- NASDAQ: WKHS is set to increase its gains after staging a recovery on Monday.

- The shares face three technical hurdles on their way up.

- Hopes for fiscal stimulus – regardless of who becomes president – may also provide support.

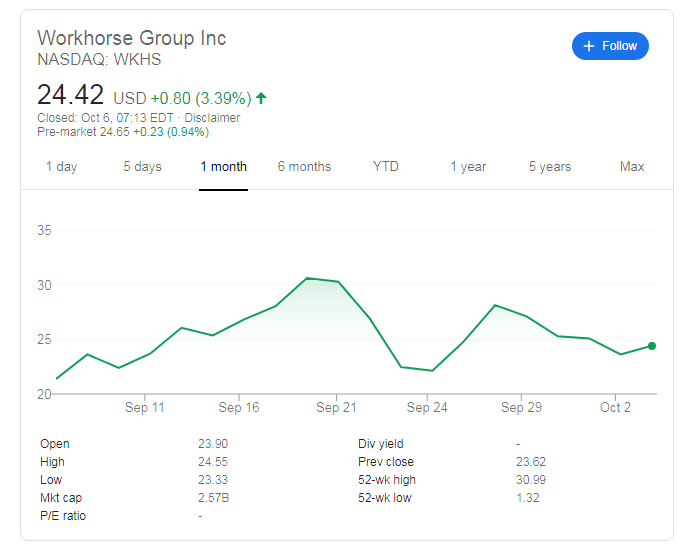

The technical stars were aligned for NASDAQ: WKHS – and it has capitalized on them. As mentioned, shares of Workhorse Group Inc closed last week above the late September trough, setting a higher low and a bullish outlook. Indeed, the Ohio-based company's stock rose by 3.39% on Monday to close at $24.42.

Pre-market data suggests that WKHS is set for additional gains of around 1% to $24.70. What are the next levels to watch?

The first hurdle is $25, which is a psychologically significant level and also a battleground in late September. Round numbers tend to serve as "magnets" for both buyers and sellers.

Further above, the next cap is at $28.13, which was Monday's closing peak. That high was achieved after President Donald Trump was pictured viewing a Lordstown Motors truck. Workhorse has a lucrative 10% stake in the fellow Ohio-based firm that makes electric delivery vans.

The third level to watch and upside target for NASDAQ: WKHS is $30.60, which was the closing level on September 10 and the highest level at which Workhorse's share settled, just below the 52-week high of $30.99.

WKHS stock news

Workhorse's shares trade mostly in response to news related to the company, which makes EVs and also drones. It is also impacted by developments related to Lordstown. If that company goes public via a Special Purpose Acquisition Company (SPAC), NASDAQ: WKHS could cash in on its stake.

However, with a lack of news on these two automotive firms, the broader market mood could make a difference. Republicans and Democrats are engaged in tense negotiations on Capitol Hill, discussing the next fiscal stimulus package. If they strike a multi-trillion accord, all boats could rise – including Workhorse Group Inc.

More WKHS Stock News: Workhorse Group Inc seems like a win-win on any election result

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD recovers above 0.6250 amid China's stimulus-led optimism

AUD/USD is recovering ground above 0.6250 early Monday, moving away from multi-month lows of 0.6199 set last week. The pair finds support from renewed optimism linked to reports surrounding more Chinese stimulus even as the US Dollar rebounds at the start of the Christmas week.

USD/JPY: Buyers stay directed toward 157.00

USD/JPY holds firm above mid-156.00s at the start of a new week on Monday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven Japanese Yen while the US Dollar regains its footing after Friday's profit-taking slide.

Gold downside bias remains intact while below $2,645

Gold price is looking to extend its recovery from monthly lows into a third day on Monday as buyers hold their grip above the $2,600 mark. However, the further upside appears elusive amid a broad US Dollar bounce and a pause in the decline of US Treasury bond yields.

The US Dollar ends the year on a strong note

The US Dollar ends the year on a strong note, hitting two-year highs at 108.45. The Fed expects a 50-point rate cut for the full year 2025 versus 4 cuts one quarter earlier, citing higher inflation forecasts and a stubbornly strong labour market.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.