WTI bulls break into key bullish territory

- WTI ended the New York day higher by over 2.9%.

- The combination of demand expectations, stockpiles and Iran headlines boosted oil overnight.

A weaker USD boosted its appeal of commodities among investors and for oil in particular, negotiations between the United States to the Iran nuclear accord have been suspended following the election of hardliner Ebrahim Raisi in Iran's presidential elections.

West Texas Intermediate (WTI) crude oil rallied to a new 32-month high on Monday while rising expectations of further declines in inventories also boosted sentiment.

WTI crude for July delivery settled up US$2.02 to US$73.66 per barrel, Marketwatch reported. August Brent crude, the global benchmark, was last seen up US$1.30 to US$74.81.

On a spot basis, WTI ended the New York day higher by over 2.9% after rallying from a low of $71.17 and to a high of $73.94bbls.

Meanwhile, a Bloomberg survey that was released has suggested that the market is expecting stockpiles fell by 4,386kbbls last week.

''Data-provider Genscape reported a 2.6mbbl drop in stockpiles at Cushing, Oklahoma. Inventories there are already at their lowest level since March 2020. This is being driven by strong travel data,'' analysts at ANZ bank said.

The combination of demand expectations and the prospects whereby otherwise, successful talks could see the return of a million barrels per day or more of Iranian exports to the world markets, has supported the price at the start of the week.

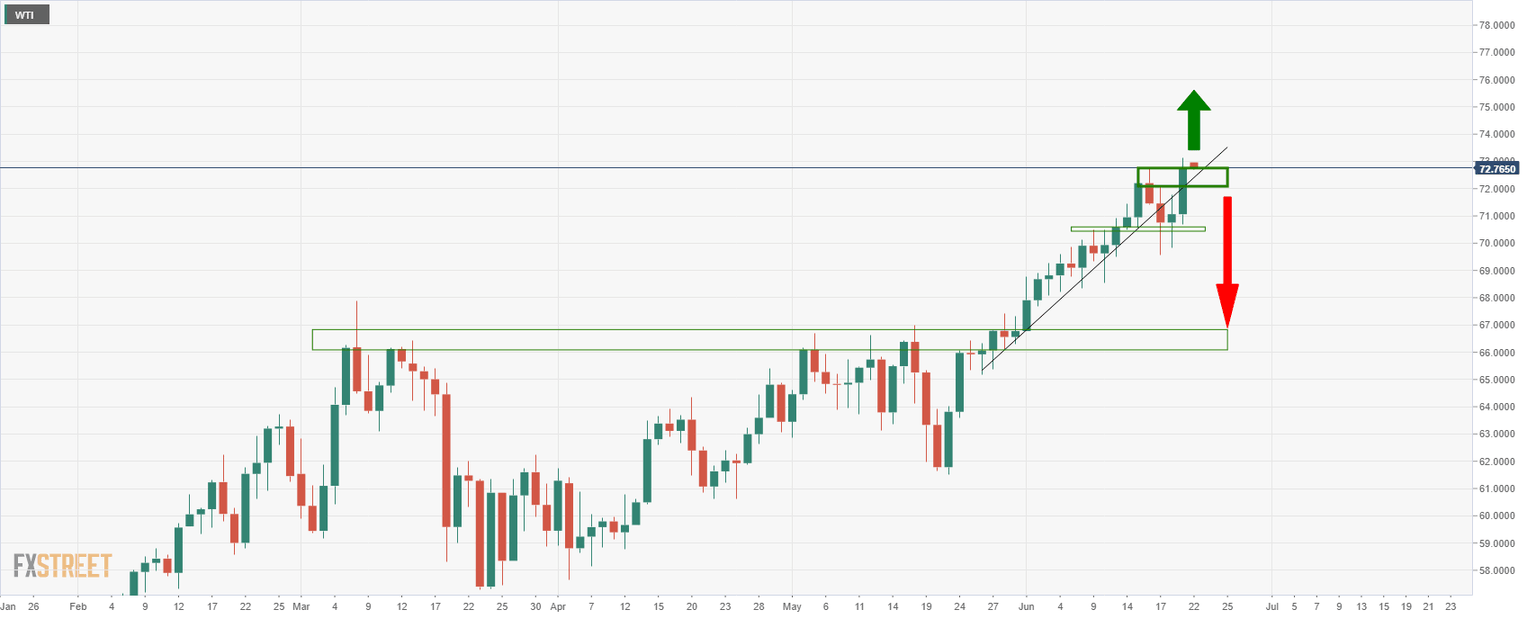

WTI technical analysis

Technically, bulls have moved in on the dynamic counter trendline which has subsequently buckled.

In doing so, the price is above the old resistance of 72.96.

This old resistance would now be expected to act as support.

On the upside, bulls will have their eyes on the psychological $75 level. On the downside, another test of 70 opens risk to the early summer highs.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.