Will the US dollar come back by popular demand?

- US dollar is not going down without a fight, supported at key levels.

- The embded fundamentals could see the greenback resurge this week.

The greenback, as measured by the DXY index vs. a basket of currencies, moved a touch higher against a basket of currencies on Tuesday, resurging from the lows seen in the prior day, although there was little conviction from a technical perspective as shown below.

Meanwhile, it's been a mixed day in terms of risk appetite as investors weigh up the earnings outlook against rising interest rates. The narrative surrounding the Federal Reserve remains the key driver, which continues to weigh on the global financial markets. Wall Street's main indexes gapped to the upside at Tuesday's open as strong earnings from Goldman Sachs and Johnson & Johnson that lifted hopes that upbeat corporate reports could soothe market worries about a potential recession due to rising inflation and interest rates. However, at the time of writing, the S&P was up just 1.00%, but still up from the lows of 3,686.53 and down from the 3,762 highs. US treasuries were little changed, with the 10-year yield at 4.01%. The DXY was trading flat at 112.07 and had moved between a low of 111.773 and 112.455.

UK politics in the spotlight

In fundamentals, the Bank of England and UK politics remained front and centre, although there was a sense of calm in the sentiment that gave some stability to markets, The BoE announced its plans to start bond sales on 1 November. however, these won’t include the longer-dated debt recently purchased in the wake of the mini-budget saga. Size and frequency are expected to be similar to that announced prior to the delay, but the BoE will be watching market conditions closely.

The UK's Chancellor, Jeremy Hunt, has announced that he was scrapping "almost all" of the tax cuts announced by the government last month, in a bid to stabilise the financial markets. However, uncertainties remain over the leadership qualities of PM Liz Truss who was said to be hiding "under a desk" after the prime minister did not attend a clash with Sir Keir Starmer in the Commons. Five of her own MPs have now called on her to resign and that does not bode well for the pound. Many more Conservative MPs are calling on the prime minister to quit in anonymous briefings the BBC reported that wrote in an article that Tuss intends to lead the Conservatives into the next general election and apologised for making mistakes.

US dollar remains in demand

With the geopolitical strife happening, the US dollar remains under demand and especially so due to the rates advantage it yields for investors due to the Federal Reserve's hawkish stance. On Tuesday, Raphael Bostic, the head of the central bank’s Atlanta district said that inflation is too high and they have to get it under control. such rhetoric has led to speculators’ net long USD index positions edging higher for the third consecutive week on the back of a persistent string of hawkish Fed speak. Even so, net longs remained below recent averages which would allow for additional length in the coming days and weeks.

Meanwhile, US Industrial Production lifted 0.4% in September, stronger than expected, and driven largely by a solid rise in manufacturing output (+0.4%). ''These results go against the signal in the ISM data, which has been on a softening trajectory for some months now,'' analysts at ANZ Bank explained.

''Part of the strength in manufacturing of late has been an auto production catch-up story, and therefore isn’t expected to persist. But nonetheless, resilience in these data in the face of rapidly tightening monetary policy remains clear. Stepping back, solid growth in goods production as the demand impulse continues to slow will help contain goods inflation, but for the Fed it’s services inflation that tends to be sticky, and currently causing the most concern.''

