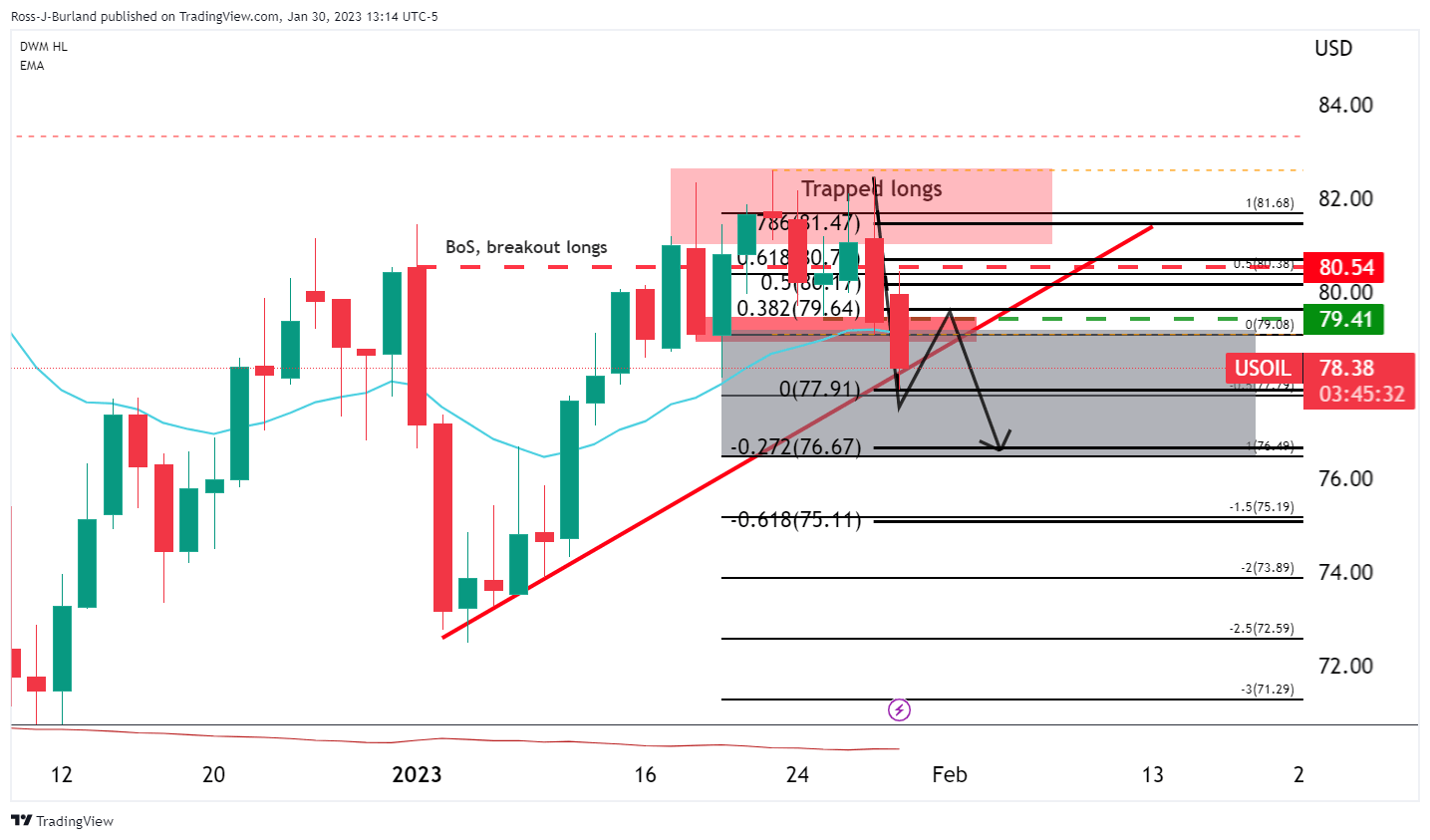

As per the prior analysis, WTI bears taking control into the Fed, eyes on $75.00bbl, the price of oil has indeed dropped towards the target areas as forecasted at the start of the week, pulling away from the trapped volume that had accumulated around $79.40/50. The following illustrates the price action and gives an update with prospects of a correction before the next move lower.

WTI, prior technical analysis

It was suggested that ''a correction into resistance could entice trapped longs to get out of losing or breakeven positions and subsequently the shorts coming onto the market around 38.2% Fibonacci correction could see a move out of the consolidation below the trapped volume and into a 100% measured target towards $75.00 over the course of the coming week.''

