Weaker data do this

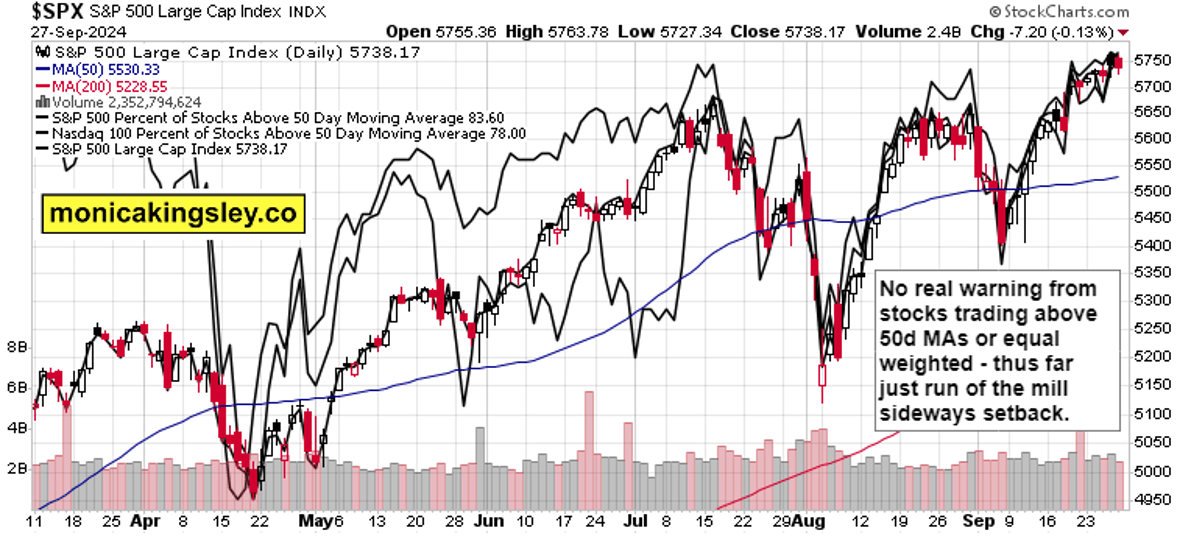

S&P 500 didn‘t quite reach Thursday‘s highs, and the 0.1% undershoot in core PCE aftermath was to blame. We caught it in Russell 2000 in the intraday channel as smallcaps benefited from bonds finally turning up. Communications had a good day too – Friday was simply about yields and continued piling into China names – the multifaceted, strong stimulus is making consumer discretionaries on the high end, materials, industrials, base metals beyond copper, and precious metals benefit.

Not that gold and silver would just be plain rising – I‘ve been striking a cautious tone before core PCE, and this is how the setback then went. Crude oil is in an entirely different position unlike natural gas or uranium (hello XLU still doing great), but I‘ve talked black gold for many weeks in this context, my conclusions haven‘t changed much. Bitcoin and crypto names COIN, MARA and MSTR are still looking good, and reacting to the great macroeconomic easing.

Inflation has quite fallen out of the vocabulary, job market isn‘t seeing spike in unemployment, it‘s just hiring that‘s slower. Labor hoarding accompanied by not crashing corporate profits and consumer acting stronger than feared – that‘s a good mix to the rate cutting cycle (easing worldwide) during the AI theme that‘s slowly, slowly improving productivity.

And in this context S&P 500 is to decline dramatically? No way.

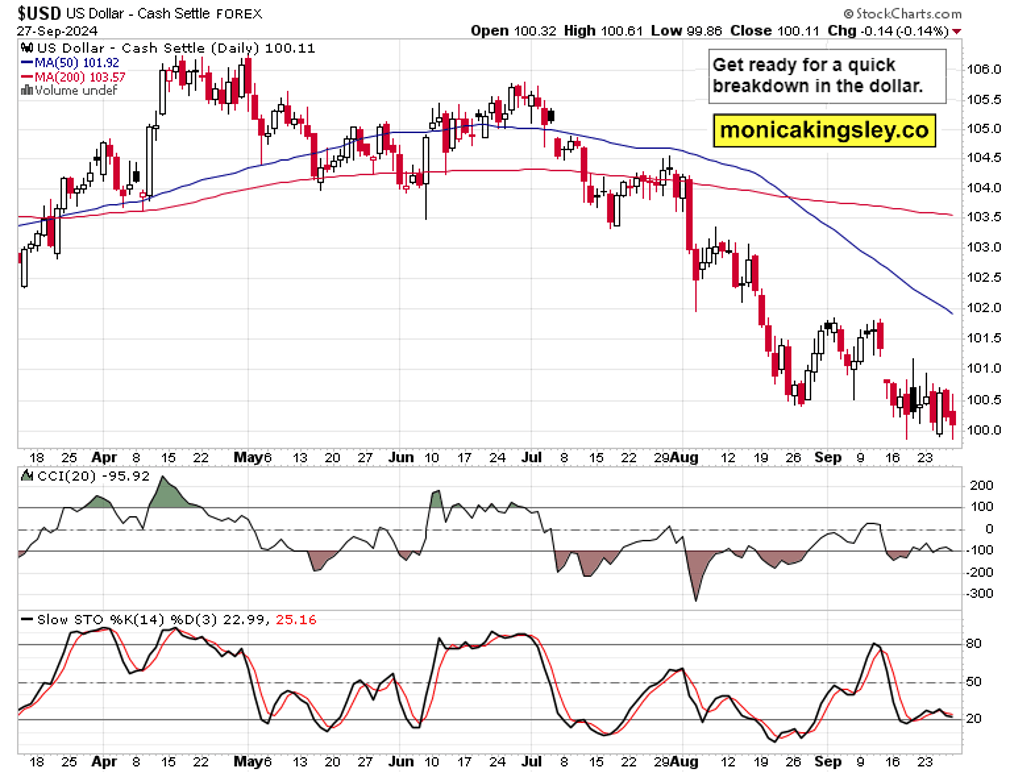

Let‘s check bonds and the dollar next – and then the S&P 500 chart that I use in addition to the breadth one or sectoral views, ratios and similar premium featured views.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.