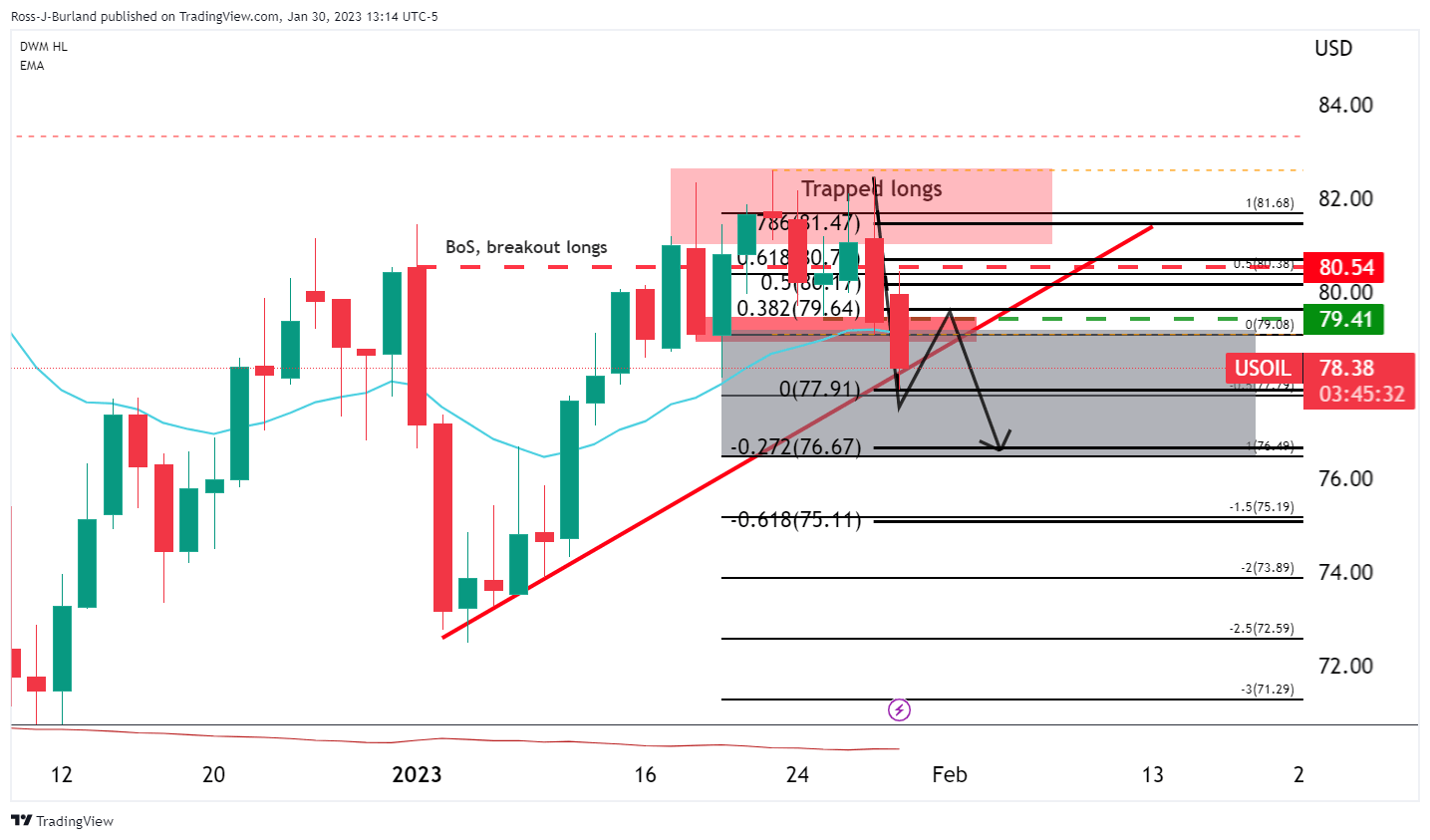

WTI bears taking control into the Fed, eyes on $75.00bbl

- trapped longs are panicking as bears take control.

- A 38.2% Fibonacci correction could result in further fresh supply.

- A 100% measured target towards $75.00 is eyed for over the course of the coming week:

West Texas Intermediate has dropped by over 1% on the day and is trading around $78.50 at the time of writing after falling from a high of $80.44 and reaching a low of $77.91 so far on the day, ending a bullish start to the year towards month-end and following its fi4rst weekly loss last week for the year so far,

Analysts at ANZ Bank argue that technical factors have been in play, with Brent futures failing to hold above the 100-day moving average. Nevertheless, they said, ''the market remains buoyed by what China’s reopening will mean for demand.''

''Money managers increased their bullish positions on Brent to its highest level in 11 months. Spot prices moved back into a premium with futures, signalling expectations that demand will outstrip supply,'' the analysts added noting that in China, ''travel surged to 90% of pre-pandemic levels over the Spring Holiday. Domestic air travel was also up 80% y/y last week.''

Meanwhile, prices on Monday are lower as investors turned cautious ahead of an expected rise in US interest rates this week. The Federal Reserve is meeting and a hawkish pushback against the notion of the market that a Fed pivot is due is keeping investors sidelined and keen to cash in on positions before the event. The Federal Reserve is expected to result in a 25-basis point rise to US interest rates, keeping recession fears top of mind for investors.

The drop in prices comes despite geopolitical risk in the Middle East rising following a drone attack on an ammunition manufacturing plant facility in the Iranian city of Isfahan. The attack is being blamed on Israel, according to the New York Times.

Elsewhere, there are ongoing concerns that markets will struggle to adjust to European sanctions on oil products. TotalEnergies warned that Europe is still at risk of diesel shortages.

Analysts at TD Securities argued that CTA trend followers are better positioned in petroleum products including heating oil and RBOB gasoline ahead of the EU's import bans on Russian fuels, although recent algo liquidations have still helped to weaken gasoline crack spreads. ''The EU's fuel ban continues to provide uncertainty with respect to fuel availabilities in coming months, but resilient Russian exports are defying expectations for imminent disruptions,'' the analysts explained. ''Nonetheless, additional CTA long acquisitions could be expected above the $2.62/gal range in gasoline, although CTAs are already nearing their effective max length in heating oil.''

WTI technical analysis

Meanwhile, New York traders were getting short of the trapped volume accumulated around $79.40/50 which led to a sell-off in the opening hours of trade before a short squeeze in the cash open on Wall Street:

However, with the Fed coming up this week, and considering the daily M-formation and trendline support, we could be in for some consolidation for the forthcoming sessions:

With that being said, a correction into resistance could entice trapped longs to get out of losing break-even positions. Subsequently, this could see more shorts coming onto the market around 38.2% Fibonacci correction. This could then see a move out of the consolidation below the trapped volume and into a 100% measured target towards $75.00 over the course of the coming week:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.