When is the UK inflation and how could it affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for February month is due early on Wednesday at 07:00 GMT. Given the recently strong employment data, coupled with the Bank of England’s (BOE) cautious rate-hike and expectations of higher inflation, today’s data will be watched closely by the GBP/USD traders.

In addition to the UK inflation data, British Spring Budget will also be released during the day, which in turn makes Wednesday the key data for GBP/USD traders.

The headline CPI inflation is expected to refresh 30-year high with a 5.9% YoY figure versus 5.5% prior while the Core CPI, which excludes volatile food and energy items, is likely to rise to 5.0% YoY during the stated month, from 4.4% previous readouts. Talking about the monthly figures, the CPI could increase to 0.6% versus -0.1% prior.

It’s worth noting that the recent pressure on wage prices and a light workforce also highlights the Producer Price Index (PPI) as an important catalyst for the immediate GBP/USD direction. That being said, the PPI Core Output YoY may rise from 9.3% to 10.0% on a non-seasonally adjusted basis whereas the monthly prints may ease to 0.9% versus 1.1% prior. Furthermore, the Retail Price Index (RPI) is also on the table for release, expected to rise to 8.2% YoY from 7.8% prior while the MoM prints could inflate to 0.8% from 0.0% previous readings.

In this regard, analysts at Westpac said,

Rising energy prices will remain a key driver of UK consumer inflation in February, with the median forecast 0.6% MoM, 6.0% YoY (versus 5.5%-yr in January) and the core measure seen jumping from 4.4% year to 5.0%yr. UK Chancellor Sunak will deliver the spring statement (mini-budget), with a focus on the cost of living pressures from soaring energy prices.

Deviation impact on GBP/USD

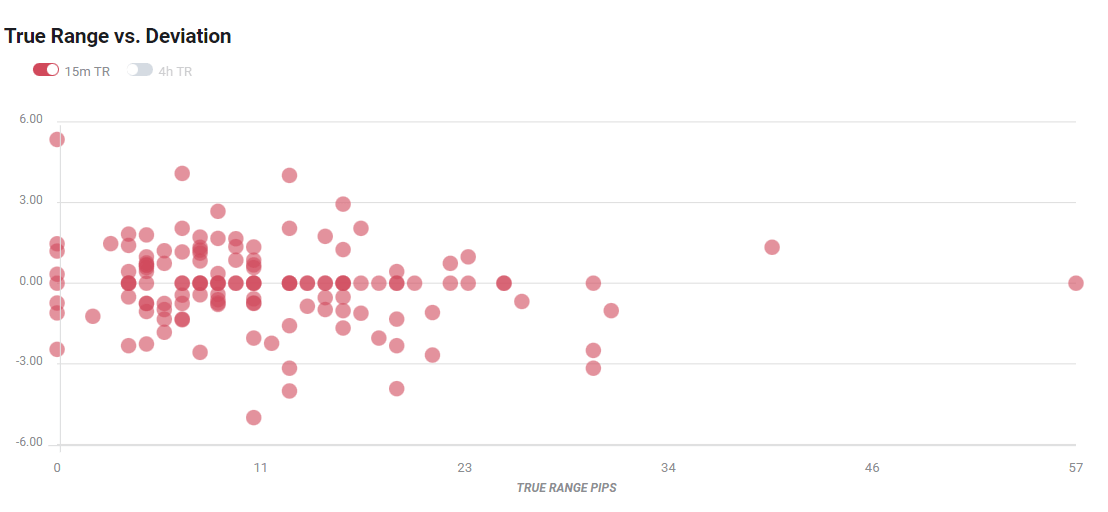

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could it affect GBP/USD?

GBP/USD upside stalls around 1.3285-90 during Wednesday’s Asian session but the bulls keep reins around a 13-day high. The cable’s latest gains could be linked to the US-UK trade deal and hopes of firmer British inflation figures pushing the Bank of England (BOE) for faster rate hikes. Additionally, chatters that UK’s Chancellor Rishi Sunak will try their best to not disappoint votes during the Spring Budget communiqué also favor GBP/USD buyers.

That said, upbeat inflation data, which is more likely, can help the GBP/USD extend the latest advances. However, Treasury bond yields and GILTS are also likely to play an important role in determining short-term cable moves.

Technically, a clear upside break of the one-month-old horizontal resistance, now support around 1.3265-70, directs GBP/USD buyers towards January’s low near 1.3360.

In this regard, FXStreet’s Dhwani Mehta says

A UK CPI print above the expected 5.9%, therefore, could further put the BOE in a tricky spot. The uncertainty surrounding the central bank’s next policy move will likely weigh on the pound.

Key notes

UK Inflation Preview: Another hit to British households, and to the pound?

GBP/USD marches towards 1.3300 ahead of UK’s CPI numbers

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.