With the recent rise in the Nasdaq and the shift into tech stocks on a potential Fed hike coming is Apple worth considering on a short term basis? Especially as the shift to digital technology looks like a permanent move rather than a passing fad.

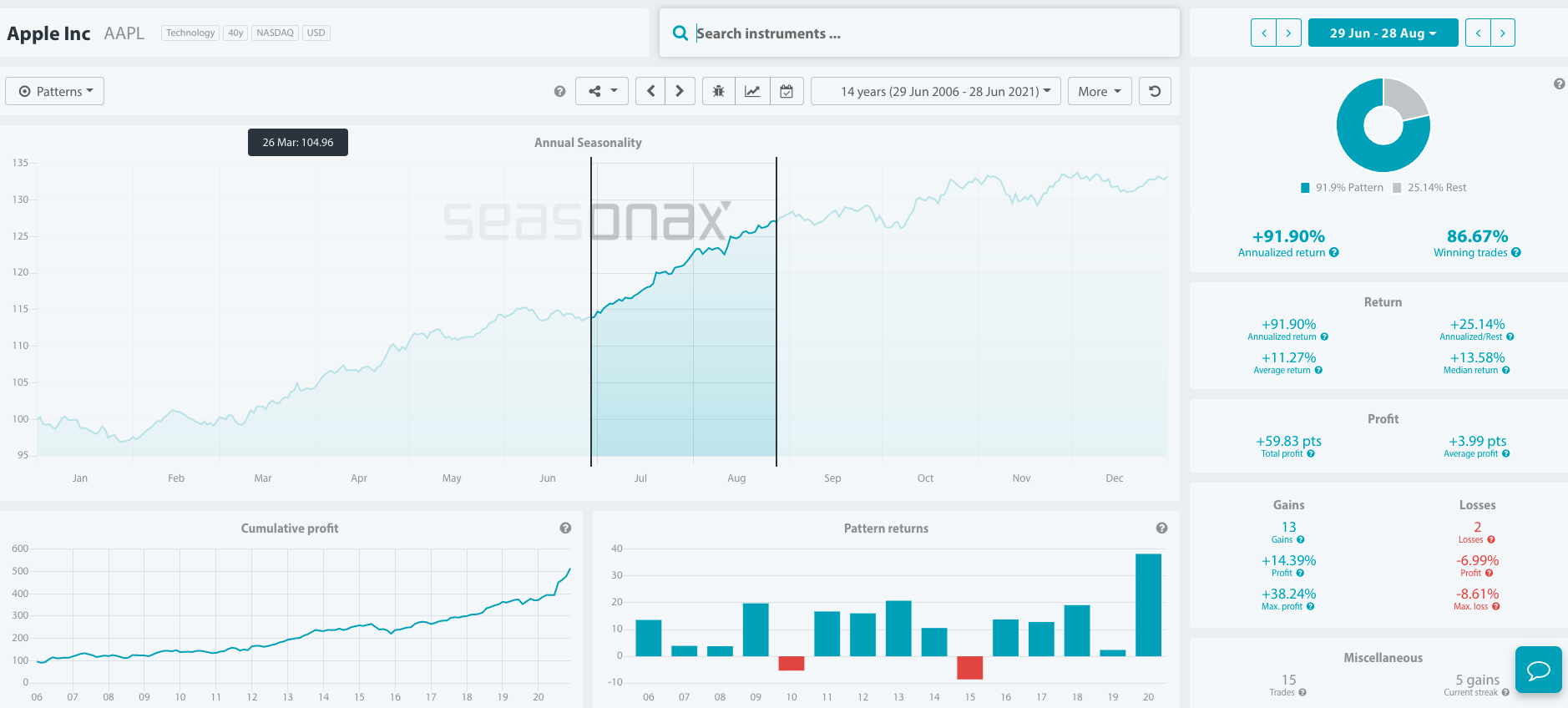

Over the last 15 years, Apple has risen a total of 13 times in 15 years between June 29 and August 28 with an average return of +11.27%. The largest gain was in 2020 with a 38.24% gain. The largest loss was in 2015 with a -8.61% loss.

Major Trade Risks: Any further hawkish policy from the Federal Reserve is liable to cause stocks to weaken in the near term could potentially hinder growth. However, a steady economic rebound should support tech stocks like Apple in the long run.

Apple Inc. is an American multinational technology company that specializes in consumer electronics, computer software, and online services. Apple is the world’s largest technology company by revenue and, since January 2021, the world’s most valuable company.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended content

Editors’ Picks

EUR/USD declines toward 1.0450 on USD recovery

EUR/USD struggles to gain traction and declines toward 1.0450 on Tuesday despite the upbeat ZEW Survey - Economic Sentiment data for Germany and the Eurozone. Rising US Treasury bond yields support the US Dollar and weigh on the pair.

GBP/USD struggles to hold above1.2600

GBP/USD stays under modest bearish pressure and trades below 1.2600 on Tuesday. Earlier in the day, the pair edged higher with the initial reaction to the UK labor market data, which showed that the Unemployment Rate held steady at 4.4% in the three months to December.

Gold gathers bullish momentum, rises to $2,920 area

Gold builds on Monday's modest gains and rises to the $2,920 area on Tuesday. Markets brace for headlines to come in from Saudi Arabia, where US and Russian officials are meeting for peace talks. Meanwhile, rising US T-bond yields could limit XAU/USD's upside.

Canada CPI set to remain at 1.8% in January, fueling BoC easing stance

This Tuesday, Statistics Canada will unveil its latest inflation report for January, based on data from the Consumer Price Index (CPI). Early forecasts suggest that headline inflation held steady at 1.8% compared with January of last year.

Rates down under

Today all Australian eyes were on the Reserve Bank of Australia, and rates were cut as expected. RBA Michele Bullock said higher interest rates had been working as expected, slowing economic activity and curbing inflation, but warned that Tuesday’s first rate cut since 2020 was not the start of a series of reductions.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.