Wild opex and three black crows

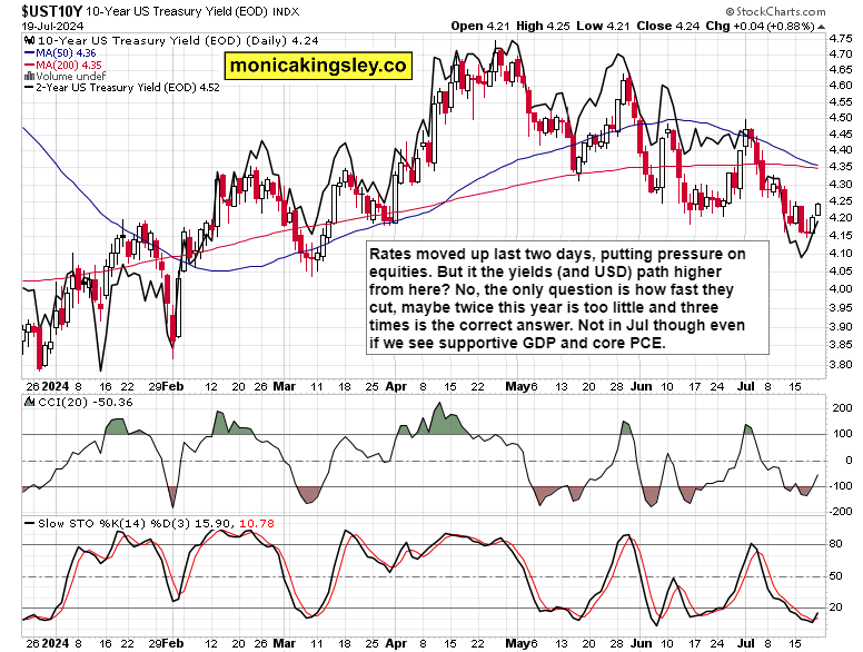

Ever since Wednesday, Nasdaq found no respite with very few S&P 500 sectors providing refuge. Even Russell 2000 – one of my key picks for clients after CPI – started to undergo a healthy correction off very overbought levels. The fundamental backdrop of rates going lower and USD to ultimately follow suit too, has not changed – but the path main indices are taking, warrants a pause for the bulls.

Also during Friday‘s opex and no key data releases, the momentum was down (it wasn‘t about MSFT-CRWD fallout) and market breadth improvements were insufficient. Next week, GDP and core PCE are the key macro turning points – I‘m sharing the weekly path ahead for indices in the premium section. Till then, we have just earnings and crucially guidance to rely on – and the ASML, TSM, AMZN with quite some financials were telling already.

Whoever guides lower or just barely meets expectations, isn‘t rewarded – and while some domestic oil companies are waking up, there can be no sustained push higher unless tech / financials lead. For now, earnings ahead aren‘t broadly questioned and rate cuts are celebrated – for now, we have to look at other leaders and take advantage intraday whether in futures or options.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.