When is the BoJ and how might it affect USD/JPY?

Expected at around 0300 GMT, the Bank of Japan meeting will conclude today with the statement being delivered, quarterly forecasts and Governor Kuroda press conference. The meeting is held in high anticipation, for one considering the high volatility in the yen of late that has at times seen ranges of over 500 pips on any given day. There is no fixed time for the announcement but it is widely expected that the central bank will keep the key rates maintained, notably the 0% yield target on the 10-year JGB (+/-0.25%).

As analysts at Westpac explained, ''BoJ officials continue to argue that while headline and CPI ex-fresh food (the official target) have risen to 8-year highs, it is a cost-push move and that without wages picking up, it will not be sustained. Still, there will be tension for JPY around the meeting and the press conference.''

Analysts at Commerzbank note that some observers argue that the MOF's interventions argue for an end to QQE-YCC. ''We argue that this is not necessarily the case. But if the end of QQE-YCC does come at some point, the exit will be tricky. Admittedly, not necessarily for the reasons that are currently commonly cited.''

How might the BoJ affect USD/JPY?

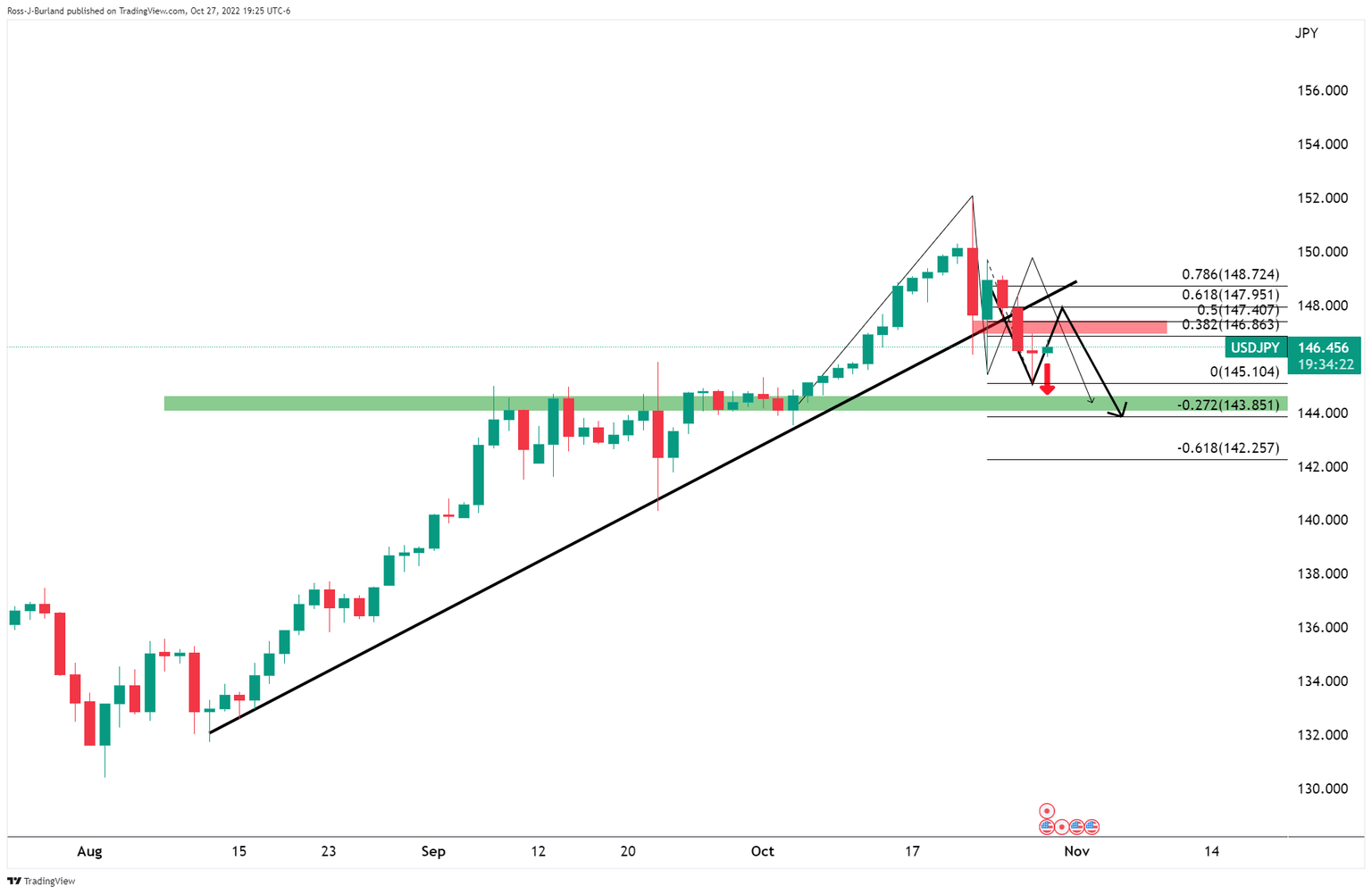

Regardless of the outcome, the price is on the backside of the trendline which leaves the bias bearish for the near to medium term. The price is correcting towards the neckline of the M-formation and the 38.2% Fibonacci of the prior bearish impulse. if this were to hold, then the bias will be on the downside to target the support near 144.00 the figure.

Meanwhile, the hourly chart confirms the move higher considering the break of the symmetrical bounded range's resistance line with near-term resistance guarding 147 the figure and then 147.50.

Ultimately, what matters for JPY exchange rates are real yields adjusted for inflation and real interest rates and real returns in Japan will be permanently less attractive for investors in comparison to the US, which will remain problematic for the BoJ. While yield curve control on the BoJ’s terms remains, only a weaker USD is likely to change the dynamic for USD/JPY.

About the BoJ interest rate decision

BoJ Interest Rate Decision is announced by the Bank of Japan. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the JPY. Likewise, if the BoJ has a dovish view of the Japanese economy and keeps the ongoing interest rate, or cuts the interest rate it is negative, or bearish.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.