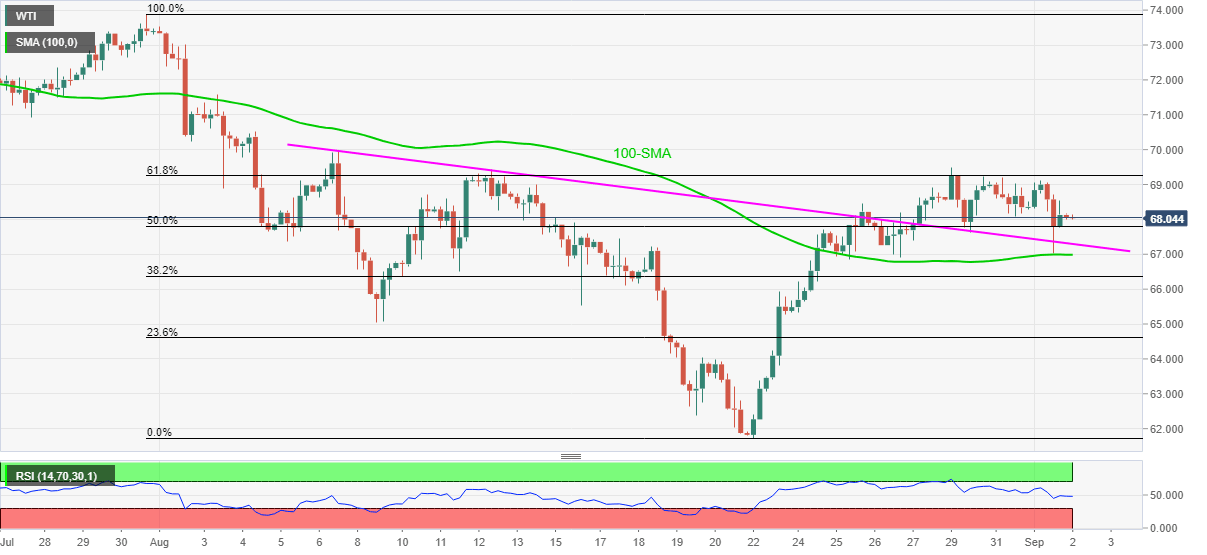

WTI Price Analysis: 100-SMA, previous hurdle back buyers around $68.00

- WTI remains sidelined after two-day downtrend, defends bounce off short-term key supports.

- Steady RSI adds to the bullish bias amid sustained trading beyond important supports.

WTI seesaws around $68.10, after a two-day downtrend, during Thursday’s Asian session.

In doing so, the oil benchmark defends the previous day’s U-turn from 100-SMA and the resistance-turned-support from August 06 amid steady RSI.

Given the quote’s ability to stay firmer beyond the short-term important support levels, WTI prices should recover.

However, a clear upside break of 61.8% Fibonacci retracement of July 30 to August 23, around $69.25, becomes necessary for the buyers to retake controls.

Following that, the $70.00 will validate the black gold’s rally towards late July’s peak close to $73.90.

Meanwhile, the stated support line near $67.30 restricts immediate losses of the WTI prices ahead of the 100-SMA level of $67.00.

Also acting as crucial support is the August 09 swing low near $65.00, a break of which will direct bears toward the last month’s low near $61.70.

WTI: Four-hour chart

Trend: Recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.