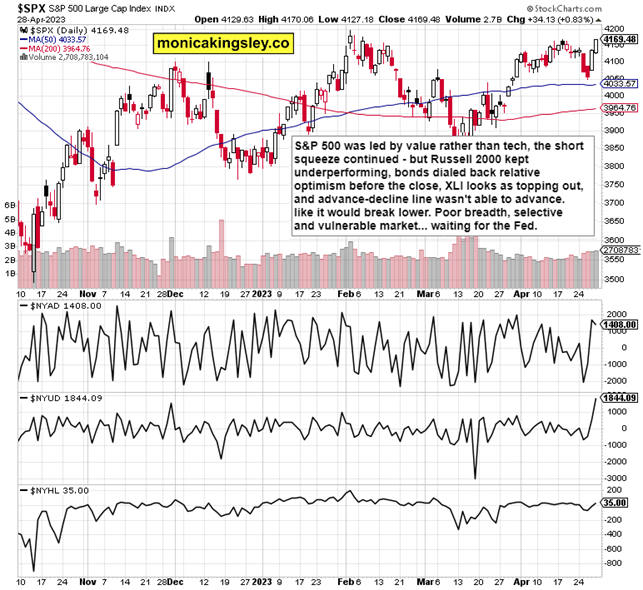

Way too narrow

S&P 500 continued the short squeeze, more than vindicating my call for no setback Friday. Market breadth and internal strength isn‘t though that positive – yet markets are celebrating as if the banking crisis was over, as if the Fed pivoted, or as if Big Tech earnings were to lend similar resilience to other industries‘ results. Somehow, the negative UPS forward guidance has been quickly lost as well.

The elephant in the room is continued deposits outflow – and it doesn‘t end with FRC no matter how much KRE and XLF rejoice. Fed is still raising rates, Fed is still shrinking its balance sheet, and the Treasury needs to roll over almost $7T in debt this year alone (and some $3T next year). Inflation, core components especially, aren‘t declining nearly fast enough, personal income is up, job market in spite of all the increase in unemployment claims still quite hot – summing up, the Fed has no reason to pivot.

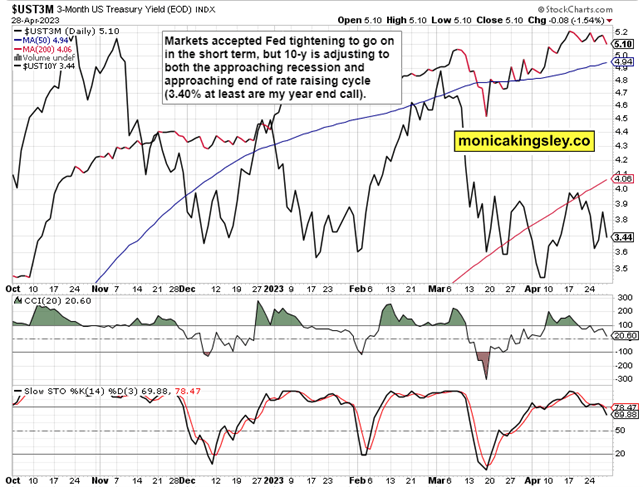

Victory can‘t be declared, oil prices have bottomed, and will continue adding to headline inflation and will work to sink consumer confidence. Credit card usage is up, gasoline prices are up, and the market expectation for Sep 2023 rate cuts is at odds with everything Powell said, and what other officials are hinting add. Remember, the Fed‘s intention is to slowly take rates restrictive, and keep them there long – long enough without first hiking excessively and too fast (in the hopes of avoiding triggering recession, the thinking goes) – it is so no matter how much the bond market craves the end of tightening and rate cutting.

The current inflows into passive investing, the approaching debt ceiling, the Treasury General Account in need of replenishment will serve to prove corporate earnings undue optimism with respect to Q2. For now, the Fed would continue being restrictive – the GDP wasn‘t that dismal as much had to do with declining private inventories and not consumption per se.

Now, the Fed still relatively easily can be restrictive and keep Fed funds rate elevated, even if that is an incentive for deposits outflow and its liquidity programs in support of the banking system expansion. It can be viewed as a protostep ultimately leading to yield curve control, but we aren‘t there yet.

The Fed would have a harder time being restrictive when the economy finally rolls over into recession (and it will – LEIs, double inverted yield curve, tightening bank lending standards etc) don‘t lie. Budget deficit would increase, default swaps are rising already, tax revenues are down – and expenses of all kinds would of course go up.

As for earnings, AAPL won‘t sink the markets either – the META, AMZN string of unabated bullishness called, won‘t see the rug pulled on AAPL.

The bulls‘ undoing would come from waning liquidity inflows, VIX bottoming a tad below 15, bond market volatility picking up again, weak market breadth, narrow rotations and overall sectoral vulnerability (have a look at precarious industrials – and these are supposed to lead early in bull runs).

S&P 500 and Nasdaq outlook

Hello 4,188 or even 4,209 (weak resistance to convince more buyers of a bull market) – market breadth though keeps sending warning signs as this short squeeze rally would meet hawkish Fed, which it isn‘t ready for. The bears lost the immediate upper hand, and prices aren‘t likely to come down too easily early in the week – so no 4,115, or 4,136 too soon. The upswing has to exhaust itself first.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.