- Walmart releases earnings before the market opens on Tuesday.

- WMT stock earnings will be joined by fellow retailer Home Depot.

- Markets look to Home Depot and Walmart for signs of life in the US consumer.

Update: Walmart's (WMT) stock quote is now heading for another look at the double top formation with resistance at $152.10. Earnings were strong with a beat on top and bottom lines. EPS was $1.45 versus $1.40 expected. Revenue came in at $140.5 billion versus $135.6 billion expected. The shares are trading at $149.38 for a gain of 1.7% in the premarket.

Walmart (WMT) stock slipped on Monday ahead of its earnings report, which is due on Tuesday before the market opens. Home Depot (HD) stock has not been so tardy as it sits just below recent highs. HD stock too reports earnings today. Both will be key for a view of the health of US consumer spending with Lowe's (LOW) due up on Wednesday.

Walmart (WMT) stock graph, 15-minute

Walmart (WMT) stock news

Earnings are due out at 7 am EST /12 GMT on Tuesday, followed by an earnings conference call at 8 am EST / 1300 GMT. The link for the conference call can be found here. The stock has slid back a bit of late before the earnings release.

Earnings per share (EPS) is expected to come in at $1.40, while revenue is expected to hit $135.6 billion for the third quarter. Some interesting news to note is the Saudi Arabia Public Investment Fund (PIF) has nearly tripled its exposure to US equities in the last quarter with WMT being one of the additions. An SEC filing shows that in Q3 the PIF holds $43.45 billion, up from $16 billion in the previous quarter. However, most of the increased exposure is due to the Saudi Arabia PIF owning a large stake in Lucid Motors (LCID), which IPO'd in July.

The Saudi PIF has a stake in Walmart of 1.7 million shares.

Walmart (WMT) stock forecast

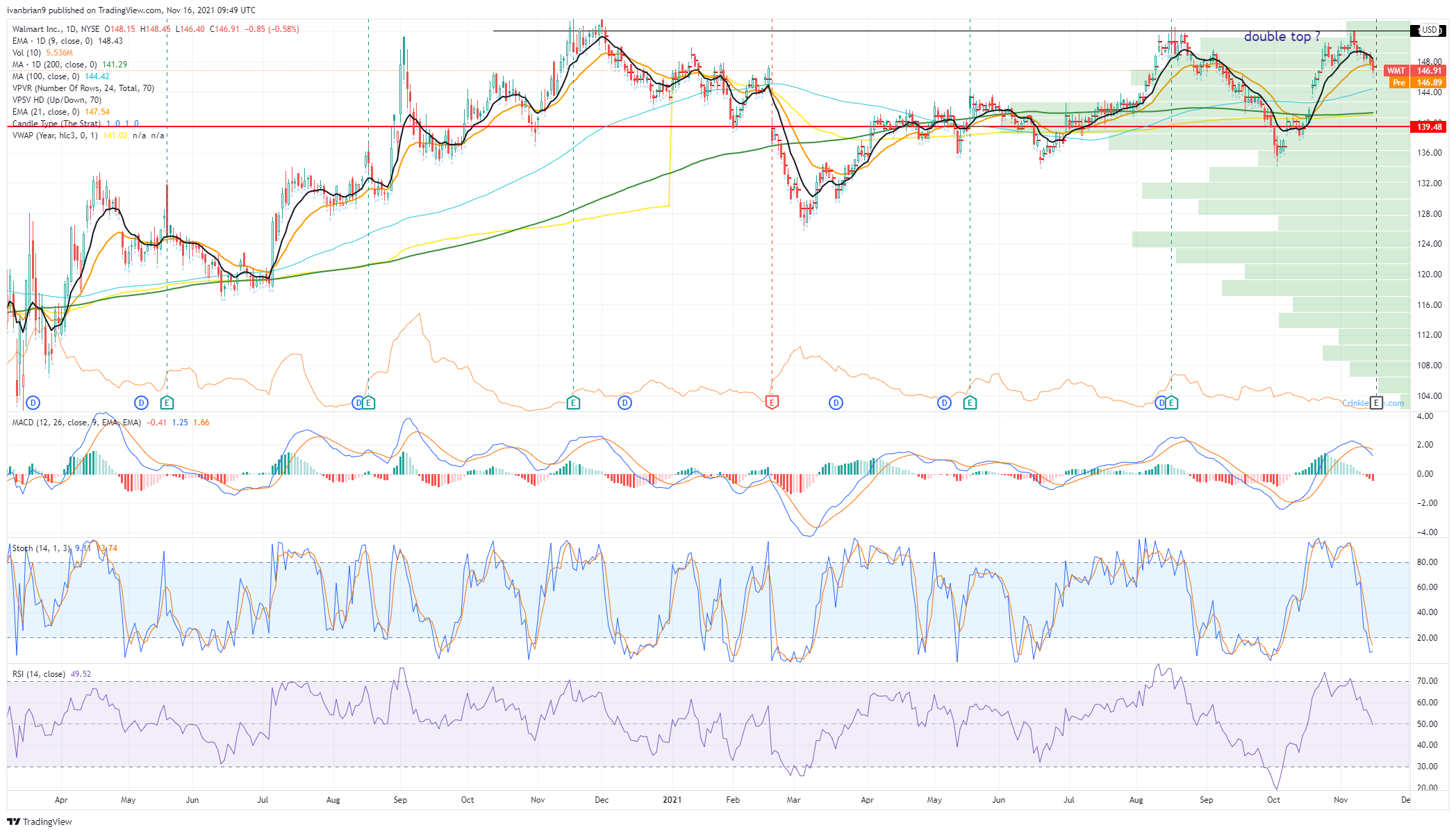

The major worry we would have is the appearance of a double top between both sets of earnings. There is a lot of resistance around this $152 zone, including going back to November of last year. If this is accurate and earnings confirm the retracement, the target is the 200-day moving average at $141.29. From there to $140 is strong support with a high volume profile bar and the point of control at $139.48. Breaking the $152 resistance would take Walmart (WMT) into unchartered record highs with little resistance in sight.

WMT 1-day chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD regains positive traction amid signs of easing US-China trade tensions

AUD/USD attracts some dip-buyers during the Asian session on Wednesday. Hopes for a possible de-escalation in the US-China trade war boost investors' appetite for riskier assets and support the Aussie. Meanwhile, The USD recovers further from a multi-year low, though the weakening confidence in the US economy and the Trump-Powell spat might cap gains.

USD/JPY jumps to one-week high amid likely US-China trade de-escalation

USD/JPY builds on the overnight solid rebound from sub-140.00 levels and jumps to a one-week high during the Asian session on Wednesday. Signs of easing US-China trade tensions lead to a sharp recovery in the risk sentiment and weigh on the safe-haven JPY.

Gold retreats further from record high amid US-China optimism, rebounding USD

Gold price extends the previous day's rejection slide from the $3,500 mark as hopes for US-China trade war de-escalation weigh heavily on safe-haven assets. Trump's remarks that he has no intention of firing Fed Chair Powell allowed the USD to move away from a multi-year low, which prompted some follow-through profit-taking around the precious metal.

Ethereum rallies 10% amid decline in CME short positions

Ethereum saw a 10% gain on Tuesday after the general crypto market rallied alongside Bitcoin. The rally comes after the ETH Chicago Mercantile Exchange basis plunged from 20% in November to about 5% in April.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637726520048732268.png)