- WTI is currently trading at $61.36bbls having travelled lower by 3.49% on the day so far from a high of $63.65 to a low of $60.97bbls.

- A spike in U.S. supplies and record. crude production has weighed in on prices which were technically overbought according to stochastics.

- Technically, this could be start of a strong bearish trend, initially targetting below the $52 handle.

The move from yesterday has extended on Thursday following the U.S. government report that had revealed a nearly 10 million-barrel rise in domestic crude supplies which was the largest weekly climb year to date. The data has been accompanied by weekly U.S. crude production moving up by 100,000 barrels to a record 12.3 million barrels per day.

Then, on the flipside, due to Saudi Arabia's disclamations over Trump's assertions that OPEC will harmonize in efforts aimed to squeeze out Iranian oil trade from the market, we are seeing backwardation in Brent prices as spot continues to rise and the diverging price action between WTI and Brent is indicative of the market's growing belief that while the Brent market will likely remain tight, the US shale patch will likely keep the domestic market well supplied in relative terms weighing on the price of WTI, especially if stockpiles, which are the highest since 2017, continue to grow.

Meanwhile, with consideration to the U.S. waivers on Iran oil sanctions which have expired today, we will have to wait and see what OPEC will do about production in June, for at this point, we know from a) Oman’s energy minister Mohammed bin Hamad al-Rumhy, who said on Wednesday it was OPEC’s goal to extend the production cuts and b) Saudi Arabia’s energy minister Khalid al-Falih reportedly told Russia’s RIA news agency earlier this week that the Saudis will also adhere to the production-cut agreement led by OPEC and possibly extend the agreement when it expires in June.

