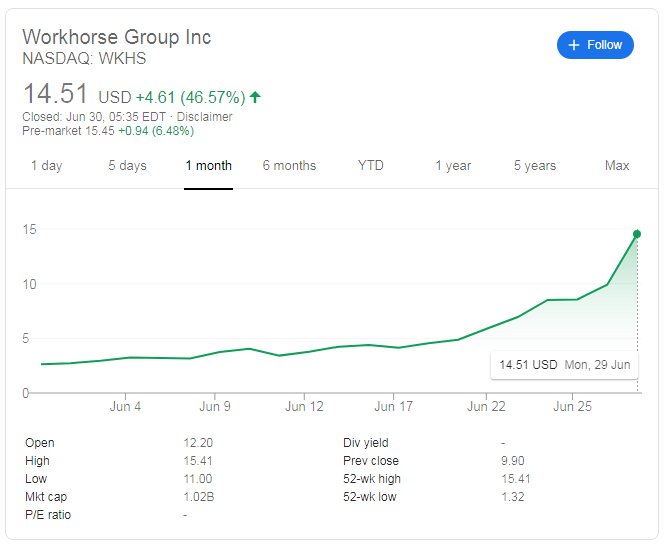

- NASDAQ: WKHS is changing hands at $15 in pre-market trade on the last month of June.

- Workhorse Group Inc. is making electric delivery vans, a winning mix of trends.

- Stake in electric pickup truck maker allows it to compete with Elon Musk's Tesla.

Electric vehicles are becoming more popular and governments incentives their usage in the past few years. A more recent trend is an increase in demand for deliveries as customers are either forced or scared to shop on the high street.

Workhorse Group Inc. – a small company from Loveland, Ohio, the heart of the "rust belt" – combines these two winning trends. It makes electric delivery vans. Workhorse, trading under NASDAQ: WKHS, is aiming to sell these vans to UPS, FedEx, and DHL.

Workhorse also has a 10% stake in Lordstown Motors, and that may prove a golden egg for the firm.

Steven Burns, its former CEO, founded Lordstown Motors and makes electric pickup trucks. Consumers have been piling into pickup trucks in recent years, amid lower prices. Even if the price at the pump returns to rise – amid falling shale oil production or any other reason – Lordstown Motors may have a winning product. Pickup trucks complete a trio of winning trends.

Competitors include Nikola Motor's Badger and Tesla's Cybertruck. Any comparison to Tesla and its funder Elon Musk adds to the interest in the firm.

Workhorse Group news

The most recent boost to NASDAQ: WKHS stock came from its dramatic announcement that it has been included in the Russell 3000 Index. That means that institutional investors focused on these stocks will now invest in the firm. That includes Exchange Traded Funds, mutual funds, etc.

Shares traded at around $2.5 early in June are now on course to surpass $15 in Tuesday's premarket trading. Looking back to mid-March, when NASDAQ: WKHS had a close low of $1.47, shares are already up around ten-fold, or over 900%.

Broader markets are torn between upbeat economic figures and concerns about rising coronavirus cases in the US.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold races toward $3,150, at record highs amid tariff woes

Gold price stretches its record-setting rally toward $3,150 in European trading on Monday. The bullion continues to capitalize on safe-haven flows amid intesifying global tariff war fears. US economic concerns weigh on the US Dollar and Treasury yields, aiding the Gold price upsurge.

EUR/USD defends gains below 1.0850 ahead of German inflation data

EUR/USD is holding mild gains while below 1.0850 in early Europe on Monday. The pair draw support from a broadly weaker US Dollar but buyers stay cautious ahead of Germany's prelim inflation data and Trump's reciprocal tariff announcement.

GBP/USD posts small gains near 1.2950 amid tariff woes

GBP/USD keeps the green near 1.2950 in the European morning on Monday. Concerns that US President Donald Trump's tariffs will ignite inflation and dampen economic growth weigh on the US Dollar and act as a tailwind for the pair.

Crypto market sheds over $130B in market cap on Trump tariff uncertainties

The crypto market lost over $130 billion in market capitalization the previous week. Major cryptocurrencies like Bitcoin, Ethereum, Ripple, and Solana fell 5.9%, 10.9%, 15% and 10.1%, respectively, according to CoinGecko data.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.