- WEN shares popped a mouth-watering 26% on Tuesday.

- $25.38 is the heavily-watched 61.8% retracement.

- WEN surged to record 30-year highs on the rally.

Another day, another mind-blowing rally as the new era of speculative frenzy shows no signs of abating. The new era will take some getting used to, but options market makers should be happy with increased volatility to sell occasionally, so long as they can manage their delta and gamma positions. The advent of handheld smartphone trading apps has unleashed a tidal wave of new aggressive hungry traders on the stock market and this trend shows no sign of moving on just yet. Particularly with Bitcoin continuing to suffer. Call it what you will, frenzy, groupthink in excess, or even a Ponzi scheme, but the fact is this new retail force is a powerful change to Wall Street's staid traditions.

AMC and GameStop (GME) have been the noted meme stocks in 2021, but now the net is spreading and Wendy's went and got itself all flame grilled up on Tuesday, soaring to close the session at $28.87 for a neat 26% gain. Wendy's had been close to breaching $30 at one point. It appears the reasoning is down to some posting on Reddit's WallStreetbets forum talking about the reopening prospects for the fast-food chain as well as a new salad lineup and chicken tenders. All that added a few billion to the market cap. Nice work, apes! Wendy's needs no introduction as a fast food chain and blew past all previous levels, hitting a near 30-year high and breaking the old high from 2006.

