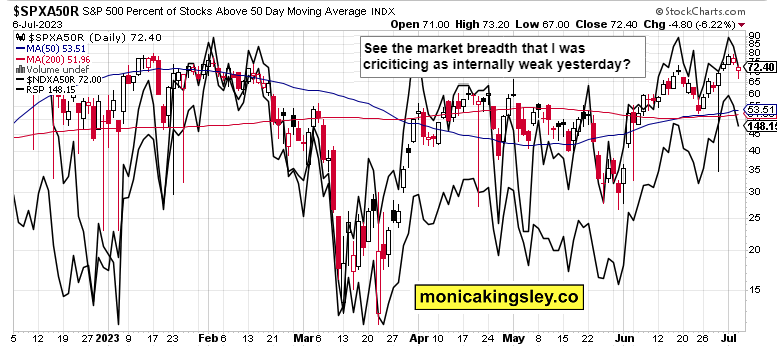

S&P 500 internal breadth deterioration signs didn‘t lie, and the index took a dive – till the dip got of course bought. The sectoral view was though nothing to write home about.

Remember the key points made in yesterday‘s extended video. Still, I looked for a reprieve in sentiment, leaning risk-on into non-farm payrolls. Markets seemed fearing a strong figure, yet the heavily loaded boat tilted the other way in the aftermath of not really finest NFPs.

Initial relief over the Fed maybe getting second thought about hiking (in July), is giving way to questioning the realities of why it wouldn‘t hike (maybe perhaps even pivot, in market‘s mind). Then, the gut level reaction to rally as liquidity won‘t be getting that bad in the very short-term, is likely to win – especially in real assets as the same mechanic would take more effort to kick in in the S&P 500.

In favor of an extended introduction to today‘s analysis, I‘ll focus on individual charts, Twitter commentary, and of course another video to top off it off.

Have a great weekend in advance!

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 4 of them.

S&P 500 and Nasdaq outlook

4,460s are the nearest support turned resistance to reconquer, and a good battle seems at hand later today. In order to achieve that, 4,432 level can‘t be broken or thoroughly tested, which opens the way to 4,415 last line of defence.

NYHL were indeed what I correctly trusted – the warning signs were there, and now it‘s up to the sectors given in the preceding chart caption, to do their job as much as Russell 2000.

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.