WKHS Stock News: Workhorse Group Inc. climbs as EV sector rebounds from Battery Day selloff

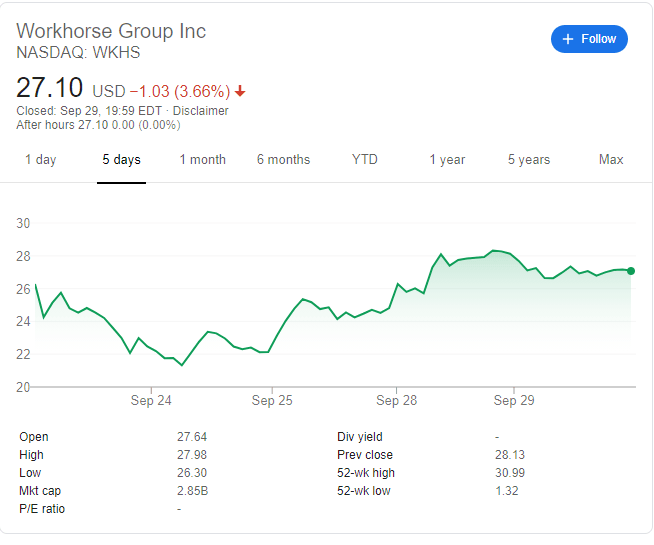

- NASDAQ:WKHS retraces 3.6% on Tuesday after climbing 13.38% on Monday.

- Workhorse shares jumped after it was announced that President Trump was looking at Lordstown trucks.

- The electric vehicle industry rallied off of the post-Battery Day selloff.

NASDAQ:WKHS started the week off on the right foot as the stock surged up 13.38% on Monday to close the day back at $28.13. On Tuesday, a quiet session saw some small profit taking, with the electric-truck company shares giving up about 3%, closing at $27.10, still within reach of its all-time high of $30.99. Shares have risen over 50% during the past month as Workhorse has benefited from the notable sudden collapse of Nikola (NASDAQ:NKLA) as well as its upcoming involvement in the IPO of Lordstown Motors.

Investing Twitter was abuzz earlier in the day when President Trump was reportedly checking out a Lordstown Motors 2021 Endurance truck that was parked on the South Lawn at the White House. It is the eve of the Cleveland, Ohio Presidential debate and Lordstown Motors is an Ohio-based company so the President may have just been using the truck as a prop to win voter support. But they say any press is good press and Lordstown and Workhorse can only benefit from the leader of the free world admiring the product.

WKHS stock news

Most of the companies in the electric-vehicle sector rallied on Monday as most of them suffered a selloff following the perceived disappointment of Tesla’s (NASDAQ:TSLA) Battery Day event. Workhorse Group has steadily climbed over the past month and is now trading well above its 50-day moving average and nearly triple its 200-day moving average. On the back of investors’ minds is the looming U.S. Postal Service contract that has been in the works for several years now. With President Trump insistent on keeping manufacturing within America, companies such as Workhorse could definitely benefit if even a portion of that contract is awarded to it.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet