When are the UK data releases and how could they affect GBP/USD?

The UK Economic Data Overview

The British economic calendar is set to dominate the markets moves at 06:00 GMT with the second quarter (Q2) GDP figures for 2020. Also increasing the importance of that time are March month Trade Balance and Industrial Production details.

The first readout of the Q2 2020 GDP is seen weaker at -20.5% QoQ and -22.4% YoY versus -2.2% and -1.7% respective priors.

Looking at the monthly readings, the UK GDP is expected to recover 8.0% MoM in June versus +1.8% prior while the Index of Services (3M/3M) for the same period is seen weaker from -19.2% to -18.9%.

Meanwhile, the Manufacturing Production, which makes up around 80% of total industrial production, is expected to rise 10% MoM in June against 8.4% recorded in May. Further, the total Industrial Production is expected to come in at 9.2% MoM for June as compared to the previous reading of +6.0%.

Considering the yearly fact, the Industrial Production for June is expected to have dropped by 12.8% versus -20.0% previous while the Manufacturing Production is also anticipated to have declined by 15.0% in the reported month versus -22.8% last.

Separately, the UK Goods Trade Balance will be reported at the same time and is expected to show a deficit of £4.75 billion versus a £2.805 billion deficit reported in May.

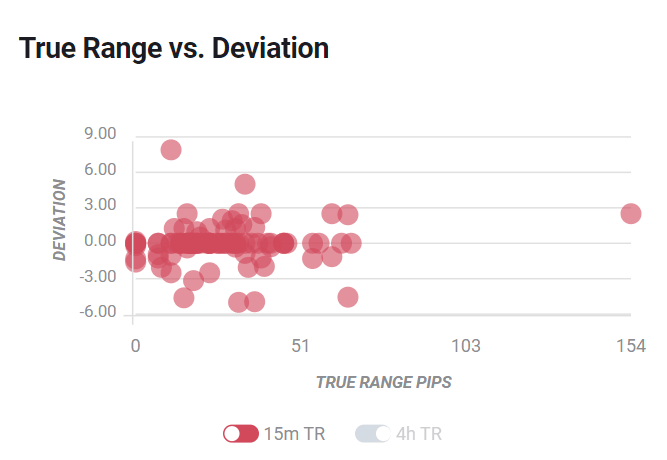

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could affect GBP/USD?

At the press time, the GBP/USD extends the previous day’s losses while declining 0.12% on a day to 1.3030. The pair dropped the previous day following downbeat UK employment data. As a result, the pound traders are waiting for the key British macro for fresh impetus.

Although market forecasts suggest further declines of the GBP/USD prices following UK GDP, FXStreet’s Yohay Elam cites odds of positive beat to propel the quote:

UK second-quarter GDP likely dropped, confirming a recession – yet probably not by around 20%. A beat may boost the pound, yet expectations may have already been adjusted. A surprising fall of over 20% would send sterling lower.

Technically, the pair’s failures to cross 50-bar SMA join bearish MACD conditions to suggest further downside. As a result, an ascending trend line from July 30, at 1.3030 now, gains the sellers’ immediate attention before targeting the 1.3000 threshold and 100-bar SMA level of 1.2965. On the contrary, a clear break of 50-day SMA, currently around 1.3090, isn’t enough to recall the bulls as a downward sloping trend line from August 06 near 1.3125 also challenges the pair’s short-term upside.

Key notes

UK GDP Preview: Three reasons why 20% contraction estimates are too low, GBP/USD may rise

GBP/USD Price Analysis: Depressed below 50-bar SMA around 1.3050, UK GDP in focus

GBP/USD Forecast: Comfortable consolidation above 1.3000 continues

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.