- WTI has been in the hands of the bears mid-week.

- A bearish H&S pattern has emerged on the daily chart with the right-hand shoulder on the backside of the micro trendline.

West Texas Intermediate (WTI) is around flat on the day so far following a consolidative and inside day on Wednesday. NATO said there was no evidence a missile that landed near a Polish village and killed two was a deliberate attack. The consensus is that it likely came from a Ukrainian air-defense system firing during Russian attacks and this has been easing concerns of an expanding war.

The Druzhba pipeline, which carries Russian oil into Europe was shut down earlier this week after Russian artillery damaged its infrastructure. However, the power supply is said to have been restored, analysts at ANZ Bank said. This is allowing oil delivers to countries such as Hungary, the Czech Republic, and Slovakia. ''Initial concerns of further disruptions in the Middle East also eased. An oil tanker was hit by a projectile in the Gulf of Oman, although damage was limited.''

Nevertheless, the analysts at ANZ Bank also said that the market is still facing supply-side issues. ''Germany warned it can’t rule out temporary supply bottlenecks when a ban on imports on Russian crude starts next month. OPEC also appears to be reducing output in line with its agreement to cut production. Tanker tracker data shows that OPEC shipments were significantly more than 1mb/d in the first 15 days of November, according to Petro-Logistics. Markets found some support from EIA’s weekly inventory report. Commercial stockpiles reached 5,400kbbl last week.''

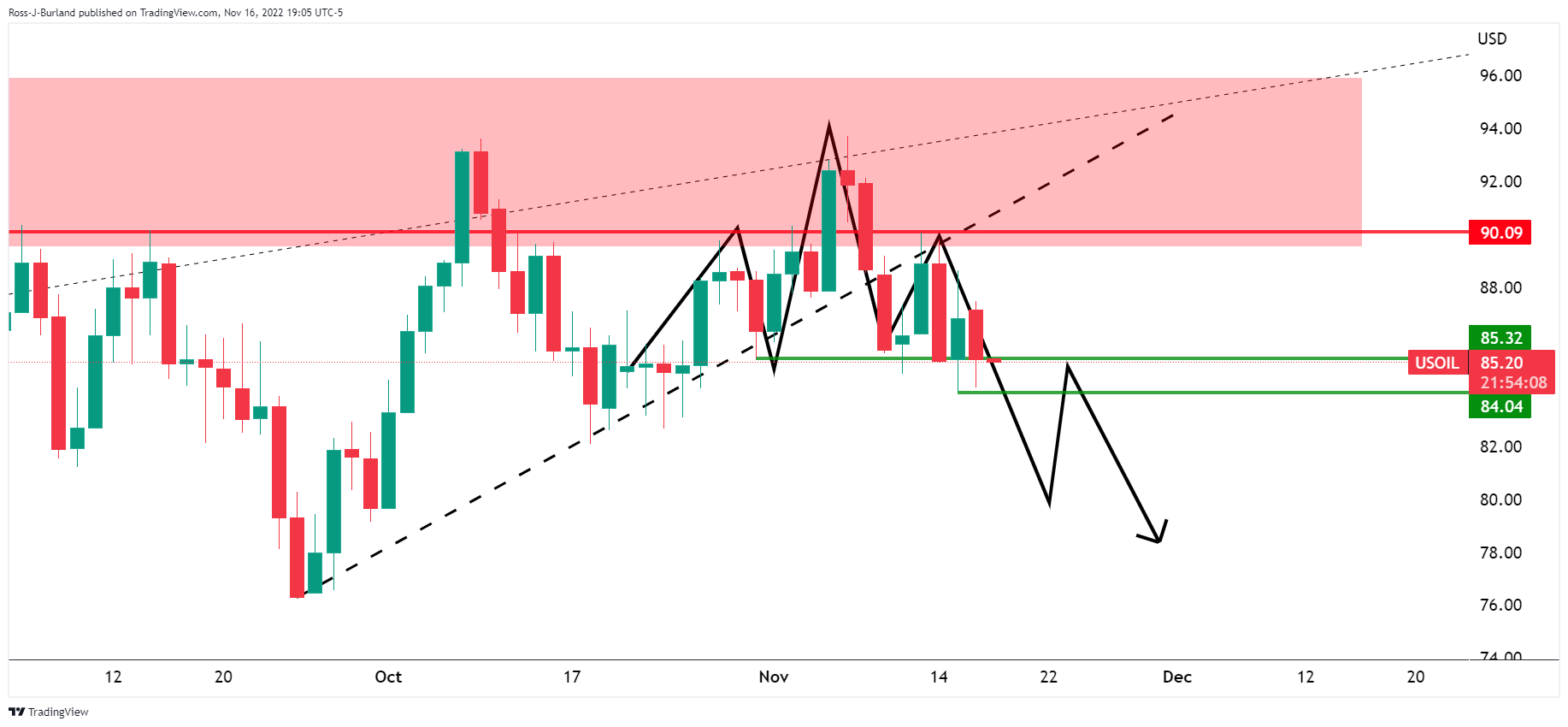

WTI technical analysis

The following illustrates a multi-time-frame bearish bias on the monthly, weekly, and daily charts.

The price is now on the back side of the monthly trendline and is being rejected on a restest.

The price could be on the verge of completing an M-formation below the locked-in highs below horizontal resistance.

A bearish H&S pattern has emerged on the daily chart with the right-hand shoulder on the backside of the micro trendline.

Bears broke the prior structure of 85.32 but have been unable to follow through. A move below $84 the figure is now required to shift the bias fully.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0400 in quiet trading

EUR/USD continues to fluctuate in a tight channel at around 1.0400 in the European session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to find direction.

GBP/USD declines toward 1.2500 as markets turn cautious

GBP/USD stays under modest bearish pressure and retreats toward 1.2500 on Friday after posting small losses on Thursday. The cautious market mood doesn't allow the pair to gain traction, while trading volumes remain low following the Christmas break.

Gold struggles to build on weekly gains, holds above $2,620

Gold enters a consolidation phase and trades below $2,630 on Friday after closing in positive territory on Thursday. The risk-averse market atmosphere helps XAU/USD limit its losses as investors refrain from taking large positions heading into the end of the holiday-shortened week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.