The US dollar is crumbling, this week as investors survey the landscape of the global economy, not just in the US. The greenback has fallen victim to improved risk sentiment, helping the likes of the euro that has been extending its rebound from a five-year low touched last week, and putting more distance between the common currency and parity with the US dollar.

However, in what could throw the US dollar bulls a lifeline, the Federal Reserve Chairman Jerome Powell is taking the Wall Street Journal's questions on the US economic outlook and its implications for the labour market, inflation and central-bank policies.

Watch live

The Federal Reserve will "keep pushing" to tighten US monetary policy until it is clear inflation is declining, Fed chair Jerome Powell said on Tuesday.

"What we need to see is inflation coming down in a clear and convincing way and we're going to keep pushing until we see that," Powell said at a Wall Street Journal event. "If we don't see that we will have to consider moving more aggressively" to tighten financial conditions.

Key notes

- We know this is a time for fed to be tightly focused on getting inflation down.

- We have tools and resolve to get inflation back down.

- No on should doubt our resolve - wall street journal interview.

- We need to see inflation coming down in convincing way.

- Ongoing rate increases appropriate.

- Broad support on fomc for having on table 50 bps at next two meetings.

- That is short of a prediction though.

- That said, if economy performs as we expect will be on the table.

- Very difficult to think about giving forward guidance.

- Economy very uncertain, as are outside events.

- Markets are pricing in a series of rate hikes.

- We like to work through expectations.

- It's been good to see markets reacting to what we are saying.

- Financial conditions overall have tightened significantly.

- What we need is to see growth moving down from high levels.

- We need supply side to have chance to catch up.

- We need to see growth moving down to a level that's still positive.

- By standards of central bank practice, we moving as fast as we have in several decades.

- We need to see clear and convincing evidence inflation is coming down.

- If we don't see that, we'll have to move more aggressively.

- We need to see clear convincing evidence that inflation is coming down.

- If we do, can slow pace of hikes.

- Underlying strength of US economy is really good right now.

- Labor market extremely strong.

- Growth this year is still at very healthy leveles.

- Consumer balance sheets are healthy.

- It is well positioned to withstand tighter policy.

- We are raising rates expeditiously to more normal level.

- We'll probably reach that in Q4 this year.

- That's not a stopping point though.

- We are raising rates expeditiously to a more normal level, will reach in 4th quarter.

- We don't know where neutral is, or where tight is.

- We're going to be looking meeting by meeting at financial conditions, economic health.

- We are going to look meeting by meeting, data by data, at financial conditions and economy.

- We will be looking at our actions impact on the economy.

- We really need to see clear and convincing evidence inflation coming down.

- If we have to go past neutral, we won't hesitate.

- If need to move past neutral, we wont' hesitate.

- We will continue raising rates until we see inflation coming down.

- There will be no hesitation about that.

- We will go until we are at a place where financial conditions are appropriate, inflation is coming down.

- There will be no hesitation about that.

- We will go until we are at a place where financial conditions are appropriate, inflation is coming down.

- Financial conditions haven't tightened so quickly in a very long time.

- It would have been better to raise rates earlier with hindsight.

- Inflation is way too high.

- We need to bring it down.

