- WTI trades lower as a function of the broader risk-off market tone, although is off $40.50 lows.

- Today’s OPEC+ JMMC largely went under the radar, with focus on the end of month official OPEC+.

WTI crude currently trades just above $41.00, above lows closer to $40.50, but still with losses of around $0.30 on the day or about 0.7%.

Crude conforms to risk-off flows

A broader tone of risk-off that has permeated global financial markets today has also weighed on crude oil markets. Broadly speaking, the downside seen in global equity and commodity markets initially seemed to be a technical correction/profit-taking following yesterday’s Moderna vaccine news inspired gains, however, soft US retail sales data at 13:30 is likely also not helping.

Supply-side developments seem not to have shifted the radar much for crude oil markets; the OPEC+ Joint Ministerial Monitoring Committee (JMMC) met today. Their meeting, which proceeds the all-important end-of-month official OEPC+ meeting, failed to yield a recommendation, but recent reports suggest that there is broad support amongst OPEC+ for at least a 3-month extension to the current 7.4M BPD in output cuts agreed to by the cartel.

Looking ahead, crude oil market focus now shifts to US inventories, with private weekly API inventory data out at 21:30GMT tonight, ahead of official inventories numbers from the US EIA on Wednesday at 15:30GMT.

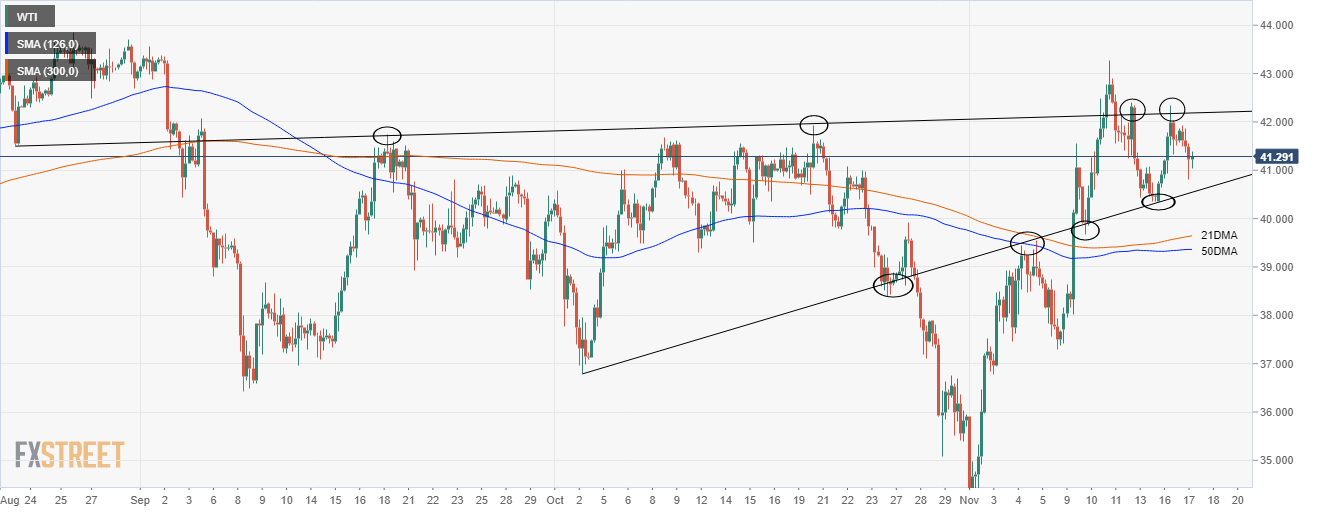

WTI continues consolidation between trendlines

WTI continues to consolidate between two long-term uptrends. To the upside is a trendline linking the 21 August low and the 18 September, 20 October, 12 and 16 November highs (all between $41.50 and $42.00), and looks set to come into play just above the psychological $42.00 level, which itself WTI has struggled to rally above over the last three months. To the downside, is a trendline linking the 2, 26 October, lows, the 4 and 5 November highs and 13 November lows. This trendline ought to come into play well before support at the $41.00 and the 13 November low at $40.06.

Looking at WTI through a shorter-term lens, Tuesday’s lows around $40.50 ought to offer the most immediate support, while Tuesday’s highs just above $41.50 will offer the most immediate resistance.

WTI four-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD climbs above 1.0500 on persistent USD weakness

EUR/USD preserves its bullish momentum and trades above 1.0500 on Monday. In the absence of high-impact data releases, the risk-positive market atmosphere makes it difficult for the US Dollar (USD) to find demand and helps the pair push higher.

GBP/USD rises to 1.2600 area as mood improves

Following a short-lasting correction, GBP/USD regains its traction and trades at around 1.2600. The US Dollar struggles to stay resilient against its rivals as market mood improves on Monday, allowing the pair to build on its bullish weekly opening.

Gold turns bearish and could test $2,600

After recovering toward $2,700 during the European trading hours, Gold reversed its direction and dropped below $2,650. Despite falling US Treasury bond yields, easing geopolitical tensions don't allow XAU/USD to find a foothold.

Five fundamentals for the week: Fed minutes may cool Bessent boost, jobless claims, core PCE eyed Premium

Will the rally around Scott Bessent's nomination continue? The short Thanksgiving week features a busy Wednesday packed with events, and the central bank may cool the enthusiasm.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.