- The Nasdaq composite reached a record closing high, as the index was underpinned by the performance of tech shares.

- The S&P 500 and the Dow Jones closed the day virtually unchanged as international trade remains a subject of worry for the markets.

The S&P 500 Index was virtually unchanged gaining 0.07% closing at 2,748.80 while the Dow Jones Industrial Average lost 0.06% to 24,799.97. On the other hand, the tech-heavy Nasdaq Composite Index rose 0.41% to 7,637.86 this Tuesday as it reached a record closing high.

The Nasdaq was led by Netflix, Amazon and Apple while the S&P 500 and the Dow Jones traded mainly sideways as investors are worried about international trade as the US-China trade war saga is far from over.

Additionally, last week the US decided to impose tariffs on imported steel and aluminium from Mexico, Canada and the European Union. The EU said it would impose countermeasures while Canada said they would respond with “dollar-for-dollar” tariffs on the US. Meanwhile, Mexico said it would target product such as cheese, pork and steel.

"There are direct and indirect consequences to the tariff tiff. First, the direct impact will be on import prices and will be borne by companies and industries that rely on imported steel and aluminum. The increased prices will either be passed onto consumers, or will impact margins," commented Katie Nixon, chief investment officer at Northern Trust Wealth Management. "From an indirect perspective, the process around trade negotiations has been fraught with stutter steps and reversals, and has contributed to a general sense of uncertainty over the direction of the global economy," she added. "It is unequivocal that broad-based tariffs or a trade war will put a constraint on global growth while lifting the structural governor on inflation."

On the macroeconomic front, the US ISM Non-Manufacturing PMI came above expectations at 58.6 versus 57.5 expected in May. A reading above 50 suggests economic expansion.

Meanwhile, the recent US protectionist measure will be debated at the 44th G7 (Group of Seven leading industrialized nations) summit on June 8 in Canada.

Over in Italy, the FTSE MIB was the worst performing index in Europe, after a speech by the country's new prime minister. Giuseppe Conte called for "radical change" in his speech and said the anti-establishment government is ready to introducing universal basic income as well as cracking down on immigration. Italy’s political situation saw markets worldwide be in risk-off mode last week.

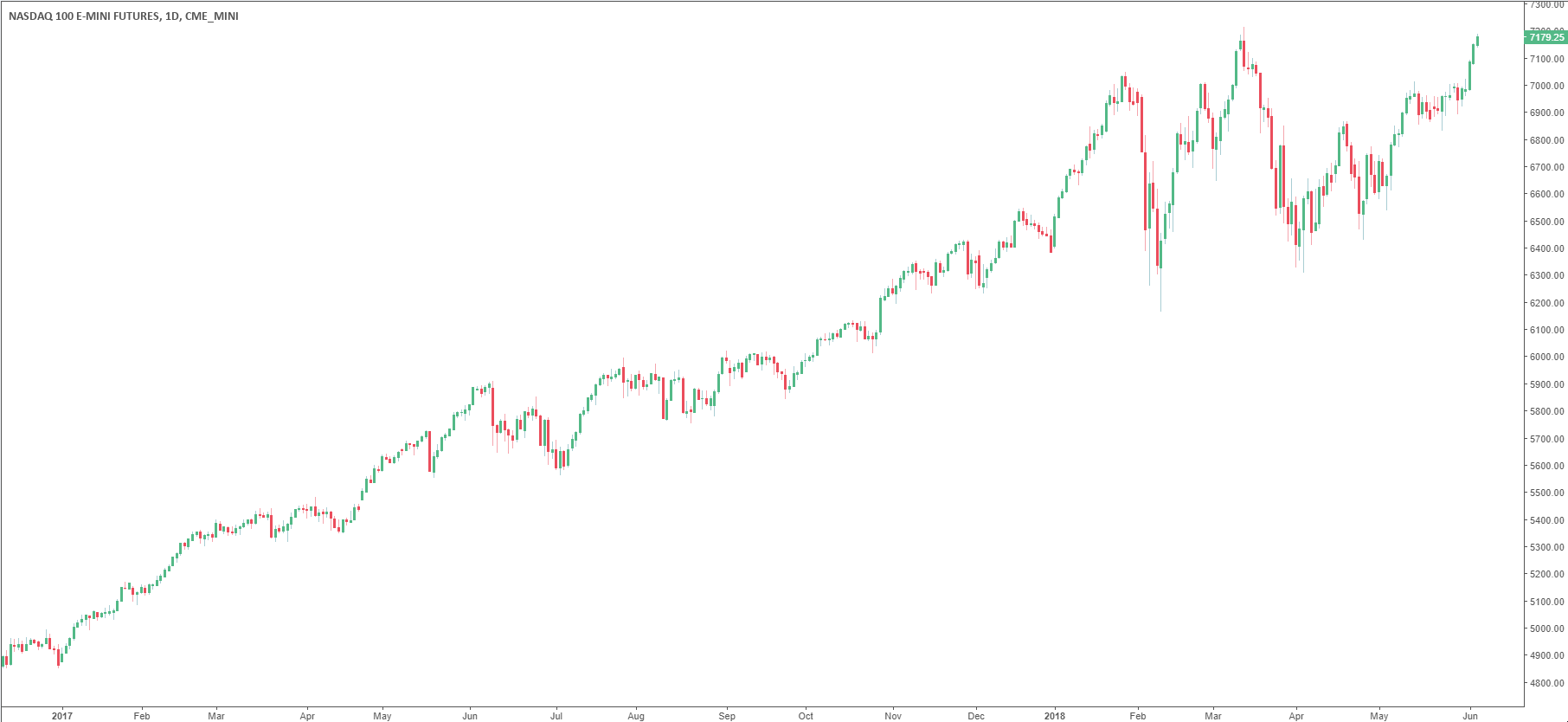

Nasdaq daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD challenges YTD tops near 1.1170 on Powell

EUR/USD now picks up extra pace and revisits the 1.1170 region after Chief Powell somewhat “confirmed” a rate cut next month at his speech at Jackson Hole.

GBP/USD reaches new 2024 highs around 1.3200, Dollar plummets

The Greenback is now accelerating its decline and flirts with the area of 2024 low as Chair Powell signals that it is time to adjust monetary policy. GBP/USD picks up extra pace and challenges the 1.3200 region, clinching new 2024 peaks at the same time.

Gold keeps the bid bias unchanged above $2,500

The precious metal maintains its bullish stance in place on Friday, climbing above the $2,500 mark per ounce troy as Fed’s Powell signals an imminent rate cut.

Decentraland price is set for a rally after breaking above the descending trendline

Decentraland (MANA) price broke above the descending trendline and trades up 1.5% as of Friday at $0.291. Additionally, on-chain data support further price gains, as MANA's Exchange Flow Balance shows a negative spike, and the long-to-short ratio stays above one.

Jerome Powell expected to hint at upcoming interest-rate cut in September

Market participants will closely scrutinize Powell’s speech for any fresh hints on the trajectory of monetary policy, particularly about the magnitude of the Fed’s first interest-rate cut in years.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.