Why North American investors are flocking to this Israeli cyber stock (TASE: HUB)

- On March 23, Hub Security agreed to a deal to go public by merging with SPAC Mount Rainier Acquisition Corp.

- Isreal-based Hub Security offers confidential computing solutions to both businesses and security agencies.

- The company seems well-positioned to grow aided by favorable macroeconomic developments.

HUB Cyber Security Limited, an Israeli company that develops confidential computing solutions for businesses and agencies, is on the cutting edge of cyber-defense technology. The company has a first-mover advantage in a niche market of the rapidly growing Confidential Computing market. According to Everest Group Inc., the market opportunity for confidential computing will reach $54 billion by 2026, growing at a compounded annual growth rate (CAGR) of close to 100% in the best-case scenario. Even in the worst-case scenario, Everest Group predicts this industry to grow at a compounded annual growth rate of over 40%, which gives reason to believe that the confidential computing market is one of the fastest-growing tech industries today. On March 23, Hub Security agreed to a deal with special purpose acquisition company Mount Rainier Acquisition Corp. to take the company public through a merger – a deal that is valued at approximately $1.2 billion. Following the completion of this transaction, Hub Security will receive approximately $198 million in additional cash assuming no redemptions by Mount Rainier shareholders, and the company will also receive gross proceeds of $50 million through a PIPE investment subscribed by Israeli and American institutional investors. Once Hub Security stock is available on Nasdaq, growth-oriented investors are likely to find Hub stock an interesting bet on the future of the cybersecurity industry as the company is making steady progress towards commercializing advanced and innovative cyber security systems.

The macroeconomic outlook is promising

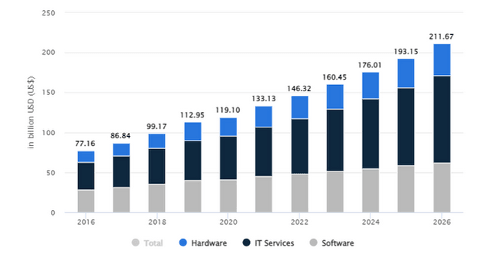

Artificial Intelligence plays a crucial role in the development of advanced, automated security systems and autonomous threat detection, and the use of AI and Machine Learning is likely to fuel the growth of the cybersecurity industry in the coming years. These technologies enable considerably faster data processing, which is beneficial for both large firms dealing with vast amounts of data and small and mid-sized businesses with limited resources. The global cyber security services market is estimated to reach $178 billion by 2027, growing at a compounded annual growth rate of 9.8%, according to ReportLinker. Many factors are driving the growth of this market, including the increased need for intelligent security software solutions, data protection, and cost-effective data management services. The cybersecurity market is estimated to generate $146.30 billion in revenue this year.

Cybersecurity market revenue by segment

Source: Statista

Recent geopolitical events such as the invasion of Ukraine by Russia and the rise of cybercrimes resulting from the growth of cryptocurrencies are also positively contributing to the growth of the cybersecurity industry as many companies and consumers are understanding the need for advanced threat detection systems in place to prevent catastrophic events.

Hub Ssecurity is uniquely positioned to grow

Hub Cyber Security, which was established in 2017 by veterans of the Israeli Defense Forces' elite intelligence units (8200, 81, MOD, C4I-IDF), is redefining cyber security using quantum-powered confidential computing. The company has developed an innovative set of data theft protection technologies as well as a sophisticated encrypted computing solution geared at preventing hostile attacks at the hardware level. The company operates through several business segments.

- Consulting Software.

- Training.

- Software Testing and Outsourcing.

Under these business segments, the company works in over 30 countries and provides revolutionary cybersecurity computing appliances as well as a comprehensive range of cybersecurity services, including professional consulting and training services. Through RAM Commander, HUB's proprietary hardware solution, the company offers solutions to safeguard sensitive IT data, resulting in a Trusted Execution Environment (TEE). Hub Security delivers end-to-end data security throughout all phases of the data lifecycle, as well as next-generation encryption solutions, such as powerful quantum computing defense. The company has been awarded FIPS 140-2 Level 3 certification, the highest level of security for cryptographic modules in the United States. The company’s solutions and services are typically offered through long-term contracts to corporations such as insurance firms, commercial banks, payment companies, telecom carriers, and government entities.

