- NASDAQ: WKHS is set to resume trading after the long weekend by consolidating its gains.

- President Donald Trump cheered the return of manufacturing jobs ahead of the long weekend.

- The five previous reasons for Workhorse Group Inc. to rise to remain intact.

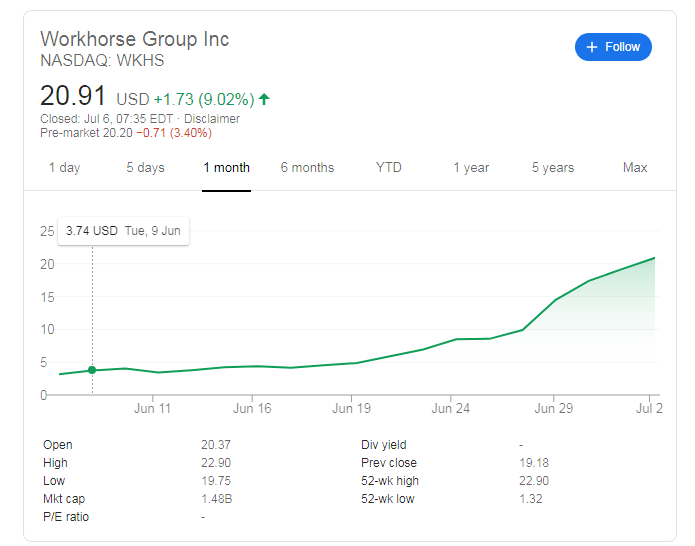

Is NASDAQ: WKHS ready to gallop over another hurdle? Workhorse Group Inc's stocks closed the short Independence Day week at $20.91, up from another 9% from the previous day and nearly completing a seven-fold increase since early June. Back then, it traded around $3.

Pre-market trading is showing a minor retreat for the Loveland, Ohio-based company – consolidating previous gains. Nevertheless, after a downside correction, Workhorse may return to riding higher.

Workhorse Group news

Just ahead of the weekend, President Donald Trump came out to the press and cheered the upbeat Non-Farm Payrolls report, highlighting the increase in 356,000 manufacturing jobs. While many workers were just called back to work after the initial lockdowns, Trump trumpeted the rise and also promised that recent trade deals will continue bringing jobs back to America.

Incumbent Trump is trailing rival Joe Biden by some nine points in national polls – making Republican-leaning Ohio a swing state. The president's "base" is white, working-class males without a college degree, many of them in the "rust belt." With the current erosion in his support, Trump may attempt to boost the sector.

In turn, that could be another factor encouraging investors to pile into NASDAQ: WKHS.

Workhorse manufactures electric vehicles, a rising trend. Moreover, the company has an investment in Lordstown Motors, which is working an electric pickup truck – which can be used for deliveries. With raging coronavirus cases – one of the factors playing against Trump – consumers are opting for home deliveries rather than in-person buying.

Overall, Workhorse Group seems to be in the right place at the right time. There are additional reasons to like the company, which all remain intact.

See WKHS Stock Price: Workhorse Group Inc has five reasons to extend its bullish surge

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.