Here is what you need to know on Tuesday, January 10:

Equities had an ugly close on Monday as intraday gains were given up. The Dow and S&P 500 closed in the red, while the NASDAQ just barely held onto some gains. Tech stocks did stage a bounce, and among them Tesla (TSLA) was the standout after some positive news about wait times in China. The lure of $100 is still close by though, so let us see if bears have the stomach for it. Equities are calmer on Tuesday as most markets are now focused on Thursday's US CPI print. So far optimism remains the core theme of the first week of the year, and Goldman Sachs added to that as it pulled its recession prediction for Europe and instead forecasts growth of 0.6% for the year. Bond yields in Europe remain supported versus the US, which is helping the Euro hold up versus the US Dollar ahead of the anticipated lower CPI print on Thursday.

The Dollar Index is slightly higher at 103.20, Gold is flat at $1,872, and Oil is higher at $74.91.

European markets are mixed: FTSE +0.2%, Dax -0.4%, and Eurostoxx is flat.

US futures are lower: S&P 500 and Dow both -0.5% and Nasdaq -0.7%.

Wall Street top news

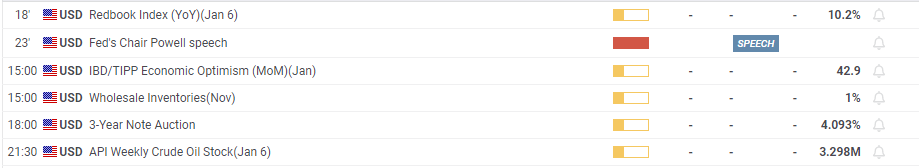

Powell to speak at Riksbank conference at 9am EST.

Crocs (CROX) raises outlook.

Coinbase (COIN) to cut 950 jobs.

Shake Shack (SHAK) sales miss estimates.

Bed Bath & Beyond (BBBY) misses on top and bottom lines.

Reuters headlines

Apple (AAPL) to replace key Broadcom chip with in-house design - Bloomberg News.

Jefferies Financial Group Inc (JEF): The Investment bank reported a 52.5% decline in fourth-quarter profit on Monday, hit by lower underwriting fees and volatile markets that dented income from its trading desks.

Alibaba Group Holding Ltd (BABA): The Chinese e-commerce giant has signed a cooperation agreement with the government of Hangzhou.

Amazon.com Inc (AMZN): The company has said it plans to shut three UK warehouses in a move that will impact 1,200 jobs, PA Media reported.

Coca Cola Inc (KO) & PepsiCo Inc (PEP): Beverage giants Coca-Cola and PepsiCo are under preliminary investigation by the U.S. Federal Trade Commission (FTC) over potential price discrimination in the soft drink market, Politico reported on Monday citing sources.

Pfizer Inc (PFE): The company is not in talks with Chinese authorities to license a generic version of its COVID-19 treatment Paxlovid for use there, but is in discussions about a price for the branded product, Chief Executive Albert Bourla said.

Southwest Airlines Co (LUV): The company said on Monday it made leadership changes across several departments in a bid to strengthen operations amid a recent technology meltdown that forced the carrier to cancel more than 16,700 flights.

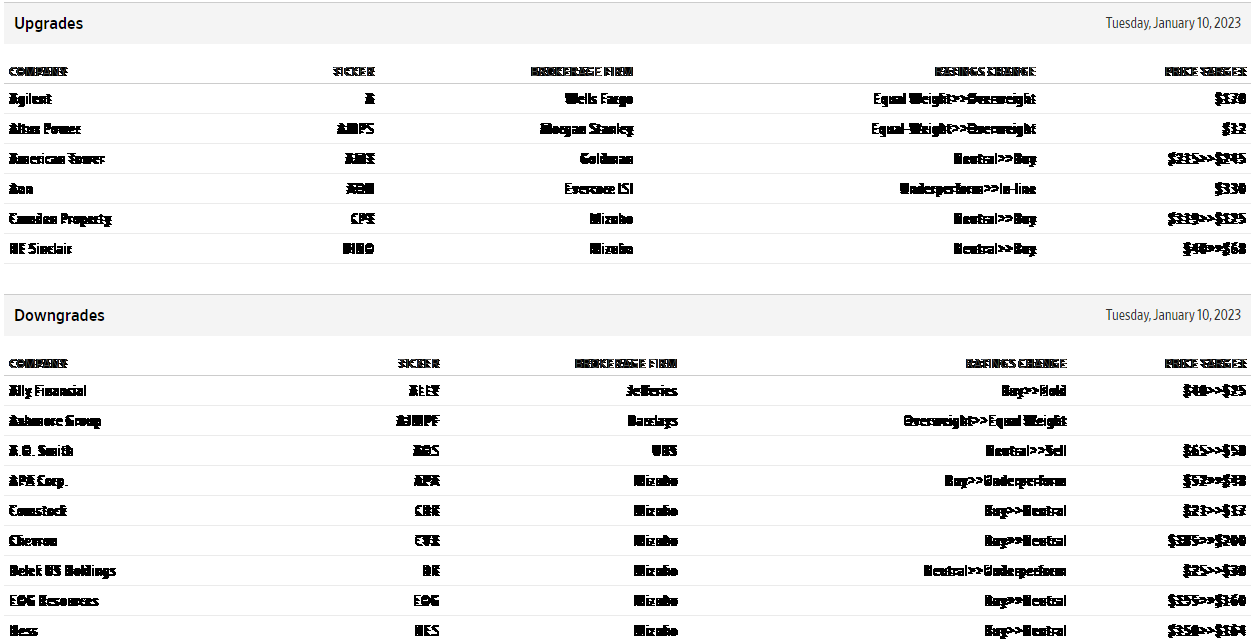

Upgrades and downgrades

Source: WSJ.com

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD recovers above 0.6200 on upbeat Chinese PMI data

The AUD/USD pair recovers some lost ground to near 0.6215, snapping the six-day losing streak during the early Asian session on Monday. The upbeat Chinese economic data provides some support to the pair.

USD/JPY faces some resistance near 151.00 mark

USD/JPY struggles to capitalize on a modest Asian session uptick to the 151.00 mark, warranting caution before positioning for an extension of last week's recovery from the lowest level since October 2024. The growing acceptance that the BoJ will hike interest rates and geopolitical risks underpin the JPY.

Gold: Bulls finally let go as key support fails

Gold turned south after setting a new all-time high to begin the week. Investors will remain focused on Trump tariff talks ahead of February US employment data. The technical outlook points to a bearish reversal in the near term.

Week ahead: NFP and ECB to steal the show

NFP take center stage amid DOGE layoffs. ECB decides monetary policy after CPI data. Canada jobs report and RBA minutes also on tap.

Weekly focus – Tariff fears are back on the agenda

While the timing of the EU measures remains still uncertain, Trump surprised markets on Thursday by signalling that the 25% tariffs on Canada and Mexico will be enacted when the one-month delay runs out next Tuesday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.