- Sky-high valuation of $1.5 billion has some analysts skeptical.

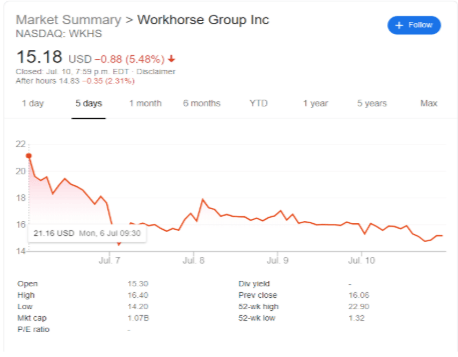

- Share price slid from $21.18 down to $15.18 this past week.

- Workhorse may fall short in their bid for a contract with USPS.

NASDAQ:WKHS has been the target of some analysts over the past week, with claims that the $1.5 billion market cap is strongly inflated due to the recent surge of the EV industry. While investors are desperately searching for the next Tesla (NASDAQ:TSLA), it should be noted that Workhorse’s customer base is significantly different. Their C-Series Electric Van is targeting the delivery sector, already having sold 1000 of the model to UPS (NYSE:UPS).

Workhorse Group news

While the Electric Van industry is definitely in need of some competition, Workhorse Group Inc. still managed less than $100,000 in revenue last quarter and even still, Workhorse shares were up an astounding 328% since February of this year, even though the heart of the Covid-19 pandemic in America. The share price inflation comes even after Workhorse posted a 119.28% decrease in earnings from the Q4.

Social media group Hindenburg Research also gives the company a ‘virtually zero’ chance at winning the USPS contract to supply electric vans around the country. The group also points to insiders within the company dumping their shares over the last few months, as the share price continued to rise. This is usually something investors should note as it generally follows that insiders sell their shares in the company when they believe the future price of the stock will be lower.

This past week saw a near 30% dip in the share price of Workhorse as analysts in the industry pointed out that not all EV companies are built equally. The future for Workhorse could be even bleaker when rival Nikola Motors (NASDAQ:NKLA) finally launches their electric delivery trucks. The share price may be retreating as some of the momentum from Tesla’s skyrocket has worn off for some of the EV companies in the market. Workhorse will have to put together some profitable quarters if they want to prove they are worthy of that valuation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD retreats further from the multi-week top, eyes mid-0.6200s

AUD/USD attracts sellers for the second straight day amid trade war fears, fueled by US President Donald Trump's threat to impose steep tariffs on Colombia. Furthermore, RBA rate cut bets, China's economic woes and a modest USD strength drags spot prices away from over a one-month peak touched last Friday.

USD/JPY retakes 155.00 mark; upside potential seems limited

USD/JPY builds on the overnight bounce from a six-week low and climbs back above the 155.00 psychological mark on Tuesday following the release of service-sector inflation data from Japan. Moreover, the uncertainty over US President Donald Trump's trade policies and a modest USD strength lend support.

Gold price bulls seem reluctant amid rising US bond yields, modest USD strength

Gold price struggles to attract any meaningful buyers on Tuesday and remains close to a near one-week low set the previous day. Rebounding US bond yields support the USD and act as a headwind for the non-yielding yellow metal. That said, Fed rate cut bets and a weaker risk tone should help limit the downside for the safe-haven XAU/USD.

Why China's DeepSeek is causing Bitcoin and crypto market to plunge

Bitcoin slipped below $100,000 on Monday as China-based artificial intelligence model DeepSeek began gaining popularity across the US market, overtaking OpenAI's ChatGPT. DeepSeek's impact also led to rapid declines in the stock market with NASDAQ, diving more than 3%.

What is DeepSeek, and why is it important?

Several Chinese companies pivoted into making their various AI model offerings open source last week, sending shockwaves through the tech sector. Chinese tech startups look set to disrupt the AI space, which has, until recently, been almost singularly dominated by high-priced US tech giants and soaring valuations.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.