The merger

Following the completion of the merger with Mount Rainier Acquisition Corp., the combined company will operate under the name "Hub Security" and is scheduled to be listed on Nasdaq under the new ticker symbol "HUBC" once the proposed transaction is completed. The business combination will result in an enterprise value of $1.28 billion, and equity value to Hub shareholders of $933 million (excluding vested and unvested HUB options). This transaction is expected to be closed in the third quarter of this year.

Recent partnerships to drive growth

Hub Security announced a strategic alliance with Getronics, a global ICT integrator, in December 2021 to provide secure compute protection to banks and companies in Europe, Latin America, and the Asia Pacific. Through this partnership, the company aims to improve current solutions such as Secure-by-Design IoT & Smart Spaces, Ransomware & IR, and SOC.

On February 15, Radiflow and Hub Security announced a partnership to integrate Radiflow's OT ICS intrusion detection (IDS) software into Hub Security's private computing platform for sensitive industrial environments. The new alliance will allow sensitive IDS data to be safeguarded at all phases of the data lifecycle, significantly reducing the surface attack risk on both the OT network and the security mechanisms in place.

The company is also expanding its services in the healthcare industry, which could be a catalyst for growth in the future. HUb Security and Enlitic established a partnership on March 14 at the HIMSS Global Health Conference & Exhibition, and the company aims to protect health data to enable professionals to make faster and more accurate diagnoses. As more data is collected and stored every day, data security becomes critical for the healthcare industry. In 2021, the U.S. Department of Health and Human Services revealed data breaches involving more than 40 million people. In the first two months of 2022, the trend persisted, with over 3.7 million people affected. Given the increasing cyber risk in healthcare, Hub Security’s confidential computing platform is likely to gain traction as it could potentially secure data across and within enterprises while safeguarding privacy and ensuring compliance with regulatory standards. Under the aforementioned partnership, the company will evaluate data from imaging systems and archives to aid in medical decision-making, resulting in the world's first real-time real-world clinical recommendations platform.

The business model is scalable

Ransomware attacks on individuals, companies, and governments are becoming more common, necessitating major public and private investments to secure sensitive data. According to Gartner, Inc., global cybersecurity spending increased 13% to $172 billion in 2021, up from 8% in 2020. Hub Security, as one of the fastest-growing companies in the field of confidential computer hardware, stands to benefit from this continued growth of the industry.

The company has a recurring revenue model that includes both a professional services business and a unique Confidential Computing hardware solutions business. This recurring revenue model will enable the company to scale economically and profitably similar to software companies that have made the most of this type of business model. With an annual pre-booking rate of 80%, a strong pipeline of new products, and a positive industry outlook, the company believes operating margins could be improved to around 50% in the coming years. With its confidential computing solutions, Hub Security might develop competitive advantages around its advanced cyber security solutions, and it has a portfolio of intellectual property that enables the successful monetization of its technology. The company also benefits from its human capital, with the top executives having many years of experience and industry knowledge that is difficult to replicate. Hub Security expects to capture 1.5% of the entire addressable market by 2026, with operating margins exceeding 25%. From 2020 to 2026, the company expects a 50% CAGR and EBITDA to increase from 4 cents to 25 cents on every dollar of sales.

Takeaway

The cybersecurity industry is winning the attention of investors amid favorable macroeconomic developments that promote the growth of the industry, and Hub Security is all set to be the latest kid on the block once it goes public through a SPAC deal with Mount Rainier. The company is already attracting institutional investors in the United States, and it would be reasonable to assume that the investing public would pay close attention to the company once it is public. The company has a long runway for growth, and if Hub Security can develop and retain competitive advantages, early investors stand to gain.

Author

Ronald Kaufman

Independent Analyst

Ronald Kaufman a writer and blogger active in the fields of foodtech, pharma, cyber, biotech and more. Ronald writes for leading publications about a number of topics.