The UK Economic Data Overview

The British economic calendar is all set to entertain the Cable traders in early Friday, at 07:00 GMT, with the preliminary Gross Domestic Product (GDP) figures for the fourth quarter (Q4) of 2022. Also increasing the importance of that time are monthly GDP figures for December, Trade Balance, Manufacturing Production and Industrial Production details for the stated period.

Having witnessed a 0.3% QoQ contraction in economic activities during the previous quarter, market players will be interested in the first estimation of the UK Q4 GDP figures, expected 0.0%, to back the BOE’s hawkish bias. More interestingly, the MoM figures are expected to turn negative and the YoY numbers signal easing growth in the British economy.

On the other hand, the GBP/USD traders also eye the Index of Services (3M/3M) for the same period, bearing forecasts of 0.3% versus -0.1% prior, for further insight.

Meanwhile, Manufacturing Production, which makes up around 80% of total industrial production, is expected to ease to -0.4% MoM in September versus -1.6% prior. Further, the total Industrial Production is expected to recover from the previous contraction of -1.8% to a -0.2% MoM for the said month.

Considering the yearly figures, the Industrial Production for September is expected to have weakened to -5.3% versus -5.1% previous while the Manufacturing Production is also anticipated to have weakened to -6.1% in the reported month versus -6.7% the last.

Separately, the UK Goods Trade Balance will be reported at the same time, which previously marked a deficit of £1.802 billion.

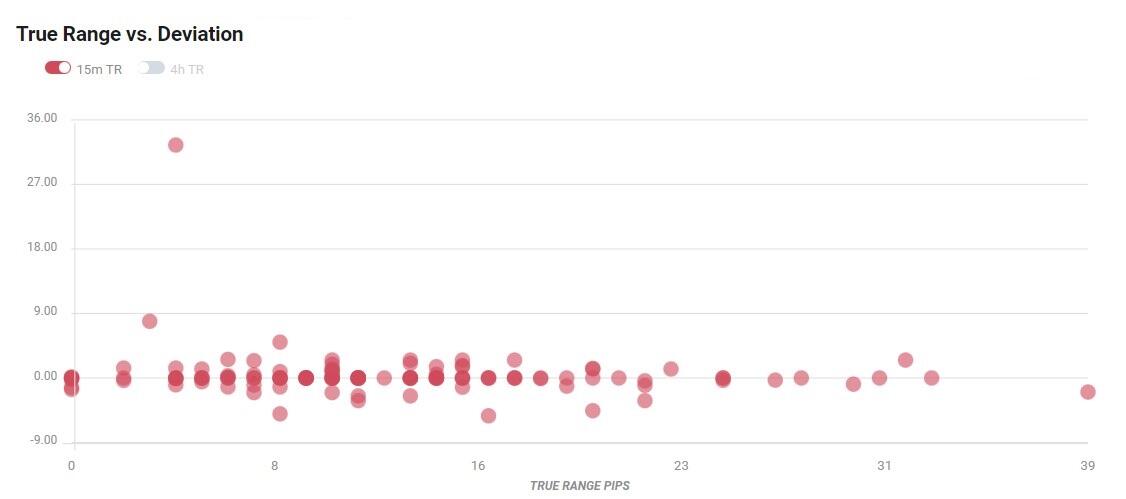

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 10-pips in deviations up to + or -9, although in some cases, if notable enough, a deviation can fuel movements over 30-40 pips.

How could affect GBP/USD?

GBP/USD remains sidelined around 1.2100 heading into Friday’s London open. In doing so, the Cable pair aptly portrays the market’s cautious mood ahead of the key UK data. Not only the British data dump but early signals for the next week’s US inflation data, namely preliminary readings of the US Michigan Consumer Sentiment Index and 5-year Consumer Inflation Expectations for February also amplifies the market’s anxiety.

That said, mixed plays of the UK recession fears, workers’ strikes and Brexit concerns join the US Dollar’s rebound to keep the GBP/USD bears hopeful. However, the dovish Fedspeak and recently downbeat US data weighed on the Cable pair.

That said, the Bank of England (BOE) officials failed to impress GBP/USD buyers the previous day as the majority of them raised doubts about further rate hike concerns despite refraining to signal rate cuts or a pause in tightening the monetary policy.

As a result, the UK Q4 GDP bears downbeat forecasts and chatters over the Bank of England’s (BOE) easy rate hikes are on the table, which in turn challenges the GBP/USD pair traders while pushing them off the bull’s radar. Hence, downbeat prints of the UK Q4 GDP could probe the GBP/USD buyers for a while, unless being too extreme, whereas a positive surprise might enable the Cable pair buyers to overcome the immediate 1.1740 hurdle.

While considering this, FXStreet’s Dhwani Mehta said,

On the expected stagnation in the UK economy, GBP/USD could encounter ‘sell the fact’ trading, as the optimism surrounding warding off recession seems to be priced in by the market in this week, thus far.

Ahead of the release, Westpac said,

The UK’s Q4 GDP release should provide further evidence on the underlying deterioration of economic conditions, though the Bank of England’s February forecasts are for a shallower recession than they projected in November. Consensus is 0.0% QoQ, 0.4% YoY, with the December month reading -0.3% MoM.

Key notes

GBP/USD probes bulls after three-day uptrend as UK GDP, US inflation cues loom

GBP/USD Price Analysis: Drops below 1.2100 as risk-off impulse spikes further

UK GDP Preview: Growth to stagnate but recession narrowly averted

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.