Watch the free-preview video below extracted from the WLGC session before the market open on 20 May 2024 to find out the following:

-

How to interpret the S&P 500’s behavior when testing previous all-time highs.

-

How to anticipate market movements based on supply-demand dynamics.

-

How a trading range could unfold for the S&P 500.

-

And a lot more…

Market environment

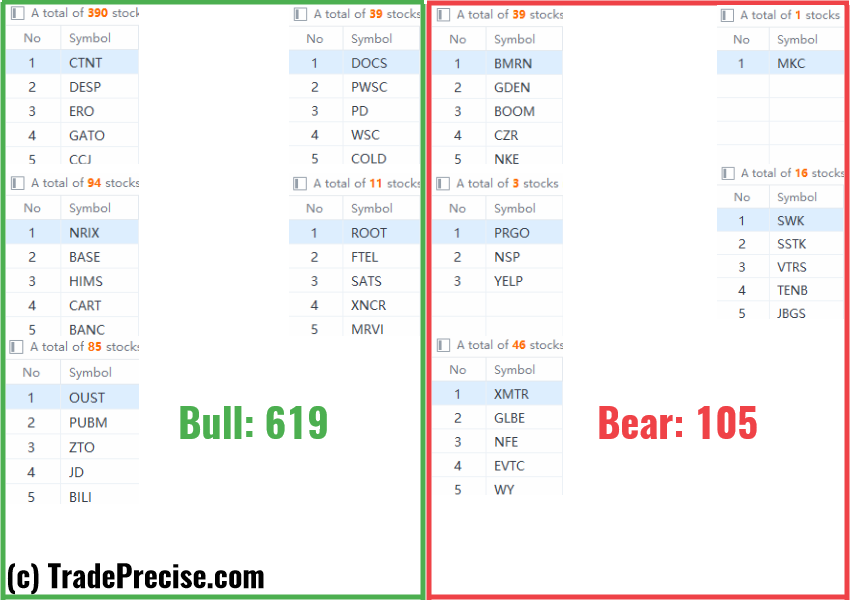

The bullish vs. bearish setup is 619 to 105 from the screenshot of my stock screener below.

The market environment is improving compared to last week while both the long-term and short-term market breadth are in the healthy zone.

Most importantly, the trade entry setups as discussed in the live session for the past few weeks are still going well.

The Bitcoin-related stocks just had a strong rally on Tuesday thanks to the continuation of the strong uptrend in the Bitcoin, highlighted in the market update email on Monday.

Market comment

8 “low-hanging fruits” (TNDM, LNTH) trade entries setups + 15 actionable setups (COIN) were discussed during the live session before the market open (BMO).

TNDM

LNTH

COIN

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

Gold: Trade war fears lift Gold to new record high

Gold shined as the go-to safe-haven asset amid growing fears over a deepening global trade war. US tariff announcements and key employment data could lift XAU/USD’s volatility. The technical outlook points to overbought conditions in the near term.

EUR/USD: US Dollar to fall further despite ruling uncertainty

The EUR/USD pair remained under selling pressure for a second consecutive week but ended it little changed at around 1.0820. The US Dollar remained trapped between tariff-related concerns and tepid US data, limiting its safe-haven condition.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Week ahead: US NFP and Eurozone CPI awaited as tariff war heats up, RBA meets

Trump’s reciprocal tariffs could spur more chaos. US jobs report might show DOGE impact on labour market. Eurozone inflation will be vital for ECB bets as April cut uncertain. RBA to likely hold rates; Canadian jobs, BoJ Tankan survey also on tap.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.