WHO: Total Coronavirus cases In China now at 77,362, new cases rose 416 over the last 24 hours

Total Coronavirus cases in China now at 77,362, new cases rose 416 over the last 24 hours.

The coronavirus global cases total reaches over 79,000 now with the death toll has reached 2,620, with 27 of those occurring outside of China. The expansion of outbreaks in South Korea and Italy have brought about fears of a global pandemic and has caused a risk-off start to the week.

People in northern Italy have been in touch with the Guardian to say they have noticed empty shelves in local supermarkets.

The Guardian wrote that Francesco Sole, a trade union regional secretary from Milan, said prices for face masks and antibacterial gel had skyrocketed.

“It’s quite a shock for us in northern Italy. My wife and I rushed to do some grocery shopping in fear of being stuck at home.

“Empty shelves for basic products such as flour, oil and bottled water were easily noticeable,” he said. “Finding a mask or antibacterial gel has become as challenging as finding water on the moon.

“Some companies have organised their workers to switch to smart working while many others are still seeking to find solutions to manage the situation. People in Milan are trying to figure out what life will be like in the days to come. For a city that is always on the move, this is an eerie pause.”

In other news, tor the first time in decades, the National People’s Congress (NPC), where hundreds of delegates gather in Beijing every March, was postponed on Monday. The standing committee for the NPC said a new date for the meeting would be announced separately, according to the state broadcaster CCTV.

South Korean cases spiked to over 760, as several countries imposed travel bans, and some airlines cancelled routes to Seoul. Afghanistan, Bahrain, Kuwait and Iraq reported their first cases – all involving people who had come from Iran.

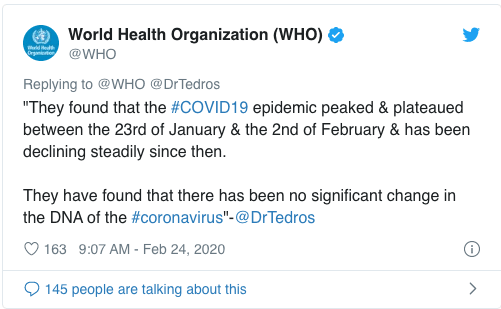

On the bright side, the WHO team in China has concluded the virus can be contained, noting that it peaked between the end of January and the beginning of February:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.