ASX: WESTPAC BANKING CORPORATION - WBC Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart).

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with WESTPAC BANKING CORPORATION - WBC. We determine that wave ((iv))-navy is unfolding, and seems to end soon, creating conditions for wave ((v))-navy to return to continue pushing higher.

ASX: Westpac Banking Corporation - WBC Elliott Wave technical analysis

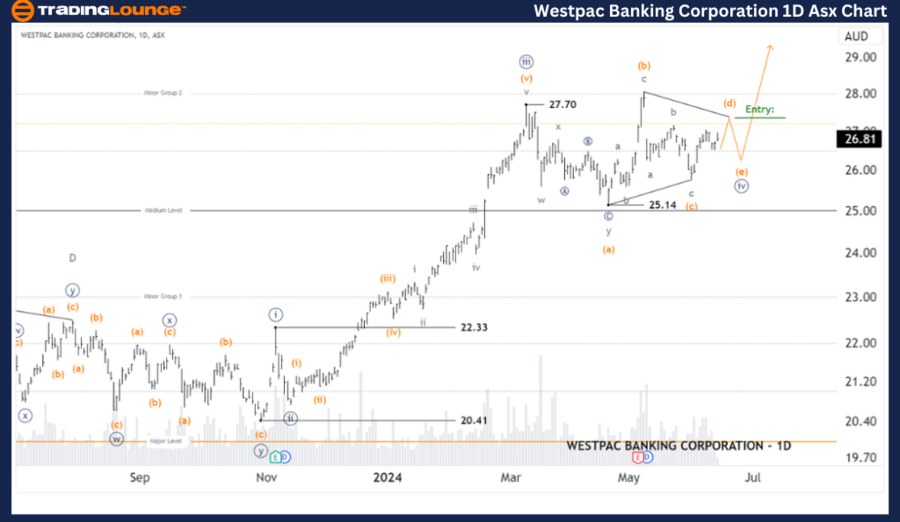

ASX: WESTPAC BANKING CORPORATION - WBC 1D Chart (Semilog Scale) Analysis.

Function: Major trend (Minute degree, green).

Mode: Motive.

Structure: Impulse.

Position: Wave (d)-orange of Wave ((iv))-navy.

Details: The short-term outlook shows that wave ((iv))-navy seems to be unfolding as a Triangle, and needs a little more time before completion. Following this, wave ((v))-navy may return to push higher. Evidence suggests this is a Triangle because there are many three-wave structures within the subwaves. Looking for a long trade setup might be optimal when the price pushes above the high labeled as wave (d)-orange.

Invalidation point: 25.14.

ASX: WESTPAC BANKING CORPORATION - WBC Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: Westpac Banking Corporation - WBC Elliott Wave technical analysis

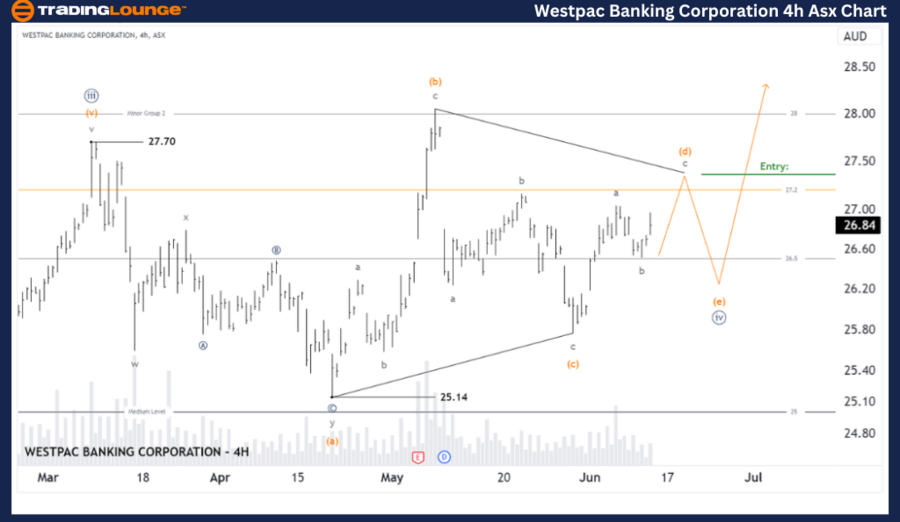

ASX: WESTPAC BANKING CORPORATION - WBC 4-Hour Chart Analysis.

Function: Major (Minor degree, navy).

Mode: Motive.

Structure: Impulse.

Position: Wave c-grey of Wave (d)-orange of Wave ((iv))-navy.

Details: The shorter-term outlook suggests that wave ((iv))-navy is unfolding as a Triangle. Wave (d)-orange is nearing its completion. Once the Triangle concludes, wave ((iv))-navy will also complete. At that point, a long trade setup can be initiated when the price pushes above the high labeled as wave (d)-orange.

Invalidation point: 25.14.

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: WESTPAC BANKING CORPORATION - WBC aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Technical analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

ASX: Westpac Banking Corporation - WBC Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

USD/JPY off lows but heavy near 151.50 amid upbeat Japan's Q4 GDP

USD/JPY is off the lows but holds moderates losses near 151.50 early Monday. Japan's prelimimary GDP report showed the economy expanded 0.7% QoQ and 2.8% YoY in Q4. The data blew past market expectations and reaffirmed bets for another BoJ rate hike, boosting the Japanese Yen.

AUD/USD holds gains above 0.6350 amid US Dollar weakness

AUD/USD holds gains above 0.6350 in the Asian session on Monday. The sustained US Dollar weakness and prospects of Russia-US meeting outweigh dovish RBA expectations, supporting the pair amid a US holiday-thinned market. All eyes remain on Tuesday's RBA interest rate decision.

Gold buyers regain poise as focus shifts to US-Russia meeting

Gold price rebounds after Friday’s profit-taking slide; light trading could exaggerate moves. The US Dollar and US Treasury yields consolidate losses, bracing for US-Russia talks and Fed Minutes.

Bitcoin, Ethereum and Ripple hold steady while XRP gains momentum

Bitcoin has been consolidating between $94,000 and $100,000 for almost two weeks. Ethereum price follows in BTC’s footsteps and hovers around $2,680, while Ripple shows strength and extends its gains on Monday after rallying 14% last week.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.