When is the Bank of Japan and how might USD/JPY react?

The Bank of Japan is scheduled for today and should be expected any time from about 11:30 am Tokyo, or 1:30 pm Sydney, that's GMT 02:30. The announcement for the meeting a year ago was made at 02:46 GMT. Governor Kuroda’s press conference is expected to start at 06.30 GMT.

Analysts at Westpac explained that ''after the Bank of Japan’s shock decision in December to widen the 10-year government bond yield target range from -0.25% to +0.25% to -0.5% to +0.5%, there is keen anticipation of the outcome of the meeting which concludes today.''

BoJ bazookas at the ready?

''Local media report that the BoJ will raise its inflation forecasts again in the quarterly update. But the intense market focus is on whether any policy adjustments will also be revealed,'' the analysts explained.

''Options include further widening the 10yr yield target range (it has been trading around or above 0.50% in recent days), shifting the yield target to the 5yr JGB, dumping yield curve control entirely and raising the benchmark policy rate which has been -0.1% since 2016.'' On a side note, it is worth mentioning that BoJ bought 5-10yr to maturity JGBs unlimited amount again today.

How might BoJ affect USD/JPY

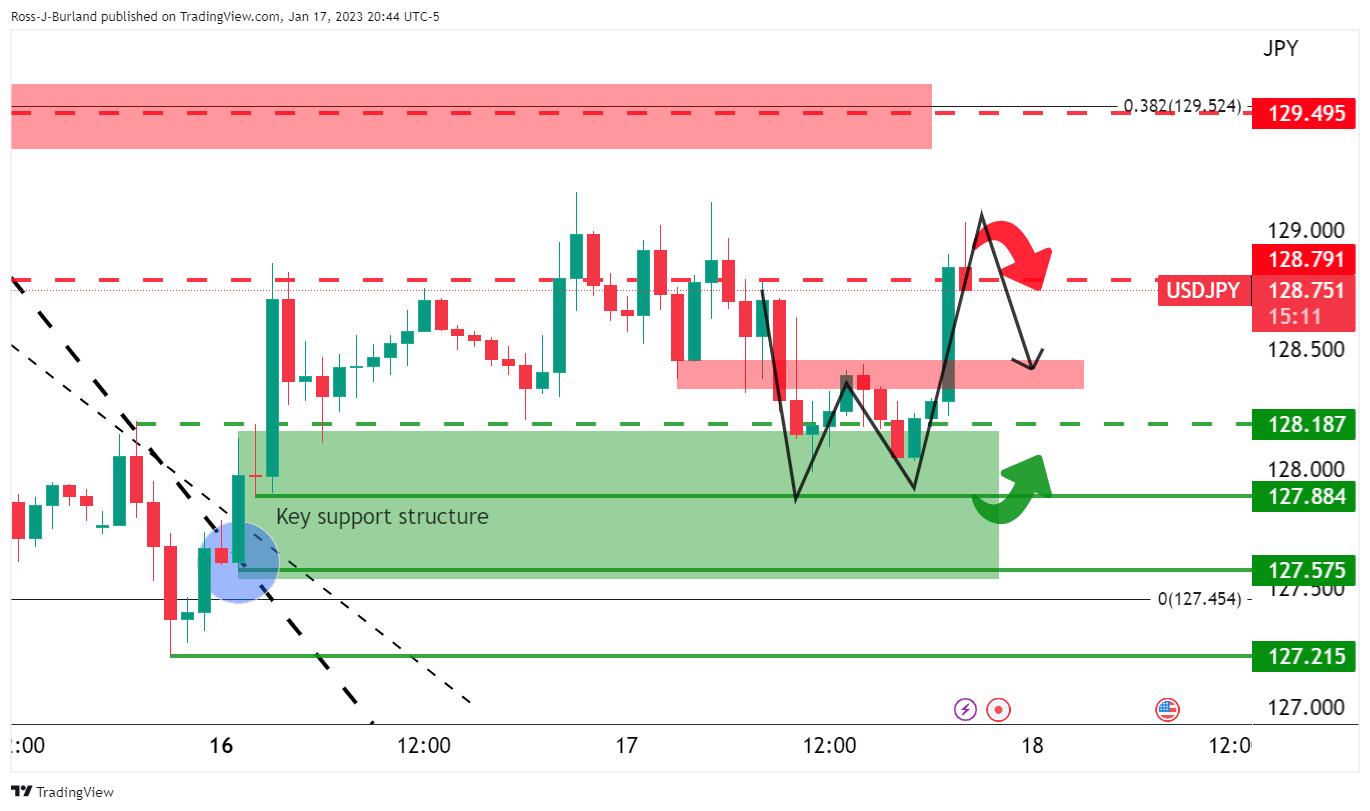

Meanwhile, the Japanese yen is up 2.2% this month suggesting that investors are pricing a notable policy change today. As stated in a prior analysis, hourly support is going to be critical today. This is seen at around 128.00 / 127.70.

