When are the UK jobs and how could they affect GBP/USD?

UK Jobs report overview

Early Tuesday, the UK’s Office for National Statistics (ONS) will release the November month Claimant Count figures together with the Unemployment Rate in the three months to October at 07:00 AM GMT.

Although the furlough schemes seem to have a future considering the latest outbreak of the Omicron covid variant in the UK, the Bank of England (BOE) is yet to dump the bullish side, which in turn highlight today’s British jobs report as an important catalyst for the GBP/USD traders ahead of Thursday’s BOE meeting.

The UK labor market report is expected to show that the average weekly earnings, including bonuses, in the three months to October, ease from the previous 5.8% to 4.5%, while ex-bonuses, the wages are seen declining from 4.9% to 4.0% during the stated period.

Further, the ILO Unemployment Rate favors upbeat signals of the employment data as forecasts suggest figures to ease to 4.2% from 4.3% for the three months ending in October. It’s worth noting that the Claimant Count Change figures dropped by -14.9K in October while the Claimant Count Rate was 5.1% during the stated month.

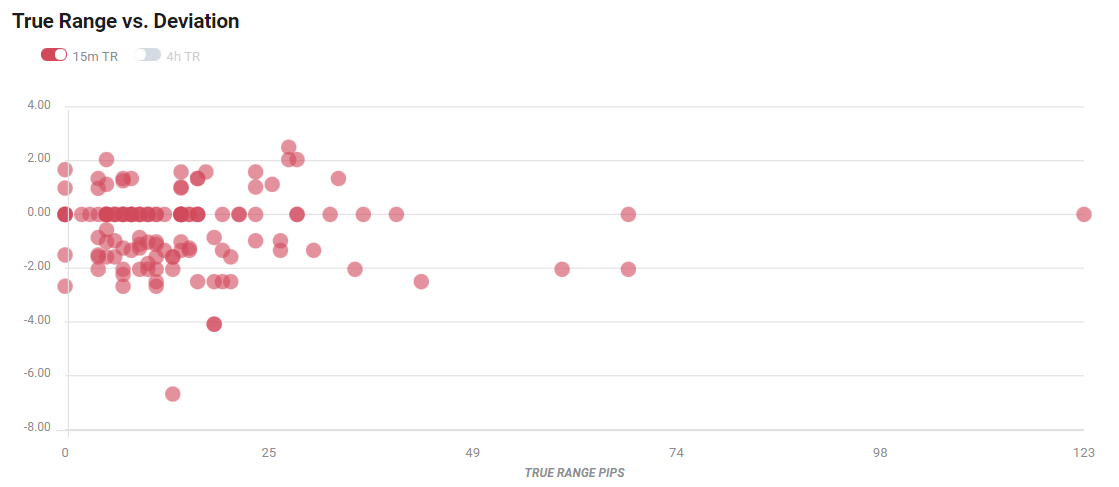

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could they affect GBP/USD?

GBP/USD bears the burden of the Omicron woes while tracking other majors to print mild losses heading into Tuesday’s London open. That said, the quote drops for the second consecutive day, reversing the previous bounce of yearly low.

In addition to the first covid variant-linked death in the UK and return of the partial activity restrictions and anxiety ahead of Wednesday’s Fed meeting, as well as Thursday’s BOE performance, also weigh on the GBP/USD prices of late.

That said, the UK employment data may offer intermediate direction to the GBP/USD prices but may witness a milder response as global markets remain most interested in the Omicron updates. Another reason is the return of the lockdowns and the jump in the virus cases in the UK that suggests hardships of British employment and inflation conditions going forward, which in turn could stop the BOE hawks during this week.

“Although the MPC has made it clear that the decision to hike rates would depend substantially on how the labor market develops post-furlough, we expect that the uncertainty introduced by the Omicron variant will delay a potential hike to February,” said TD Securities.

On the same line, FXStreet’s Ross J Burdland said, “On the macro front for the week idea, employment and inflation data on Tuesday and Wednesday will precede the latest Bank of England policy decision on Thursday. Cable is suffering on the divergence between the BoE and the Federal reserve as trader expectations for a rate hike have been eroding due to the new variant with the market now expecting the BoE to leave all policy settings unchanged, at least until February.”

Technically, a downward sloping trend line from November 04, around 1.3225 by the press time, directs GBP/USD towards a fresh yearly low, currently around 1.3160.

Key notes

GBP/USD leans bearish towards 1.3050 and then 1.2920

GBP/USD slips, as UK report first Omicron death, US Indices lower ahead of Fed meeting [Video]

About UK jobs

The UK Average Earnings released by the Office for National Statistics (ONS) is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, the positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.