- Workhorse Group Inc has received $70 billion in financing.

- Inclusion in the Russell 3000 index increases flows from fund managers.

- NASDAQ: WKHS received a bullish buy recommendation with a target price of $26.

- Elon Musk's Tesla has become the world's most valued carmaker, lifting all EV stocks.

- Robinhood accounts owning the stock surged by 436% in June to 116,000.

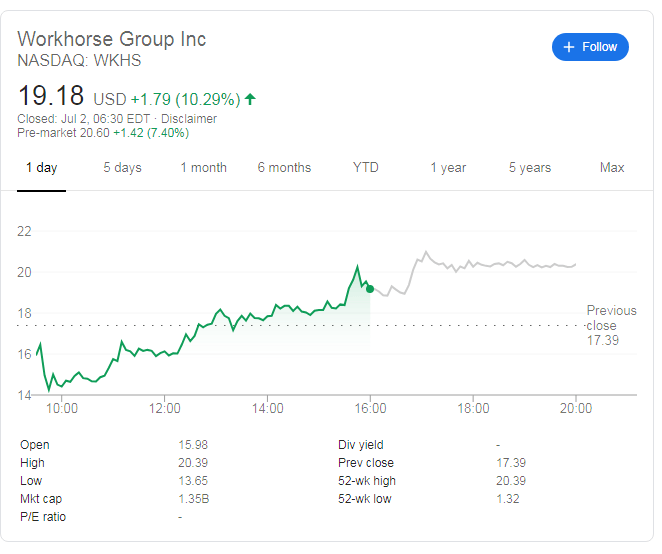

NASDAQ: WKHS has been on a winning streak, rising from below $3 in June to near $20 as July kicked off. Premarket trading shows that Workhorse Group Inc. is set to extend its gains by another 8% to around $20.75.

Why is the electric carmaker rising? There are five reasons.

Workhorse Group news

1) Workhorse secured $70 million in new financing: The Loveland, Ohio-based firm received the lump sum from an institutional investor and that will enable it to expand production and provide peace and calm for investors.

2) Russell 3000 inclusion: NASDAQ: WKHS has recently been included in the Russell 3000 index of small stocks. Mutual funds and ETFs will now automatically invest in the firm due to their obligation. That is boosting the stock price and also encouraging private investors to pile in.

3) Bullish recommendation: Gregory Lewis, an analyst with BTIG, upgraded his target for NASDAQ: WKHS big-time – from $10 to $26, a whopping increase of 160%. It is essential to note that price is some 30% above levels that shares are currently changing hands, so there is room for more, at least according to Lewis.

4) Tesla: Elon Musk's firm is undoubtedly the leader in the electric vehicle field, and it has now topped Toyota to become the biggest carmaker – in terms of market capitalization. As Tesla is producing only a fraction of what its legacy automotive competition does, perhaps it is overvalued. That allows other firms such as Workhorse Group to come into the spotlight.

5) Robinhood hype: The accessible trading application has seen a surge in usage and people using it. They may either have free time due to lockdowns – or fewer things to gamble on as sports are shuttered. The young crowd using it often coalesces around specific stocks and NASDAQ: WKHS is an example. Accounts surge by 436% in June to 116,000.

These five reasons to rise join Workhorse Group's core offering, which combines a trio of winning advantages. It is not only limited to operating in the EV industry.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold rallies to new record-high above $3,030

Gold benefits from escalating geopolitical tensions and extends its rally to a new record-high above $3,030 in the American session on Tuesday. Israel resumed military operations against Hamas in Gaza after the group rejected US proposals for extending ceasefire. All eyes now remain on the Trump-Putin call.

EUR/USD retreats from fresh 2025 highs, flirts with 1.0900

EUR/USD retreats from the multi-month high set above 1.0950 earlier in the day and tests 1.0900. The risk-averse market atmosphere helps the US Dollar (USD) holds its ground and makes it difficult for the pair to preserve its bullish momentum.

GBP/USD turns south after testing 1.3000

After reaching its highest level since early November above 1.3000, GBP/USD loses its traction and declines toward 1.2950 on Tuesday. The US Dollar makes a strong comeback and weighs on the pair, helped by upbeat local data and the souring risk mood ahead of this week's key central bank meetings.

Trump-Putin talks raise hopes of a ceasefire – Middle East risk returns

The prospective end to the Russia-Ukraine war has traders excited for a more positive growth outlook in Europe going forward, with heavily industrialised nations such as Germany having suffered under the weight of elevated energy costs in recent years.

Tariff wars are stories that usually end badly

In a 1933 article on national self-sufficiency1, British economist John Maynard Keynes advised “those who seek to disembarrass a country from its entanglements” to be “very slow and wary” and illustrated his point with the following image: “It should not be a matter of tearing up roots but of slowly training a plant to grow in a different direction”.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.