WTI Update

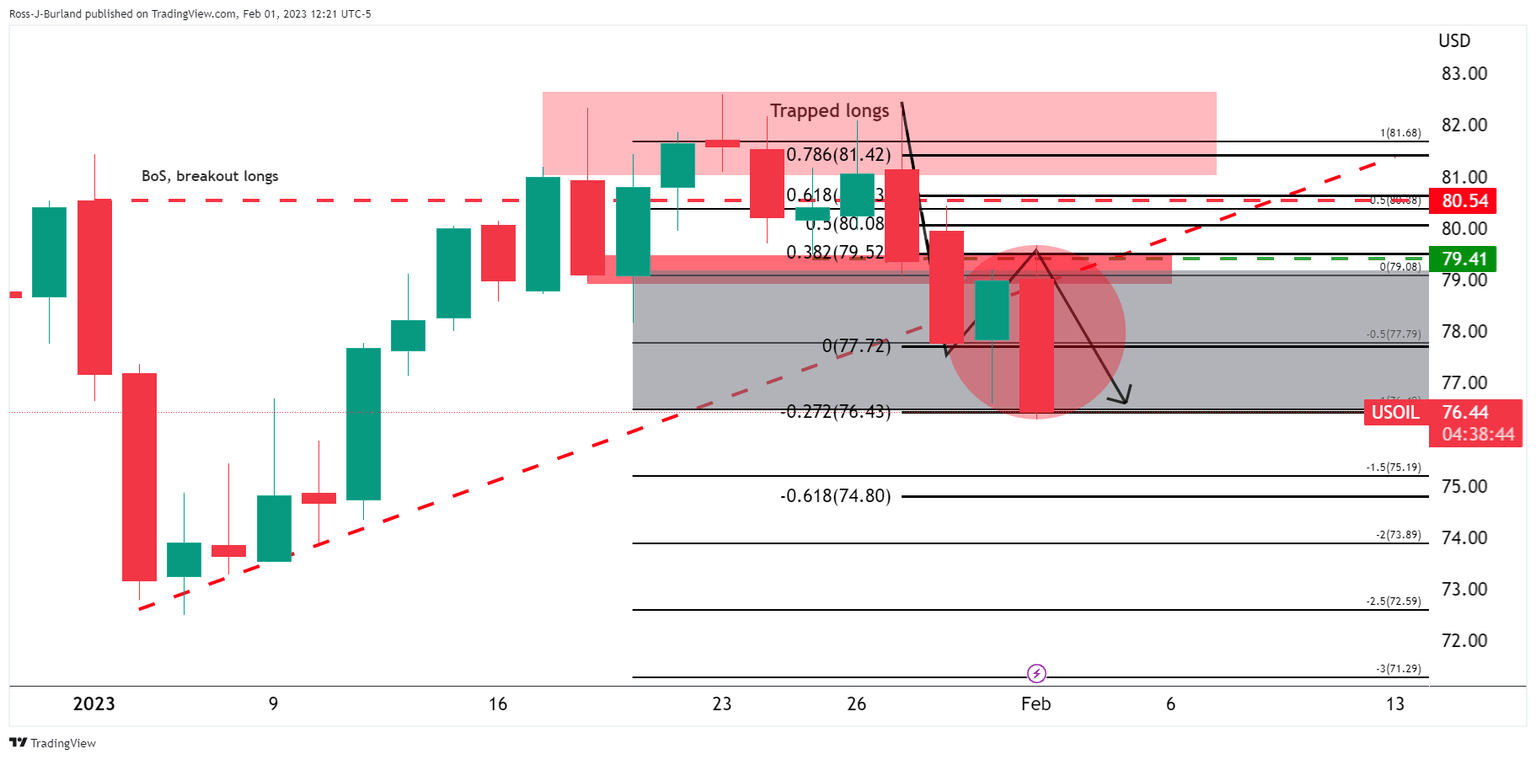

As illustrated, the price sank into the target area following a correction into where shorts were looking to get in at a premium. The subsequent move has fulfilled the 100% measured move and $75.00 beckons:

WTI H1 charts

Zoomed in ...

The greyed areas are price imbalances while the red marking is a resistance zone that has a confluence with the 61.8% Fibonacci retracement level near $78.50. While below there, the bias is to the downside. However, a more shallow correction may be all that is needed towards the 38.2% Fibo at $77.70. Either way, bears can target between $75.36 and $74.88 on a break of $75.50.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.