When is the RBNZ and how might it affect NZD/USD?

The Reserve Bank of New Zealand is seen raising OCR by 50 bps to 3.5% in October today when it meets and announces the decision at 0100 GMT.

''The RBA’s surprise smaller 25bp hike yesterday has gotten FX markets wondering if the Reserve Bank of New Zealand might be the next central bank to slow the pace of tightening,'' analysts at ANZ Bank said.

However, as they note, inflation risks are a more pressing matter for New Zealand. However, a surprise 75 bps rate hike now seems off the table after the RBA hiked by only 25 bps.

''We expect a 50bp hike and hawkish tone, but the market is already pricing in a lot, so the bar is high.''

''While officials in Australia may be taking a more cautious approach we expect the RBNZ will lift the official cash rate by 50bps today. The Quarterly Survey of Business Opinion released by the NZIER yesterday shows inflationary pressures remain very strong.

Capacity pressures are only easing slowly and the labour market remains very tight. In this inflationary environment we see the RBNZ has little choice but to focus on dampening inflation pressures by delivering another 50bp rate hike,'' the analysts explained.

Overall, the focus will be on RBNZ’s policy guidance.''

How might the RBNZ affect the NZD/USD price NZD/USD?

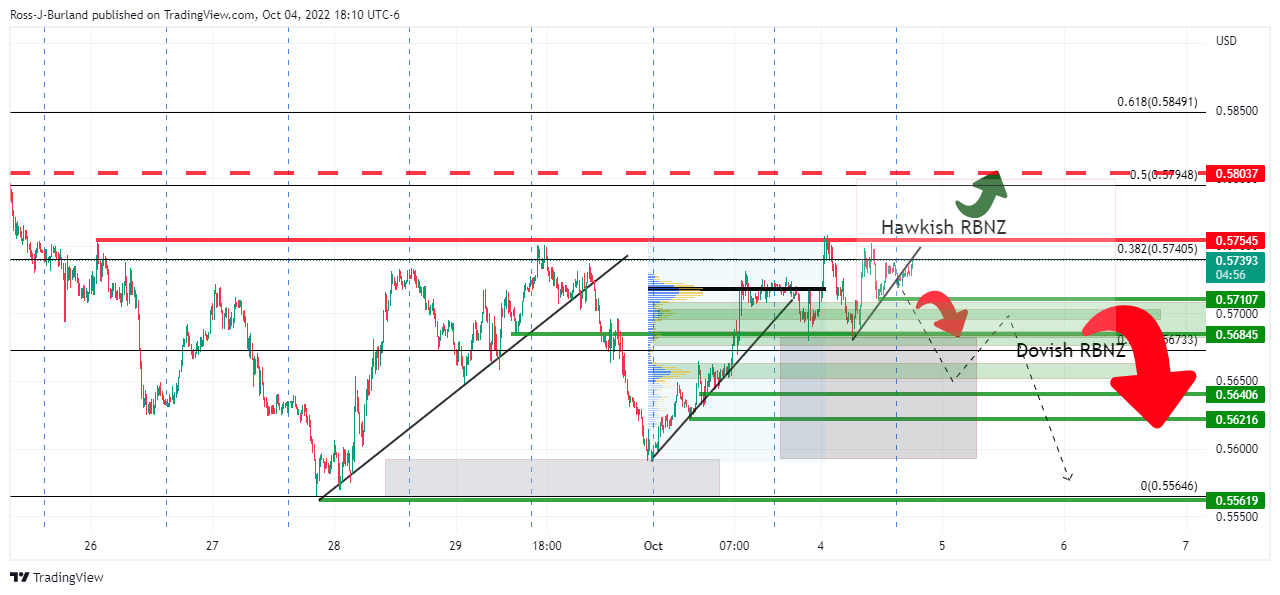

The price is leaning over the top of a 100 pip box and resisted by the 0.5750s. Should the RBNZ outcome be dovish, then this could lead to a hefty sell-off towards the middle of the 100 pip box near 0.5650 and then 0.5600.

On the other hand, the price could shoot up on a hawkish outcome towards a 50% mean reversion of the daily bearish impulse near 0.5800 and beyond.

The knee jerk to the RBA on Tuesday was a 50 pip sell-off before a 100 pip rally that was faded by the bears in London back to the post-RBA lows until the US dollar was sold off in New York.

About the RBNZ

RBNZ Interest Rate Decision is announced by the Reserve Bank of New Zealand. If the RBNZ is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the NZD.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.