WTI levels

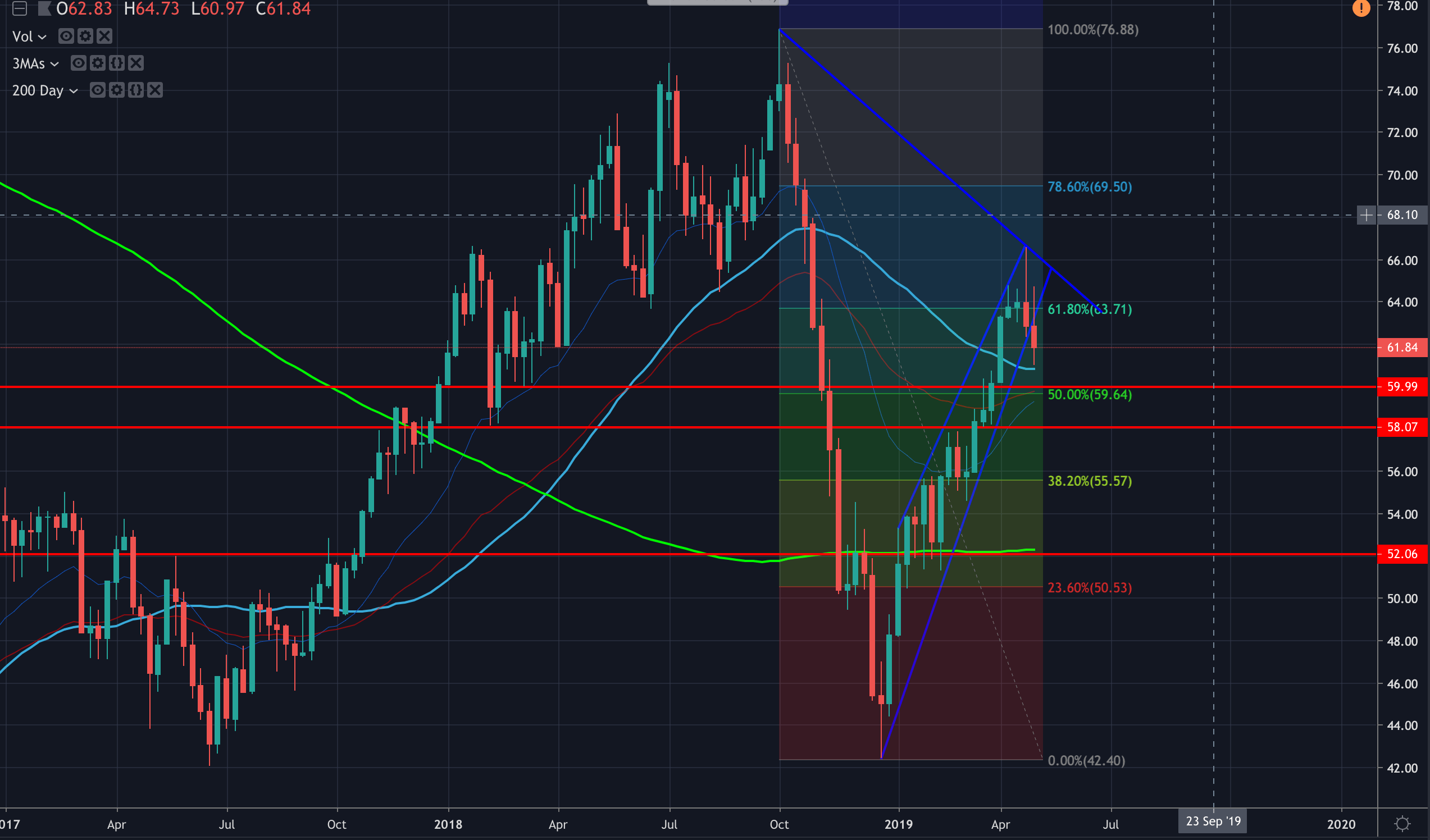

From a technical standpoint, the price has fallen away from the rising wedges' support. Stochastics still lean bearish on the longer time frames and bears are en route for a test of the 200-D SMA and 50-D SMA converging just below the low today. However, a mean reversion might be expected at this juncture and the 50% retracement of the move comes in at 62.31, in line with 26th April's low. A less ambitious retracement falls in at 61.80.

Bearish wedge continuation pattern breakout

However, the rising wedge is a bearish continuation pattern and wedges can be significant turning points. In this case, a break and continuation of the bear trend would target below the $42 handle and late Dec lows - (Wedge breakouts can see the price run in the breakout direction for long periods of time). The price could drop by at least the height of the wedge (measured at the base where the two trendlines start) which is around $10.80 for a target of $52.00 (at weekly 200 MA/ 50 pips above Feb lows).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0850 as mood sours

EUR/USD stays under modest bearish pressure and declines toward 1.0850 on Tuesday. The US Dollar benefits from safe haven flows and weighs on the pair as investors adopt a cautious stance ahead of this week's key earnings reports and data releases.

GBP/USD stays pressured toward 1.2900 as US Dollar stabilizes

GBP/USD is on the defensive toward 1.2900, struggling to find a foothold on Tuesday. The US Dollar holds steady following Monday's pullback amid a negative shift seen in risk sentiment, not allowing the pair to regain its traction.

Gold recovers above $2,400 as US yields retreat

Gold stages a rebound and trades above $2,400 on Monday after closing the fourth consecutive trading day in negative territory on Monday. The pullback seen in US Treasury bond yields help XAU/USD stretch higher despite the US Dollar's resilience.

Bitcoin price struggles around $67,000 as US Government transfers, Mt. Gox funds movement weigh

Bitcoin struggles around the $67,000 mark and declines by 1.7% at the time of writing on Tuesday at around $66,350. BTC spot ETFs saw significant inflows of $530.20 million on Monday.

Big tech rebound ahead of earnings, Oil slips

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

Tesla and Google are due to report earnings today after the bell, and their results could shift the wind in either direction. Despite almost doubling its stock price between April and July, Tesla sees appetite for its cars and its market share under pressure.