- Oil prices are bid ahead of the Fed on-demand expectations.

- The focus is back on tight supplies rather than rising coronavirus infections.

West Texas Intermediate (WTI) crude is higher on the day following data showed US crude inventories fell more sharply than analysts had forecast.

At the time of writing, WTI is trading at $72.48 and up over 0.8% after climbing from a low of $71.73 and reaching a high of $72.57.

The focus on Wednesday is on tight supplies rather than rising coronavirus infections.

Crude inventories fell by 4.1 million barrels in the week to July 23, the US Energy Information Administration said Wednesday. Gasoline and distillate fuel stocks also dropped.

The data follows the prior day's American Petroleum Institute (API) which had little initial impact on the market:

- Crude -4.728M.

- Cushing -0.126M.

- Gasoline -6.226M.

- Distillate -1.882M.

Meanwhile, the spread of the delta variant, despite vaccination programs, had capped progress in rising prices, and while it remains a concern, the market is taking the view that demand will outstrip supply.

''While the delta-variant continues to spread in the US, it is unlikely to meaningfully tighten mobility restrictions and derail the recovery in energy demand,'' analysts at TD Securities explained.

Equally, although the Organization of the Petroleum Exporting Countries and allies, known as OPEC+ have agreed to increase supply by 400,000 barrels per day from August, this is seen as too low.

''OPEC's cautious output deal will continue to underwhelm the recovery in energy demand,'' the analysts at TD Securities argued.

Meanwhile, the focus is on the statement from the US Federal Reserve policy meeting due at 1800 GMT and the Fed's chair, Jerome Powell, shortly afterwards.

Oil prices could be affected by the outcome of the event from the impact on the US dollar, for which oil is predominately priced, US stocks, the Fed's view on the economy, the delta variant and the possibility of a timetable for tapering.

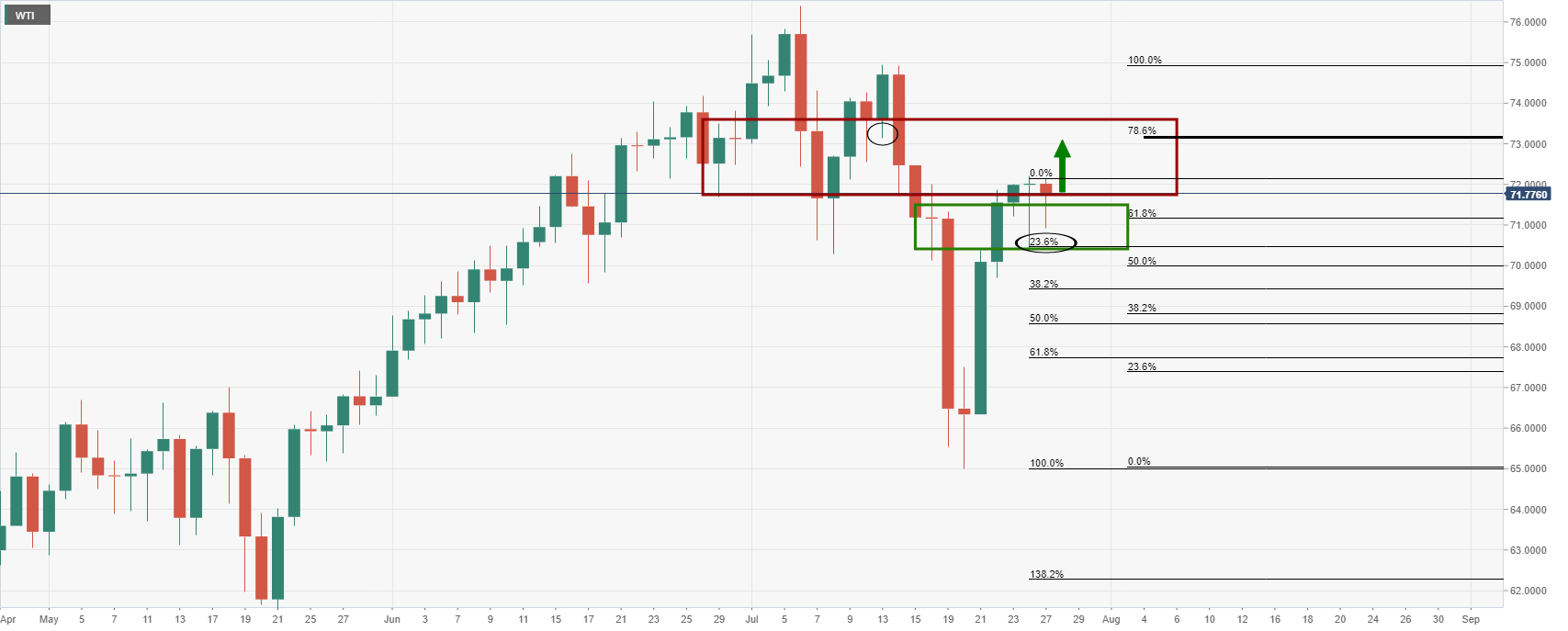

WTI technical analysis

In yesterday's chart analysis, above, it was noted that the price was supported by the 23.6% Fibonacci retracement of the current daily impulse near 70.50.

It was stated that the bulls can target the 78.6% Fibonacci retracement of the prior bearing impulse that has a confluence with the 13 July lows at 73.13.