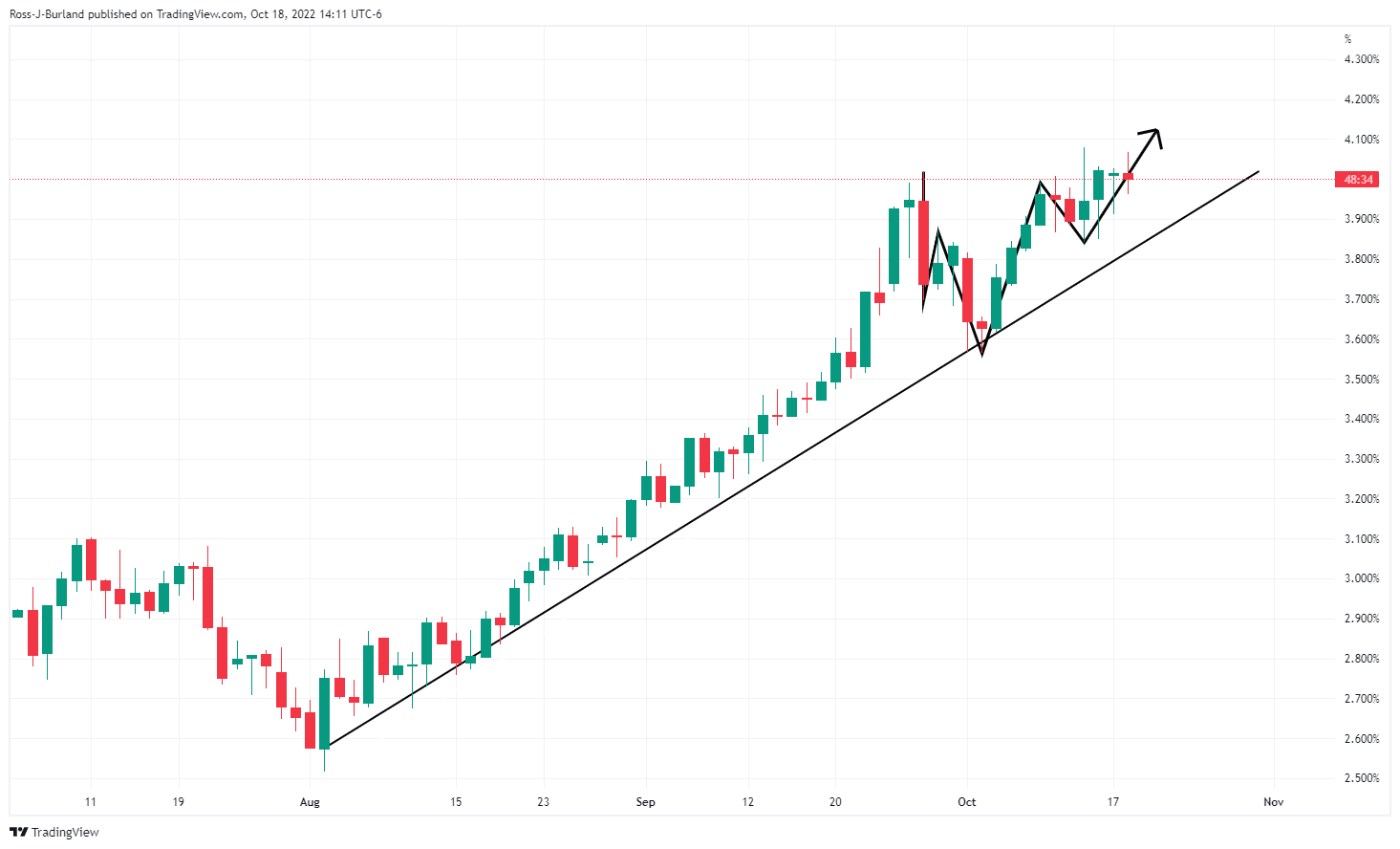

US yields and the dollar's technical analysis

The 2-year yield is under pressure which has left the US dollar hanging out to dry below last week's low. However, should both of their trendline supports hold up, we could see some upward pressure in both assets.

The US 10-Year Treasury yield, which ended Friday at 4.006%, being its highest weekly finish since July 2008, remains close to the mark which is a supportive factor for the greenback longer term, with the yield closing up for an 11th-straight week last week. Since the yield's March 2020 record-low, pronounced weekly winning streaks have marked some significant highs and only a reversal below 3.81% can put the 3.5620%/3.4980% area at risk, with potential for a much deeper, surprise decline. For now, the W-formations and necklines remain a supportive feature for both the yield and the greenback:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.