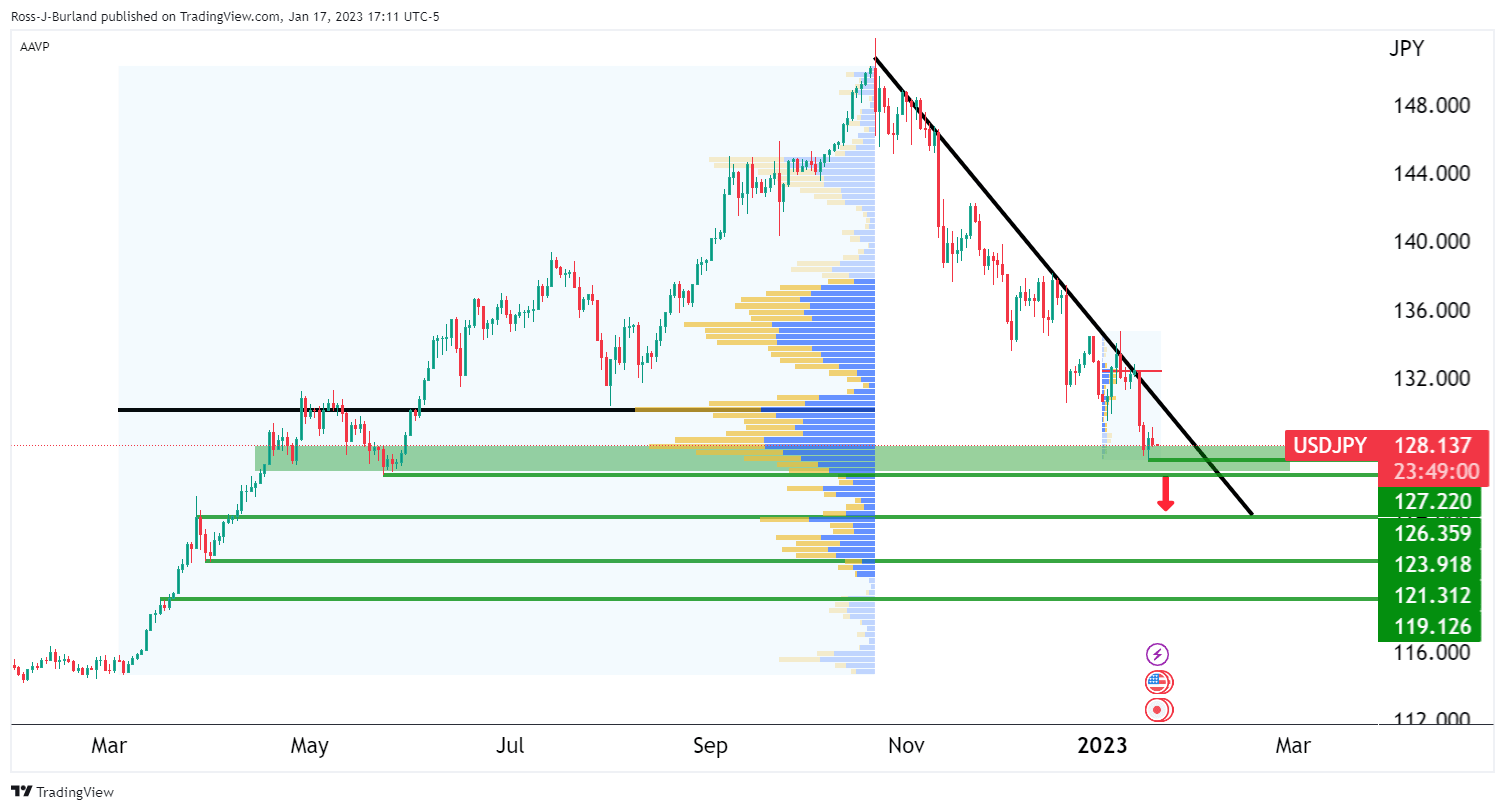

The support could prove critical in and around the BoJ event guarding 127.20.

A break below here opens the risk of a significant downside extension:

''The market is keen to learn if the December decision to widen the yield curve target was a first step to exit the BoJ's ultra-expansionary monetary policy stance. If so, the yen could strengthen further,'' analysts at Commerzbank argued.

As for the hourly chart, we have a W-formation in play in the countdown to the announcements:

Resistance could be expected to hold and thus the neckline is a target near 128.50 that guards the support structure below it.

On the whole, analysts at Commerzbank said that ''it is quite possible that the BoJ — despite many arguments to the contrary — will initiate a monetary tightening in the near future that will significantly support the yen.''

''If the BoJ tightens its monetary policy now, that argues for the yen to remain a low-interest rate currency (and thus arguably a safe haven, much like the Swiss franc and gold). Because it then becomes likely that Japan will also remain a special case in terms of its return to zero or low inflation.''

About the Bank of Japan interest rate decision

BoJ Interest Rate Decision is announced by the Bank of Japan. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the JPY. Likewise, if the BoJ has a dovish view on the Japanese economy and keeps the ongoing interest rate, or cuts the interest rate it is negative, or bearish.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.