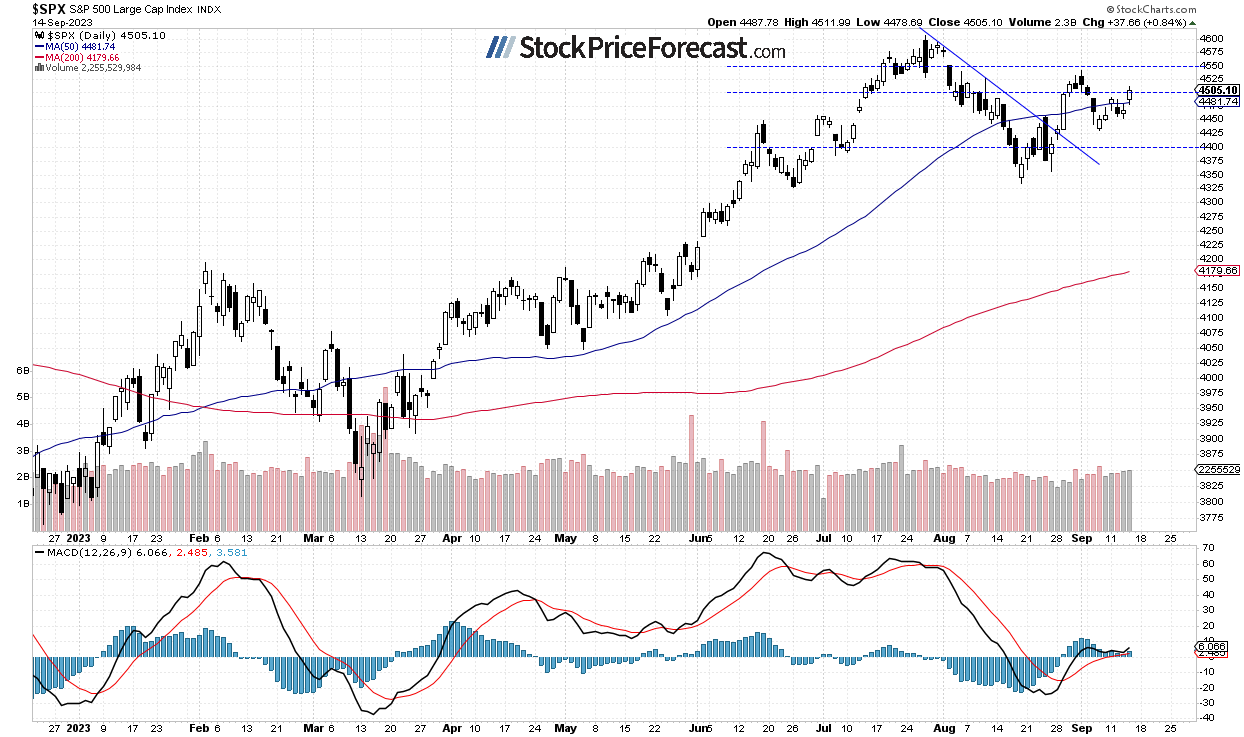

The S&P 500 index gained 0.84% on Thursday as it broke above the recent local high. The market was advancing after the important Wednesday’s CPI and Thursday’s PPI releases. Recently the index traded along the 4,450 level and yesterday it broke slightly above the 4,500 mark. There’s still a lot of uncertainty about monetary policy, economic growth and stock prices continue to move sideways after their advances from March to July.

Stock prices are expected to open virtually flat this morning following better-than-expected Empire State Manufacturing Index release. The index retraced more of its recent declines yesterday as we can see on the daily chart:

Futures contract trades close to 4,550

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning it’s trading along the 4,550 level. The resistance level is at around 4,580-4,600 and the support level is at 4,500-4,520, among others.

Conclusion

The S&P 500 will likely fluctuate following its yesterday’s advance. There may be some uncertainty as the market gets closer to the recent local high of around 4,540. However, there have been no confirmed short-term negative signals so far.

Recently the investors’ sentiment improved as the pressure for further monetary policy tightening somewhat eased. But stocks retraced most of their late August rally after bouncing off their mid-July local lows resistance level.

Here’s the breakdown

-

Stocks retraced more of their recent declines but they remain below the early September highs.

-

The S&P 500 went back above the 4,500 level.

-

In my opinion, the short-term outlook is still bullish.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

EUR/USD stays below 1.0500 after German and EU PMI data

EUR/USD stays on the back foot and trades below 1.0500 in the European session on Friday after the data from Germany and the Eurozone showed that the economic activity in the private sector expanded at a moderate pace in February. Investors await US PMIs.

GBP/USD retreats to 1.2650 area after mixed UK data

GBP/USD struggles to gather bullish momentum and stays near 1.2650 in the European session on Friday. Earlier in the day, the upbeat UK Retail Sales helped Pound Sterling find demand but the mixed PMI reports limited the pair's upside. Focus shifts to key US data releases.

Gold drops over 1% from Thursday’s all-time high

Gold dives lower and slips below $2,925 on Friday. The Trump administration puts lifting trade bans against Russia on the table. Traders are mulling the upcoming US preliminary S&P PMI data for February.

US S&P Global PMIs set to show healthy services and manufacturing sector in February

S&P Global is set to release its early estimates for the US Purchasing Managers Indexes (PMIs) for February this Friday. These PMIs are based on surveys of top private-sector executives and offer a snapshot of the overall economic health.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.