- NASDAQ: WKHS has room to edge lower ahead of a long weekend.

- Workhorse Group Inc is vulnerable to a broad market drop if fiscal stimulus is not enacted.

- The electric vehicle maker's bullish outlook remains intact.

Christopher Colombus's risky journey proved successful when he reached the western hemisphere on October 12, 1492. Nearing the same date some 528 years later, traders enjoy the long Colombus Day weekend – and may take some risks off the table, and that includes promising stocks like NASDAQ: WKHS.

Selling ahead of a long weekend is one reason to foresee some losses on stock markets. The other comes from a potential disappointment in fiscal stimulus talks. President Donald Trump made a U-turn and now wants a deal with Democrats – after sending shares lower by cutting off talks with Democrats earlier this week.

However, there reasons to believe a deal will not be struck, at least not now. First, the opposition party is in the lead in the polls and may be reluctant to give the president a win. Secondly, Senate Republicans are reluctant to spend more funds. They have rediscovered their concerns about the deficit and prefer to focus on the Supreme Court, especially as prospects for Trump look dire.

More WKHS Stock News: Workhorse Group Inc seems like a win-win on any election result

WKHS stock news

WorkHorse Group Inc has been trading in relatively moderate ranges lately – and sometimes in tandem with broader stock markets. If no company-specific news shows surprises investors, NASDAQ: WKHS could lean lower.

Nevertheless, that could provide a buying opportunity. The Ohio-based company is promising. The immediate financial attraction is Workhorse's stake in Lordstown Motors, which makes electric trucks. The upcoming availability of Lordstown's share on the stock market – potentially via a Special Purpose Acquisition Company (SPAC) would raise WKHS' value.

Moreover, Workhorse's own electric vehicles are on the US Postal Service's shortlist for a lucrative contract. Merely passing from a group of 15 contenders to an exclusive one of only three already shows its strength and opens the door to additional deals.

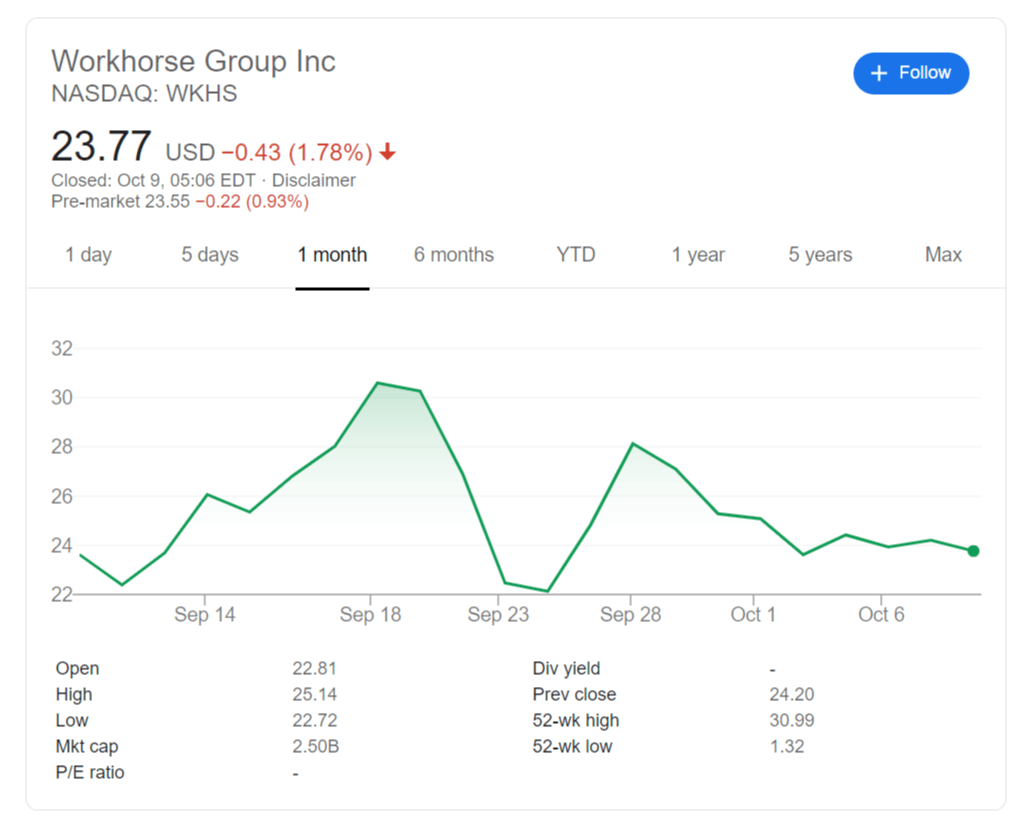

NASDAQ: WKHS shares dropped by 1.78% to close at $23.77 on Thursday. The $22.13 trough recorded in late September is still far below, supporting the bullish case.

More WKHS Stock News: Workhorse Group Inc. set to extend gains, three bullish levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds steady near 0.6250 ahead of RBA Minutes

The AUD/USD pair trades on a flat note around 0.6250 during the early Asian session on Monday. Traders brace for the Reserve Bank of Australia Minutes released on Monday for some insight into the interest rate outlook.

USD/JPY consolidates around 156.50 area; bullish bias remains

USD/JPY holds steady around the mid-156.00s at the start of a new week and for now, seems to have stalled a modest pullback from the 158.00 neighborhood, or over a five-month top touched on Friday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven JPY.

Gold price bulls seem non-committed around $2,620 amid mixed cues

Gold price struggles to capitalize on last week's goodish bounce from a one-month low and oscillates in a range during the Asian session on Monday. Geopolitical risks and trade war fears support the safe-haven XAU/USD. Meanwhile, the Fed's hawkish shift acts as a tailwind for the elevated US bond yields and a bullish USD, capping the non-yielding yellow metal.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.