Progress:

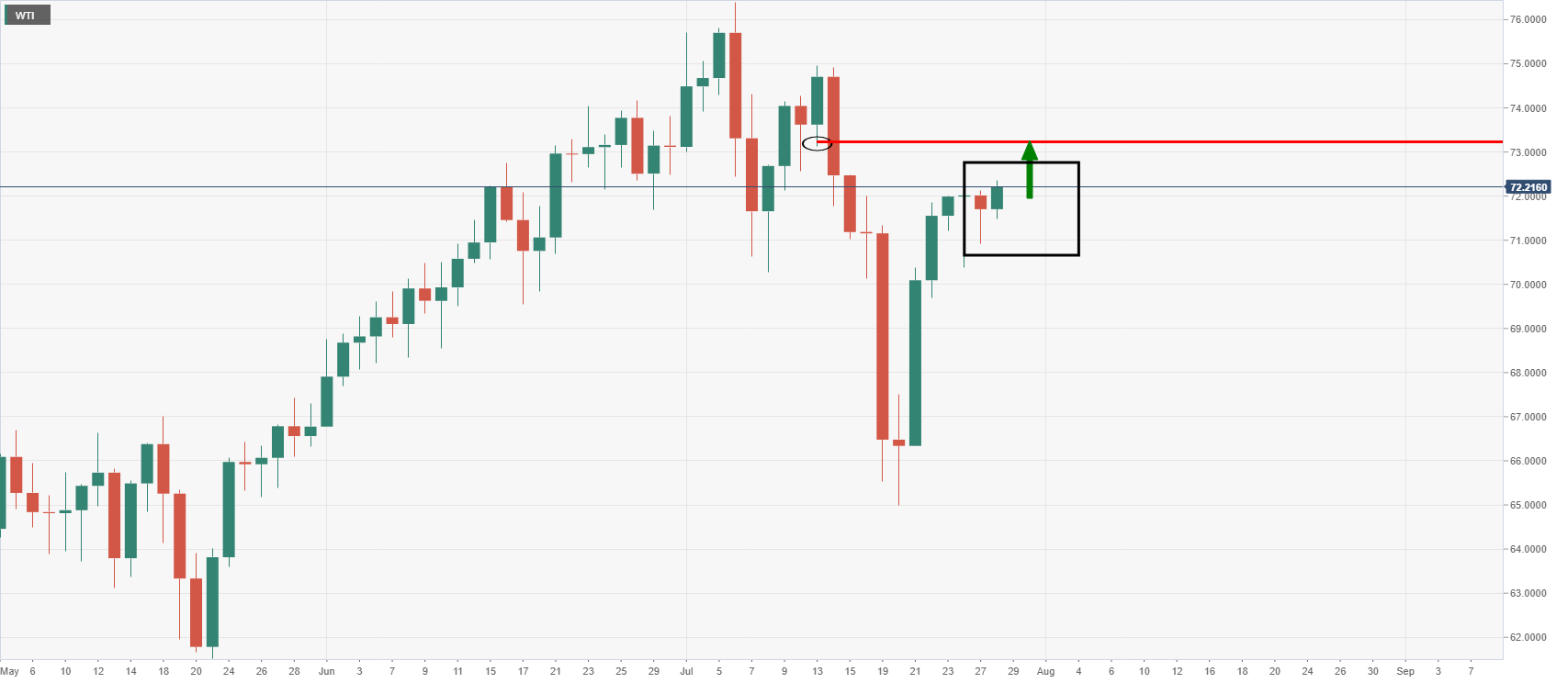

With all that being said, the Fed could throw a spanner in the works and send the US dollar flying high on an uber hawkish twist, such as mentioning a time frame for tapering within the statement itself.

DXY daily chart

If the bulls go in for a harder test of the resistance near 92.80, then oil could come under pressure.

This could negatively impact risk appetite and result in a deeper correction to test the bullish commitments at the 38.2% Fibo near 69.50 and below the psychological 70 level.

On the other hand, the dollar is ripe for a downside extension given that the resistance has already been tested and held.

A break of the trendline resistance would be a significant development in the greenback and likely point to lower lows for the near term.

DXY, 4-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold retreats after setting new record-high above $3,000

Gold corrects lower and trades below $3,000 after setting a new record-high above this level earlier in the day. Rising US Treasury bond yields and the upbeat market mood seems to be limiting XAU/USD's upside for the time being.

EUR/USD advances toward 1.0900 on renewed USD weakness

EUR/USD gains traction and rises toward 1.0900 in the European session on Friday. The improving risk mood makes it difficult for the US Dollar (USD) to find demand and helps the pair push higher. Markets await US consumer sentiment data for March.

GBP/USD rebounds from session lows, stays near 1.2950

GBP/USD recovers toward 1.2950 after falling below 1.2920 with the immediate reaction to the disappointing macroeconomic data releases from the UK in the early European session. The renewed USD weakness amid a positive shift seen in risk sentiment helps the pair hold its ground.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Brexit revisited: Why closer UK-EU ties won’t lessen Britain’s squeezed public finances

The UK government desperately needs higher economic growth as it grapples with spending cuts and potential tax rises later this year. A reset of UK-EU economic ties would help, and sweeping changes are becoming more likely.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.