Wall Street Close: Still no cure in sight for COVID-19, extinguishes optimism

- Dow Jones Industrial Average added a small gain of 39.44 points, or 0.2%, to around 23,515.26.

- The S&P 500 added 1.51 points or less than 0.1%, at 2,797.80, sliding below its peak for the day of 2,844.90.

- The Nasdaq is down 1.8% and the Dow is off by 3%.

US benchmarks were mixed on Thursday, little changed albeit choppy in volatile market conditions. Investors were deflated on the reports that Remdesivir from Gilead Sciences was failing to speed the improvement of patients, delivering disappointing results in an “inconclusive” trial. US stocks ended off their highs for the day as a focus remained on slowing numbers of new COVID-19 cases. However, economic data was highly disappointing.

The results from a long-awaited clinical trial conducted in China showed that the drug wasn’t associated with patients getting better more quickly, and 13.9% of patients getting the drug died, versus 12.8% getting standard care. Gilead, however, said the data suggest a “potential benefit,” but nevertheless, shares of the company plunged.

US benchmark performances

Consequently, the Dow Jones Industrial Average added a small gain of 39.44 points, or 0.2%, to around 23,515.26, a touch below the high at 23,885.36 and supported with gains ing UnitedHealth Group Inc, adding 3% for the day. The S&P 500 added 1.51 points or less than 0.1%, at 2,797.80, sliding below its peak for the day of 2,844.90. Meanwhile, the Nasdaq Composite ended the session virtually unchanged at 8,494.75. So far for the week, the S&P 500 is losing 2.7%, the Nasdaq is down 1.8% and the Dow is off by 3%.

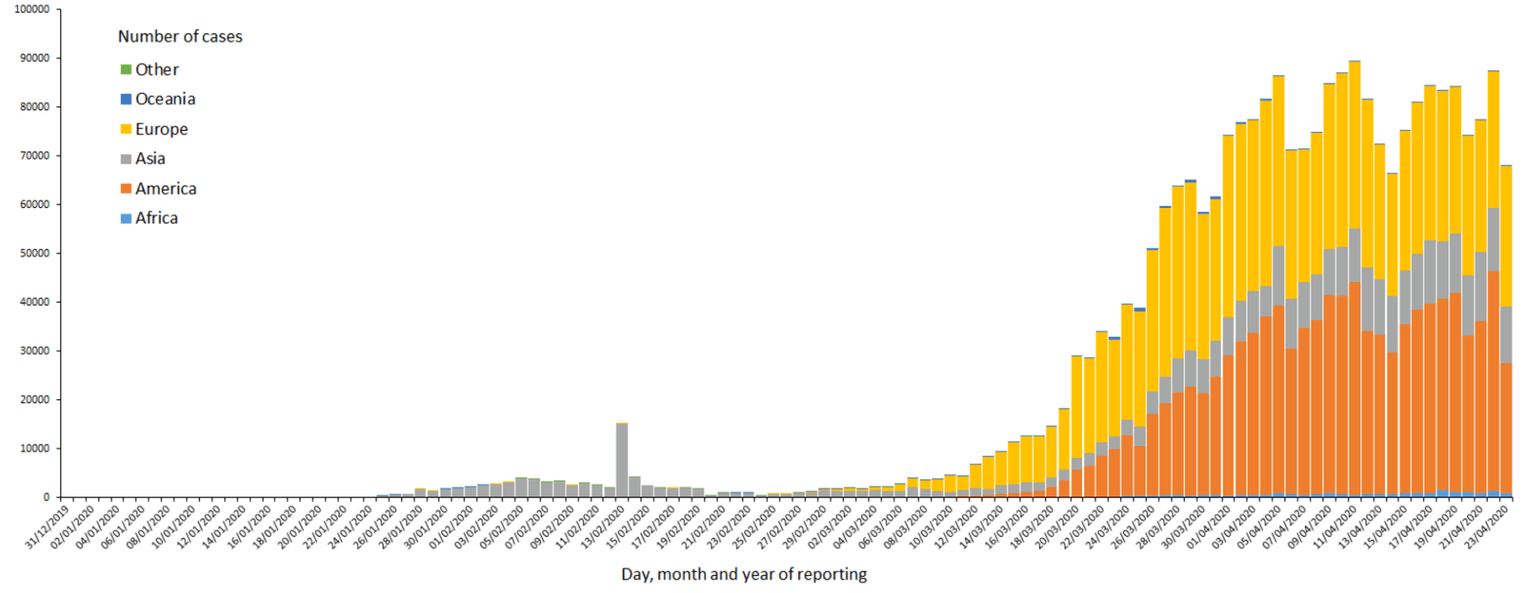

Meanwhile, according to the European Centre for Disease Prevention and Control, since 31 December 2019 and as of 23 April 2020, 2 588 068 cases of COVID-19 (in accordance with the applied case definitions and testing strategies in the affected countries) have been reported, including 182 808 deaths.

However, the new cases have only risen 2.5% which is the slowest rate this month – so there is some optimism for markets monitoring the contagion, as displayed in the following chart:

Source: ECDC

PMIs worse than feared

Analysts at ANZ Bank explained how the April PMI data fell into deeply contractionary territory, reaching the lowest levels on record:

- In the US, the composite PMI fell to 27.4 from 40.9. Services fell to 27.0 from 39.8 and manufacturing fell to 36.9 from 48.5.

- The euro area composite PMI fell to 13.5 from 29.7. Services dropped to 11.7 from 26.4. Manufacturing dropped to 33.6 from 44.5.

- The UK composite PMI tumbled to 12.9 from 36.0. Services fell to 12.3 from 34.5 and manufacturing dropped to 32.9 from 47.8. Around 81% of UK service providers and 75% of manufacturing firms reported a fall in business activity. On April 5 the ONS estimated that 27% of the UK workforce has been furloughed and roughly 25% of businesses had ceased trading.

However, there is an expectation that this will be the nadir, assuming no second wave of infections.

DJIA levels

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.