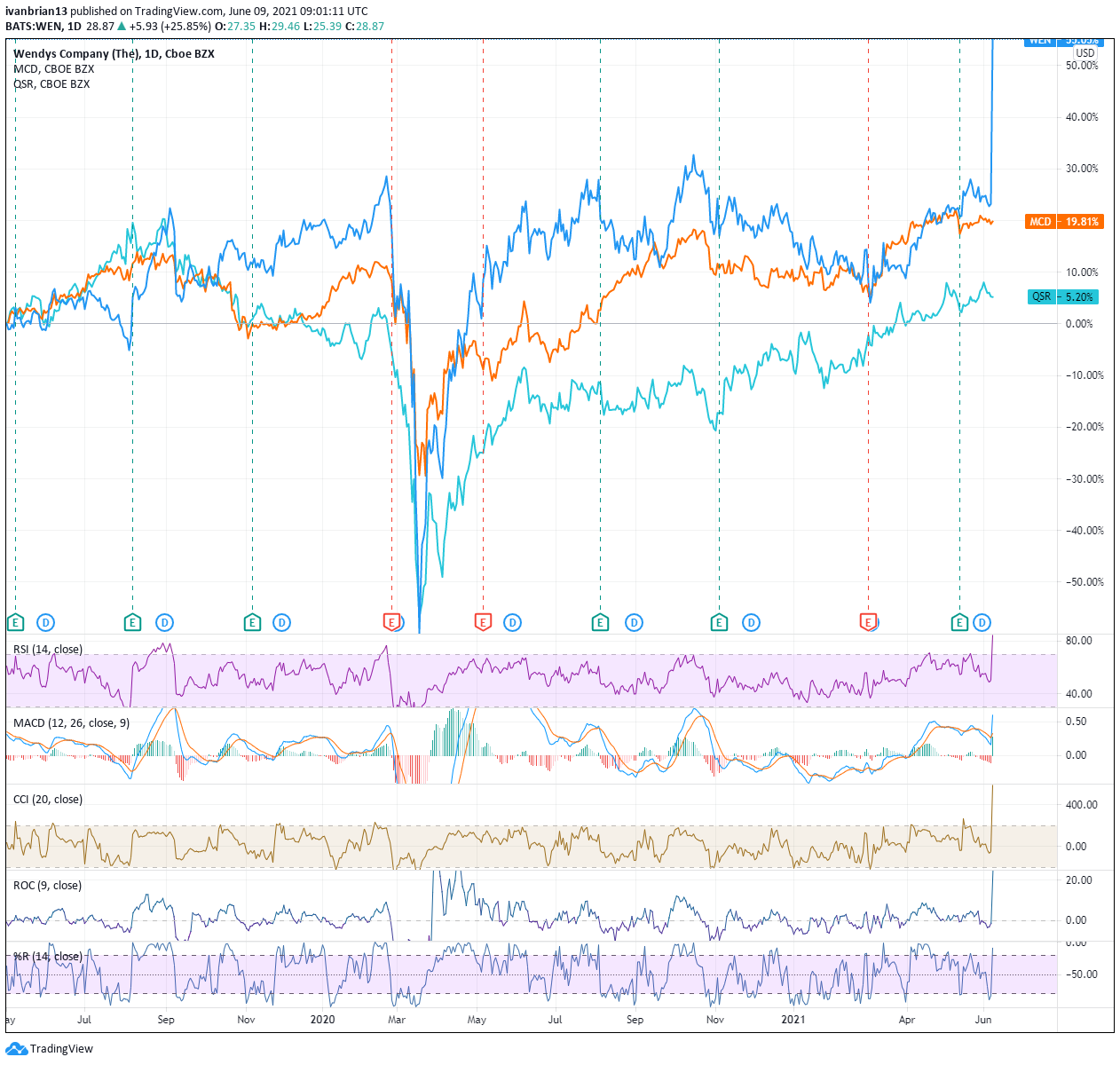

The interesting thing to note is the argument made by WallStreetBets for Wendy's (reopening, new menu, etc.) should also be directly applicable to McDonald's (MCD) shares and Restaurant Brands Burger King (QSR) shares. However, a quick glance at the chart below shows this is not the case. Why is this? Could it be this is a frenzy with no real reasoning behind it or does it matter?

Is Wendy's still a buy?

Firstly, FXStreet always begins our coverage of the majority of these meme stocks by saying how out of whack they have become with the underlying fundamentals. Investing, as in the Warren Buffet style of buying and holding for the long term, is governed by fundamental metrics such as the health of the balance sheet, sales and revenue generation, etc. Trading or speculating does not have to be subject to such underlying metrics as it is usually of a more short-term nature. So again, Wendy's has gone too far and is not attractive at this price. That is not to say it will not keep going higher, so trading the stock in the short term will have different metrics to look at. Momentum is clearly behind the name as is a wall of retail money. A 26% move is not actually that much when compared to some of the moves we have witnessed in other meme stocks: AMC, KOSS, GME, etc.

The difference with Wendy's is it does not have a larger short base to squeeze. Refinitiv data shows the short base around 3%. Wendy's does not have a low float like KOSS either. So two of the major crutches have been removed straight away. It is, however, a relatively small-cap stock, making it is easier to move. If the WallStreetBets crowd decided to apply their logic to Mcdonald's (MCD), they would be up against a much larger flow of money and find it harder to move the stock. They may succeed, but the effect would likely not be as long lasting. All the momentum indicators, Relative Strength Index (RSI), Commodity Channel Index (CCI) and Williams %R are showing massively overbought conditions. This usually signifies either a sell-off or at least price consolidation. But the history of AMC and GME shows that the squeeze can go on for longer than anticipated.

For such an explosive move, the only real technical analysis left in the toolkit is Fibonacci retracements, as all other support and resistance levels have been blown past. $26.94 is the 38.2% retracement, and $26.16 is the 50%, with $25.38 being the most watched at the 61.8% retracement.

As ever, use good risk management when trading these highly volatilie, highly speculative names.

- Skillz Stock News: SKLZ jumps 6% at open, continues swing high

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0400 after upbeat US data

EUR/USD consolidates daily recovery gains near 1.0400 following the release of upbeat United States data. Q3 GDP was upwardly revised to 3.1% from 2.8% previously, while weekly unemployment claims improved to 220K in the week ending December 13.

GBP/USD extends slide approaches 1.2500 after BoE rate decision

GBP/USD stays on the back foot and break lower, nearing 1.2500 after the Bank of England (BoE) monetary policy decisions. The BoE maintained the bank rate at 4.75% as expected, but the accompanying statement leaned to dovish, while three out of nine MPC members opted for a cut.

Gold approaches recent lows around $2,580

Gold resumes its decline after the early advance and trades below $2,600 early in the American session. Stronger than anticipated US data and recent central banks' outcomes fuel demand for the US Dollar. XAU/USD nears its weekly low at $2,582.93.

Bitcoin slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.