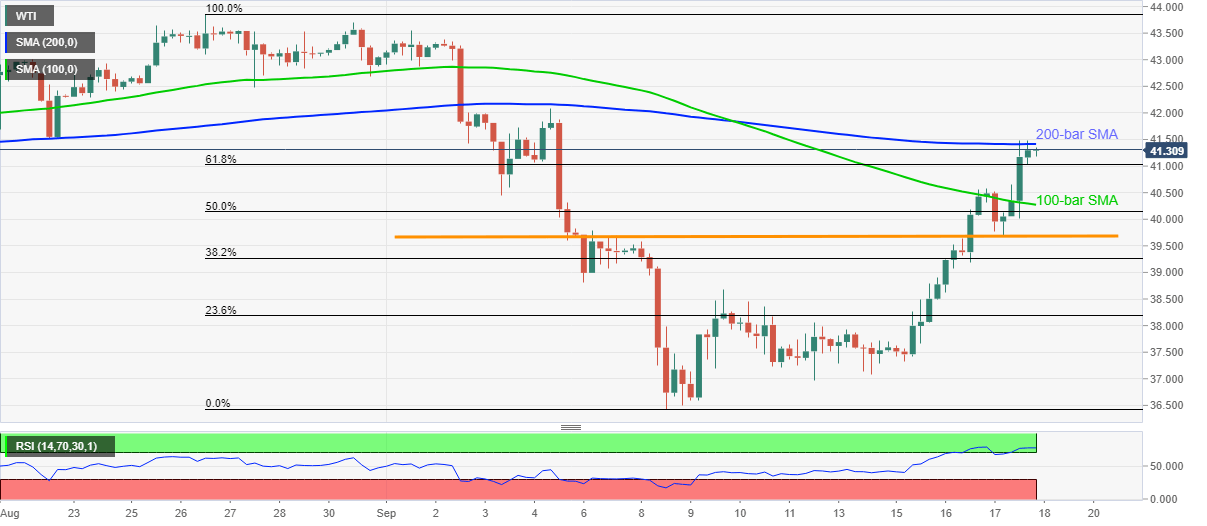

- WTI fizzles the run-up above $40.00 after flashing two-week high of $41.48.

- Overbought RSI conditions, strong SMA probe the bulls.

- Sellers await a clear downside break of 61.8% Fibonacci retracement level around the $41.00 area.

WTI consolidates the recent gains to $41.48 within a choppy range above $41.00, currently up 0.20% around $41.30, during the early Friday morning in Asia. The black gold surged to the highest since September 04 the previous day after breaking 100-bar SMA. Though, the 200-bar SMA seems to restrict the commodity’s latest up-moves amid overbought RSI conditions.

Considering the strength of the 200-bar SMA and signals of a pullback marked by the RSI, sellers remain hopeful. The same push them to look for entry if oil prices drop below the 61.8% Fibonacci retracement level of August 26 to September 08 downside, near $41.00.

In doing so, WTI will become vulnerable to revisit the 100-bar SMA level of $40.27 before catching a breather around the $40.00 threshold.

It should, however, be noted that a nine-day-old horizontal support linear $39.70 may question the energy bears after $40.00.

Meanwhile, an upside clearance of $41.42 figures, comprising 200-bar SMA, will aim for September 04 top of $42.07 before the August 27 bottom near $42.50 challenge further rise.

In a case where the WTI bulls dominate past-$42.50, August month’s top, also the highest since March 05, surrounding $43.85, will be in the spotlight.

WTI four-hour chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD softens below 1.0950 as Fed rate decision looms

The EUR/USD pair weakens to near 1.0935 during the Asian trading hours on Wednesday, pressured by a modest recovery in the US Dollar. Traders prefer to wait on the sidelines ahead of the US Federal Reserve interest rate decision on Wednesday.

Gold renews all-time highs ahead of the Fed verdict

Gold price is picking up fresh bids to hit a new record high near $3,040 early Wednesday. Gold buyers regain poise amid looming geopolitical risks while bracing for the all-important US Federal Reserve monetary policy announcements.

USD/JPY rises toward 150.00 on cautious Ueda comments

USD/JPY gains traction and rises toward 150.00 in the European morning after BoJ Governor Ueda said that they will continue to adjust the degree of policy easing. Earlier in the day, the BoJ announced that it left monetary policy settings unchanged, as anticipated.

XRP battles key trendline support as long-term holders continue holding onto large profits

XRP futures open interest has remained largely flat since the market crash in early February. The remittance-based token has shed 33% of its OI between February 1 and March 18, per Coinglass data.

Tariff wars are stories that usually end badly

In a 1933 article on national self-sufficiency1, British economist John Maynard Keynes advised “those who seek to disembarrass a country from its entanglements” to be “very slow and wary” and illustrated his point with the following image: “It should not be a matter of tearing up roots but of slowly training a plant to grow in a different direction”.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.