Here is what you need to know on Tuesday, November 2:

November maintains its steady record-breaking start for equity markets as the flow of money is just too strong to argue against. We alluded to this yesterday, but now that earnings season is out of the way the year-end push for corporate buybacks is ramping up with a huge wall of money set to be unleashed. Clean energy stocks certainly benefit from the ongoing COP26 forum just after the G20 climate meeting in Rome and imminent stimulus from President Biden. BP of the older energy generation is not to be outdone though as surging energy prices see it add a cool billion dollars to its buyback program.

Away from energy, the continued persistence of covid is at least proving a boon for vaccine manufacturers with Pfizer (PFE) boosting its sales numbers. This is due to booster shots, more deals and shots for kids now being added to the likelihood that covid is endemic and will be added to the yearly vaccination quota globally.

The dollar is pretty flat again as yields dip slightly, 1.16 versus the euro. Gold is steady at $1,792. Bitcoin is at $63,300, a gain of 3%. US yields are slightly lower, and Oil dips to $83.30.

See forex today.

European markets are mixed, Eurostoxx is flat, FTSE +0.7% led by BP, while Dax is -0.75.

US futures are flat with the Nasdaq at -0.1%, the biggest mover.

Wall Street (SPY) (QQQ) stock news

Pfizer (PFE) jumps 3% on strong earnings and forecasts.

Tesla (TSLA): Elon Musk tweets that no deal signed with Hertz. Also, Tesla to recall up to 12,000 vehicles.

Hertz (HTZZ) says the initial demand for Teslas is very strong, says deliveries of Tesla already started in response to Elon Musk tweet-Reuters.

Avis Budget (CAR) reports earnings well ahead of estimates, up 75% premarket.

Clorox (CLX) beats estimates, up 2% premarket.

DuPont (DD) beats estimates but cuts outlook.

Simon Property (SPG): Simon says "Wow!" as it smashed EPS estimates, up 4% in premarket.

ConocoPhillips (COP) posts a strong return to profit on energy prices, no surprise!

Marathon Petroleum (MPC): copy-paste above!

Under Armour (UA) still seeing the benefits of a more flexible working environment as it raises forecasts.

Apple (AAPL) cutting back production of iPads to boost iPhone chip availability-Reuters.

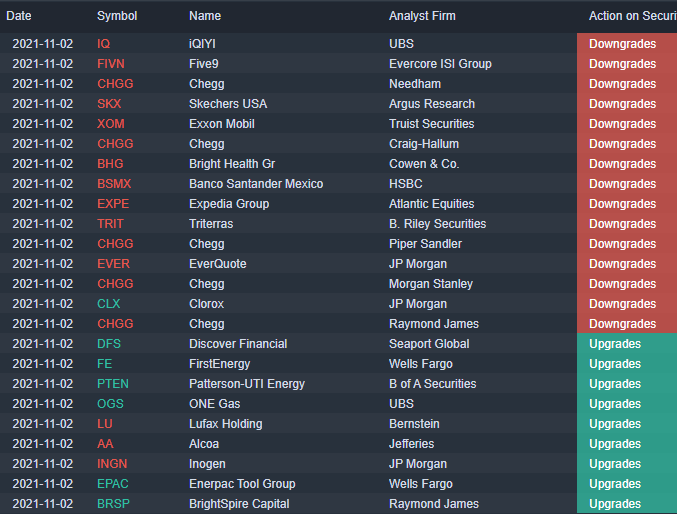

Upgrades, downgrades

Source: Benzinga Pro

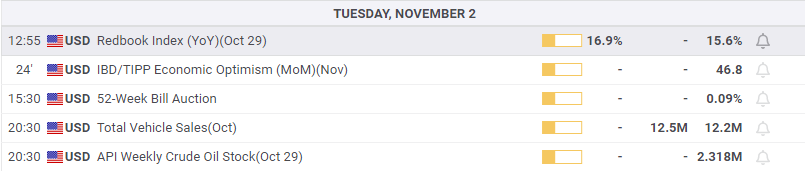

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold falls amid a possible de-escalation of US-China tensions Premium

Gold pulled back from its all-time high of $3,500 per troy ounce reached earlier on Tuesday, as a resurgent US Dollar and signs of easing tensions in the US–China trade dispute appeared to draw sellers back into the market.

EUR/USD retreats to daily lows near 1.1440

EUR/USD loses the grip and retreats to the 1.1440 zone as the Greenback’s rebound now gathers extra steam, particulalry after some positive headlines pointing to mitigating trade concerns on the US-China front on Tuesday.

GBP/USD deflates to weekly lows near 1.3350

GBP/USD loses further momentum and recedes to the 1.3350 zone on Tuesday, or two-day troughs, all in response to the frmer tone in the US Dollar and encouraging news from the US-China trade scenario.

3% of Bitcoin supply in control of firms with BTC on balance sheets: The good, bad and ugly

Bitcoin disappointed traders with lackluster performance in 2025, hitting the $100,000 milestone and consolidating under the milestone thereafter. Bitcoin rallied past $88,000 early on Monday, the dominant token eyes the $90,000 level.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.