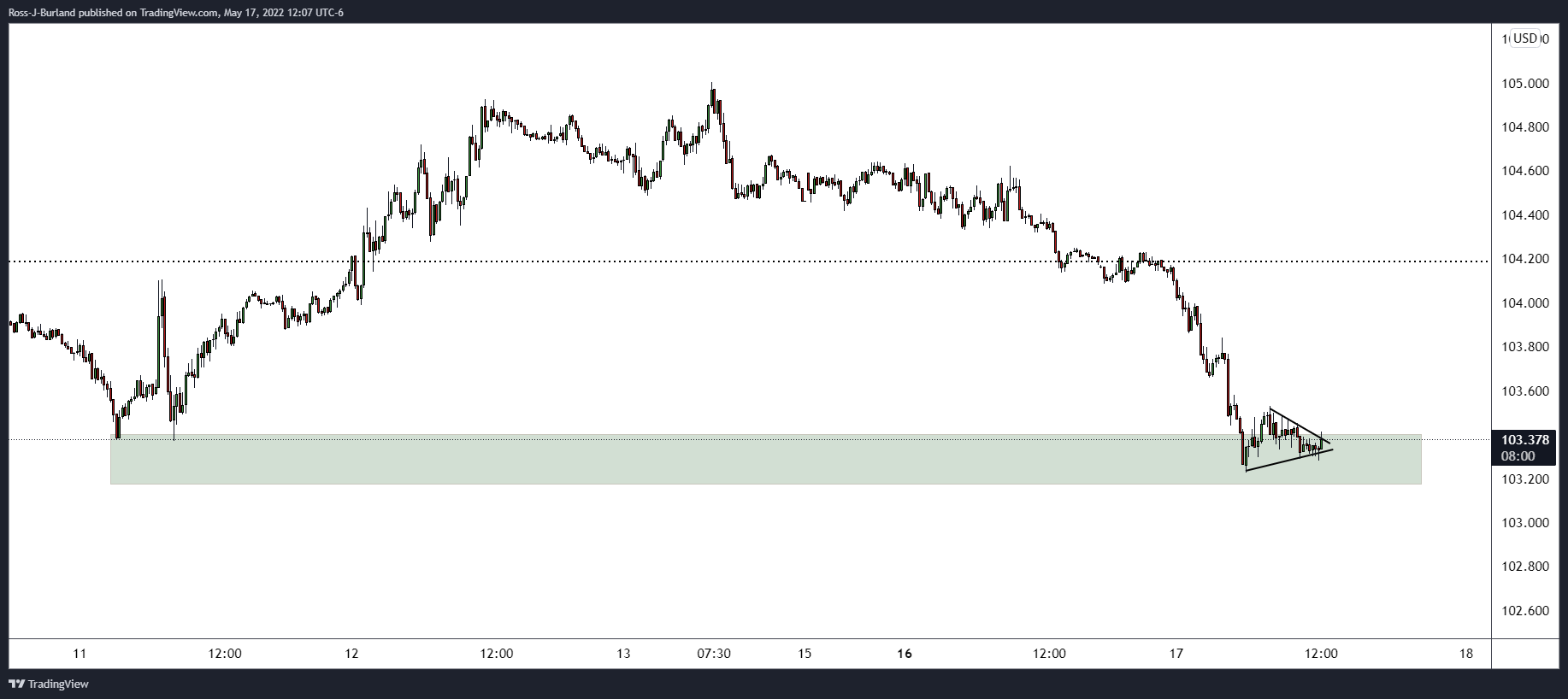

US dollar chart

The US dollar was testing the resistance of the wedge formation on the 15-min chart ahead of the event.

The US dollar is now picking up a bid during the interview:

About Fed chair Powell

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD keeps the range bound trade near 1.1350

After bottoming near the 1.1300 level, EUR/USD has regained upward momentum, pushing toward the 1.1350 zone following the US Dollar’s vacillating price action. Meanwhile, market participants remain closely tuned to developments in the US-China trade war.

GBP/USD still well bid, still focused on 1.3200

The Greenback's current flattish stance lends extra support to GBP/USD, pushing the pair back to around the 1.3200 level as it reaches multi-day highs amid improved risk sentiment on Monday.

Gold trades with marked losses near $3,200

Gold seems to have met some daily contention around the $3,200 zone on Monday, coming under renewed downside pressure after hitting record highs near $3,250 earlier in the day, always amid alleviated trade concerns. Declining US yields, in the meantime, should keep the downside contained somehow.

Six Fundamentals for the Week: Tariffs, US Retail Sales and ECB stand out Premium

"Nobody is off the hook" – these words by US President Donald Trump keep markets focused on tariff policy. However, some hard data and the European Central Bank (ECB) decision will also keep things busy ahead of Good Friday.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.