When XLF rotation

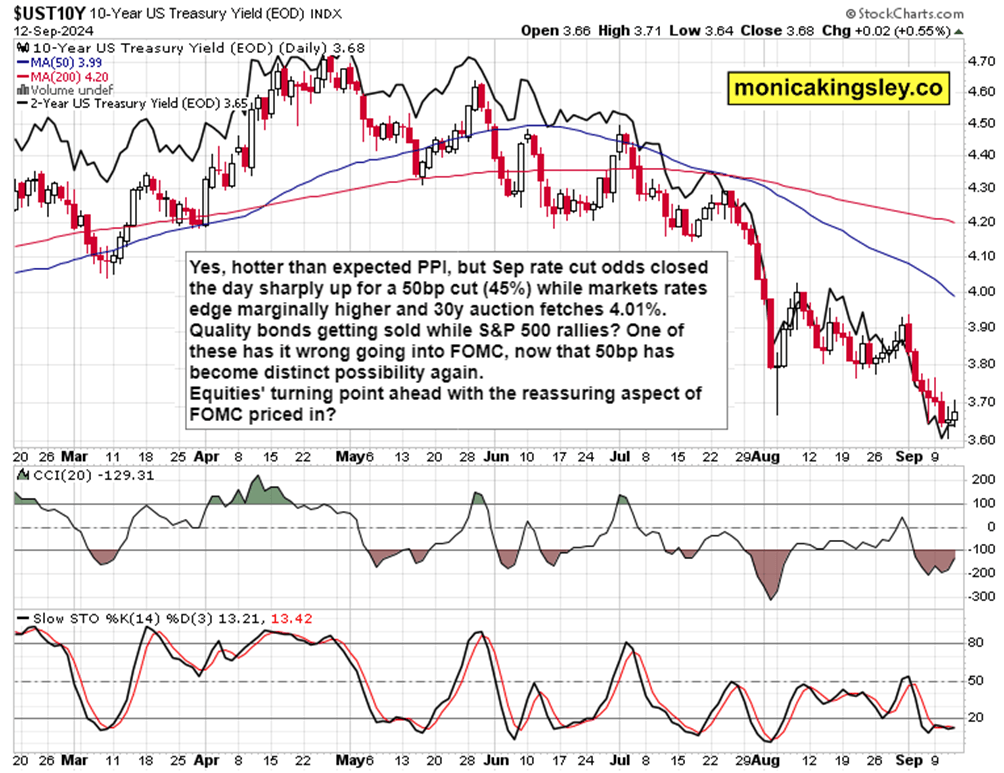

S&P 500 followed through on Wednesday‘s reversal, and the right shoulder of Sunday discussed inverted H&S is complete. Hotter than expected PPI wasn‘t sold into much (low print I saw as a greater danger to rising equities), and selling attempts in its aftermath turned out weak, making for intraday opportunities with Ellin having a great day.

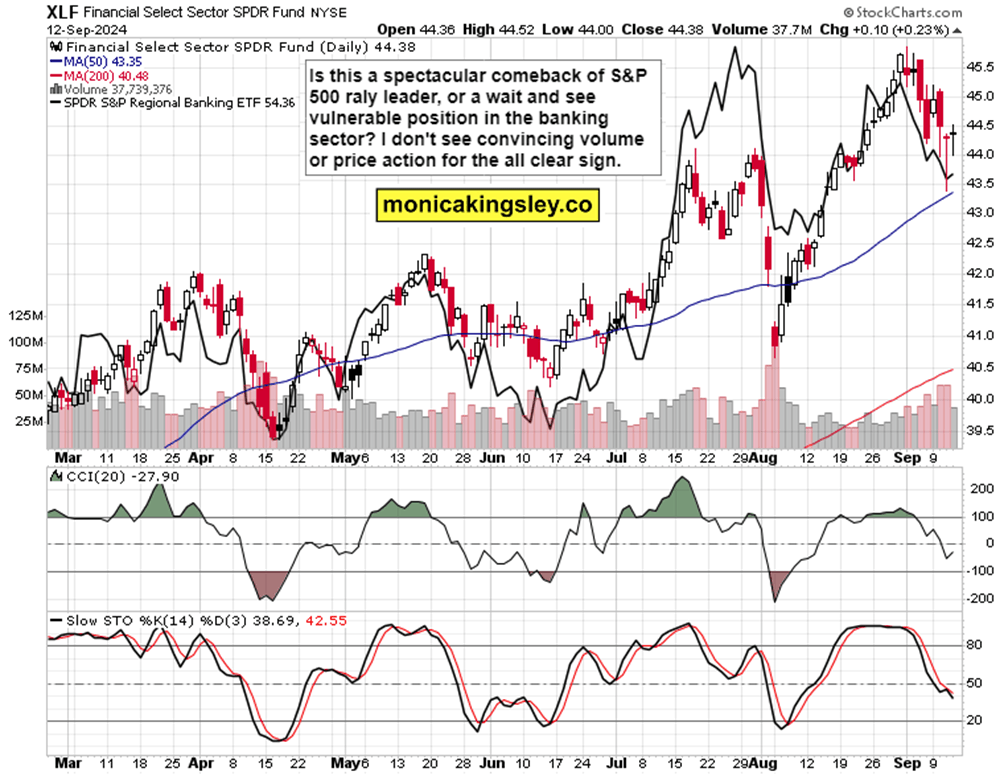

Swing trading perspective though has question marks over both financials performance, and how far can Nasdaq resurgence carry S&P 500 after I called for a day of rotations (yes, market breadth broadened out satisfactorily yesterday) that brought a very decent follow through (outside key financials and select income / interest rate sensitive plays).

Caution is warranted, just remember yesterday‘s sharp drop in the latter half of the session (that I capitalized on in our channel) out of nowhere (no catalyst), followed by fast recovery. That signifies uncertainty ahead (I say why exactly in the premium section), and I would argue that most of upcoming Fed moves have been priced in.

See these charts and think how to explain the TLT daily non-confirmation, and then remember my yesterday‘s premium words mentioning XLF and XLY – what buyers want to see.

(…) Bulls want to see financials not at all lagging over the next two days, and actually seeing rotation as buyers return even if to other names than to JPM succession plans hit aftermath or the ALLY warning). Must be said that consumer discretionaries kicking in yesterday, is a bullish sign as well – but without financials coming back to lead, it‘s easy to witness a retracement on the S&P 500 in the coming days).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.